A temporary drop for commodities?

What to look out for today

Companies reporting on Monday, 2nd February: Walt Disney Company, Palantir Technologies

Key data to move markets today

EU: German Retail Sales, French CPI, Eurozone, German, Spanish and Italian HCOB Manufacturing PMI

UK: S&P Global Manufacturing PMI and a speech by Bank of England Deputy Governor for Financial Stability Sarah Breeden

USA: S&P Global Manufacturing PMI, ISM Manufacturing Employment Index, Prices Paid, New Orders and PMI, a speech by Atlanta Fed President Raphael Bostic and Loan Officer Survey (Q4)

CHINA: RatingDog Manufacturing PMI

US Stock Indices

Dow Jones Industrial Average -0.36%

Nasdaq 100 -1.28%

S&P 500 -0.43%, with 7 of the 11 sectors of the S&P 500 down

Global stocks fell for a second straight session Friday after President Trump nominated former Federal Reserve governor Kevin Warsh as the next chair. Stock markets were also weighed down by a stronger than expected PPI, which indicated that businesses appeared to now be passing on the higher costs from the tariffs.

The S&P 500 lost 29.98 points, or -0.53%, to end at 6,939.03 points. The Nasdaq Composite lost 223.30 points, or -0.94%, to end the session at 23,461.82. The Dow Jones Industrial Average dropped 179.09 points, or -0.36%, to 48,892.47.

In corporate news, Eli Lilly & Co. failed to win backing from the European Union’s medicines regulator for the use of its weight-loss drug Mounjaro to treat a certain kind of heart failure in adults with obesity.

Colgate-Palmolive was a big gainer on Friday after the toothpaste and soap maker forecast annual sales above Wall Street estimates on steady demand for household staples in markets such as Latin America and Europe.

Bloomberg news reported that Amazon is in talks to invest as much as $50 billion in OpenAI and expand an agreement that involves selling computer power to the AI startup, according to a person with knowledge of the matter.

According to LSEG I/B/E/S data, 2025 Q4 y/o/y earnings are expected to be 10.9%. Excluding the Energy sector, the y/o/y earnings estimate is 11.3%. Of the 166 companies in the S&P 500 that have reported earnings to date for 2025 Q3, 76.5% reported above analyst expectations. This compares to a long-term average of 67%. The 2025 Q4 y/o/y blended revenue growth estimate is 7.7%. If the Energy sector is excluded, the growth rate for the index is 8.5%. Thus far, 66.3% of companies have reported 22025 Q4 revenue above analyst expectations. This compares to a long-term average of 62.6% and an average over the past four quarters of 70.9%. For 2025 Q4, there have been 57 negative EPS preannouncements issued by S&P 500 corporations compared to 50 positive EPS preannouncements. By dividing 57 by 50 the N/P ratio is 1.1 for the S&P 500 Index. The forward four-quarter (26Q1– 26Q4) P/E ratio for the S&P 500 is 22.3.

During the week of 2 February 128 S&P 500 companies are expected to report quarterly earnings.

S&P 500 Best performing sector

Consumer Staples +1.35%, with Colgate-Palmolive +5.92%, Church & Dwight +4.67%, and General Mills +4.12%

S&P 500 Worst performing sector

Materials -1.84%, with Newmont -11.49%, Freeport-McMoRan -7.52%, and Albemarle -5.57%

Mega Caps

Alphabet -0.07%, Amazon -1.01%, Apple +0.46 %, Meta Platforms -2.95%, Microsoft -0.74%, Nvidia -0.72%, and Tesla +3.32 %

Information Technology

Best performer: Verizon Communications +11.43%

Worst performer: Applovin -16.89%

Materials and Mining

Best performer: Air Products and Chemicals +6.44%

Worst performer: Newmont -11.49%

Corporate Earnings Reports

Posted on Friday, 29th January from Pulse, a real-time AI- driven news tool. Available exclusively on the EXANTE Web Platform

Chevron revenue of $46.87 billion surpassing $44.1 billion consensus, reported an EPS of $1.39 beating estimates of $1.38; cash flow from operations at $10.8 billion exceeding $9.3 billion forecast, though downstream earnings missed at $823 million versus $889.6 million expected and liquids production slightly missed at 1,488 mb/d against 1,501 mb/d. The company is refining 50,000 bpd of Venezuelan oil in Mississippi and plans to boost exports to 300,000 bpd in March amid US sanction relief and Venezuelan oil reforms granting autonomy to private producers. Chevron's CEO noted capacity for an additional 100,000 bpd of Venezuelan crude and positive steps to protect investments. Chevron seeks better terms to acquire Lukoil's Iraq field. — see report

Verizon Communications reported Q4 2025 adjusted EPS of $1.09, beating estimates of $1.06. Operating revenue reached $36.4 billion, surpassing consensus of $36.18 billion, with consumer revenue at $28.44 billion versus expected $28.14 billion. Wireless retail postpaid phone net adds totaled +616,000. For 2026, the company guided adjusted EPS to $4.90-$4.95, above estimates of $4.75, free cash flow of at least $21.5 billion versus $20.79 billion expected, and capex of $16.8-$17.5 billion below the $18.08 billion forecast. Verizon authorised a share buyback program of up to $25 billion. — see report

American Express revenue of $18.98 billion vs $18.92 billion estimate. EPS of $3.53 missing consensus of $3.56. Full-year 2025 revenues grew 10% to a record high, with adjusted EPS increasing 15% year-over-year. Q4 card member spending rose 8% FX-adjusted, and net card fee revenues expanded double digits for the 30th consecutive quarter. For 2026, the company anticipates 9-10% revenue growth and EPS of $17.30 to $17.90, while planning a 16% increase in its quarterly common stock dividend.— see report

Exxon Mobil revenue of $82.31 billion versus expected $81.34 billion. Adjusted EPS of $1.71, beating Wall Street consensus of $1.69. Earnings topped estimates despite low oil prices. Exxon's XTO unit is seeking buyers for select Eagle Ford assets as a divestiture. Kazakhstan urged ExxonMobil to speed up repairs at the Tengiz field after an outage, with output resuming. SoFi Technologies reported Q4 2025 earnings before market open on January 30, 2026, with revenue of $1.03 billion beating consensus estimates of $982 million and EPS of $0.12 meeting expectations. Adjusted EBITDA increased 60% year-over-year to $318 million, while new members grew 35% to 13.7 million. For FY 2026, guidance includes revenue of $4.7 billion above estimates of $4.5 billion, EPS of $0.60. — see report

European Stock Indices

CAC 40 +0.68%

DAX +0.94%

FTSE 100 +0.51%

According to LSEG I/B/E/S data, fourth quarter earnings are expected to decrease 3.9% from Q4 2024. Excluding the Energy sector, earnings are expected to decrease 4.4%. Fourth quarter revenue is expected to decrease 3.5% from Q4 2024. Excluding the Energy sector, revenues are expected to increase 1.1%. Of the 17 companies in the STOXX 600 have reported earnings by 29 January for Q4 2025, 76.5% reported results exceeding analyst estimates. In a typical quarter 54% beat analyst EPS estimates. Of the 36 companies in the STOXX 600 that reported revenue by 29 January for Q4 2025, 52.8% reported revenue exceeding analyst estimates. In a typical quarter 58% beat analyst revenue estimates.

During the week of 2 February, 56 companies are expected to report quarterly earnings.

Commodities

Gold spot -11.37% to $4,713.90 an ounce

Silver spot -25.50% to $85.26 an ounce

West Texas Intermediate -0.34% to $65.21 a barrel

Brent crude -0.03% to $70.69 a barrel

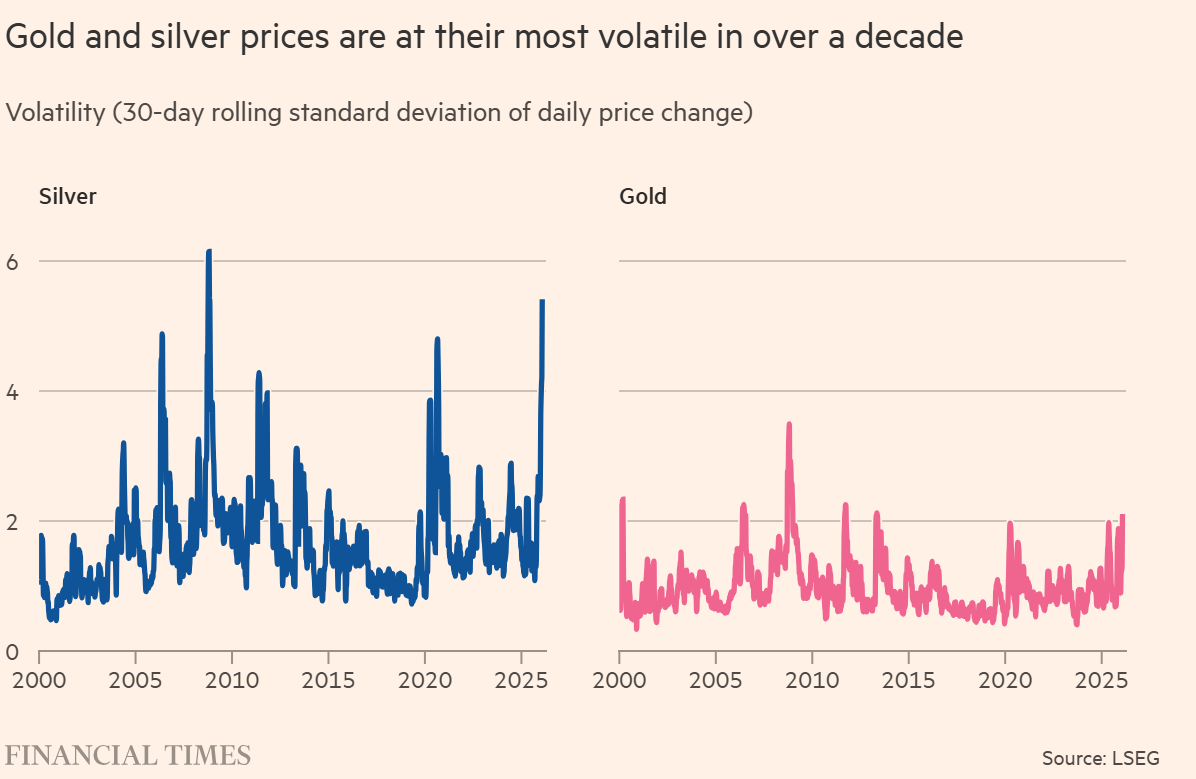

Gold and silver plummeted on Friday, with gold down 11% and silver dropping over 25%, both suffering their worst one-day slides since 1980. Spot gold was down -4.7% for the week. Silver spent much of the week above $100 per ounce, but saw a huge Friday drawdown, logging its worst single session since the Hunt Brothers attempted to control the silver market in 1980; for the week, silver was down -22.5%.

Brent crude futures settled at $70.69 a barrel, down 2 cents or -0.03%. Brent was +7.3% on the week. US WTI crude finished at $65.21 a barrel, down 21 cents or -0.32%. It was +6.8% on the week.

The rise in oil comes at the same time as the EU’s gas storage levels have fallen to their lowest since before the 2022 energy crisis. Supply concerns have driven prices to their biggest monthly gain in more than two years, with the TTF benchmark gas price rising to as much as €42.60 per megawatt hour this past week, a ten-month high. As noted by the Financial Times, prices have also been affected by severe winter storms in the US, which have disrupted domestic gas markets and lifted European prices, due to the continent becoming increasingly reliant on seaborne US LNG following a sharp reduction in pipeline supplies from Russia.

Note: As of 4 pm EST 30 January 2026

Currencies

EUR -0.95% to $1.11856

GBP -0.85% to $1.3861

Bitcoin -0.73% to $83,978.00

Ethereum -4.46% to $2,696.20

The dollar index was +0.87% to 97.14 as the announcement by President Trump of his nomination of former Fed governor Kevin Warsh to replace current Fed chair Jerome Powell eased market sentiment against the dollar. The euro fell -0.99% to $1.1854, while the British pound fell -0.91% to $1.3686. The euro was at 86.62 pence.

The yen was down -1.08% against the US dollar to trade at ¥154.75.

Fixed Income

US 10-year Treasury +2.2 basis point to 4.256%

German 10-year bund +1.3 basis points to 2.846%

UK 10-year gilt +0.3 basis points to 4.507%

The US yield curve steepened following President Trump’s nomination of Kevin Warsh to replace current Fed chair Jerome Powell in May on suggestions that the balance sheet may not be a primary focus for Warsh. In addition, data revealed that US producer prices rose in December more than expected, suggesting businesses were passing on higher costs tied to import tariffs.

The US 30-year Treasury yield jumped 6 bps to a session high of 4.914% before settling at 4.889%. They ended the day +3.4 bps higher. It was +4.5 bps MTD.

The benchmark 10-year yield was up +2.2 bps at 4.256% on Friday. It was +8.7 bps MTD. The two-year yield, more sensitive to expected Fed moves, was -2.8 bps on Friday to 3.533% and +5.8 bps MTD for January.

The spread between two-year and 10-year yields steepened to 72.30 bps, the steepest in more than a week..

According to CME Group's FedWatch Tool, Fed funds futures traders are now pricing in a 15.3% probability of a 25 bps rate cut at March's FOMC meeting, down from 14.9% a week ago. US rate futures on Friday priced in about 51 bps of easing this year, up from 44 bps after Thursday’s Fed decision to hold interest rates steady.

In the UK, the 10-year gilt was slightly up, +0.3 bps to 4.507%.

The yield on Germany’s 10-year Bund was +1.3 bps to 2.846% on Friday. Germany’s two-year yield, sensitive to policy rate expectations, was +1.5 bps to 2.064%. At the long end, the 30-year yield was +1.1 bps to 3.494%.

The French 10-year was +1.9 bps to 3.430. The yield spread between 10-year French government bonds and Bunds was 58.4 bps.

Italy’s 10-year government bond yield was +1.6 bps to 3.461%. The spread relative to Bunds stood at 61.5 bps.

Note: As of 4 pm EST 30 January 2026

Global Macro Updates

Fed nominee announced. On Friday, President Trump put forward his nominee to replace Jerome Powell as Fed chair when Powell’s term ends in May. He put forward Kevin Warsh, a former Fed governor whom he first interviewed for the top role back in 2017. He will take over when Jerome Powell's term ends in May, if his nomination passes a closely divided Senate.

Warsh is seen as an advocate of lower interest rates, but also as someone who may not take on the more aggressive easing President Trump wants. President Trump said it would be inappropriate to ask Warsh whether he would cut interest rates, but added he was confident Warsh was inclined to lower borrowing costs. This nomination therefore doesn’t completely eliminate concerns around Fed independence.

Warsh's nomination prompted investors to reassess the outlook for policy support in the Treasury market as inflation risks continue to loom. Balancing political pressures to reduce policy rates will remain a challenge and will likely continue to pressure longer-dated yields higher. Warsh has called for regime change at the Fed, seeking among other things less quantitative easing, meaning he could push to reduce the amount of bonds it owns.

Higher than anticipated PPI and government shutdown worries Wall Street. Stock markets were lower on Friday as economic data showed the Producer Price Index (PPI) for final demand surged 0.5% last month, the most in three months, after an unrevised 0.2% gain in November, according to data from the Bureau of Labor Statistics (BLS). In the 12 months through December, the PPI increased 3.0% after rising by the same margin in November. This suggests inflation could pick up in the months ahead although Fed chair Powell said that “there's an expectation that sometime in the middle quarters of the year we'll see tariff inflation topping out." The PPI advanced 3.0% in 2025 after rising 3.5% in 2024.

The rise in PPI was attributed to a surge in services. The cost of services less trade, transportation and warehousing increased 0.3%, while prices for transportation and warehousing services rose 0.5%. Portfolio management fees increased 2.0% after gaining 1.4%. Airline fares rose 2.9%, while wholesale prices of hotel and motel rooms jumped 7.3%. These categories are among the components that go into the calculation of the Personal Consumption Expenditures price indices, the Fed’s favourite inflation measures tracked by the Fed for its 2% target. The PCE inflation data for December is due to be released on 20 February.

The BLS is now caught up on the PPI and Consumer Price Index releases that were delayed by the 43-day shutdown of the federal government. However, the US government is now in another shutdown over a spending bill that covers a wide swath of government operations, including at the Labor Department. According to The Hill, the partial government shutdown is poised to last through at least Tuesday as House Democrats decline to commit to providing the votes needed to fast-track approval of a funding package to reopen the government. The House Rules Committee is scheduled to meet today at 4 pm EST to consider the funding package and other legislation it will set up for the week. Floor votes to approve procedural rule legislation setting the terms of debate for the package, and then a final vote on the funding package, are not expected until Tuesday at the earliest.

The BLS' closely watched employment report for January is scheduled for release this Friday, with the CPI report due a week after.

The eurozone grows more than expected. The eurozone grew 0.3 percent in Q4 2025 despite geopolitical tensions and widespread uncertainty. This was in line with the 0.3 percent record in the previous three months and better than the consensus 0.2 percent expected. It grew +1.3% compared with the fourth quarter of 2024. The eurozone has now expanded for nine consecutive quarters. According to an estimation of annual growth for 2025, based on quarterly seasonally and calendar adjusted data, GDP increased by 1.5% in the euro area.

The ECB raised its GDP forecast for this year to 1.2%. Germany, Europe’s biggest economy, expanded last year for the first time since 2022. Growth in Germany is expected to accelerate further this year due to fiscal expansion targeted at investments in infrastructure and defence.

The ECB is widely expected to leave interest rates unchanged at 2 percent at its meeting this week.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。