How far can gold go?

What to look out for today

Companies reporting on Monday, 26th January: Steel Dynamics, Brown & Brown, Nucor, W.R. Berkley, Alexandria Real Estate Equities, Ryanair Holdings

Key data to move markets today

EU: German IFO Business Climate, Sentiment and Expectations Surveys and a speech by Bundesbank President Joachim Nagel

USA: Durable Goods Orders and Non-Defence Capital Goods Orders

JAPAN: BoJ Monetary Policy Meeting Minutes

US Stock Indices

Dow Jones Industrial Average -0.58%

Nasdaq 100 +0.34%

S&P 500 +0.03%, with 7 of the 11 sectors of the S&P 500 up

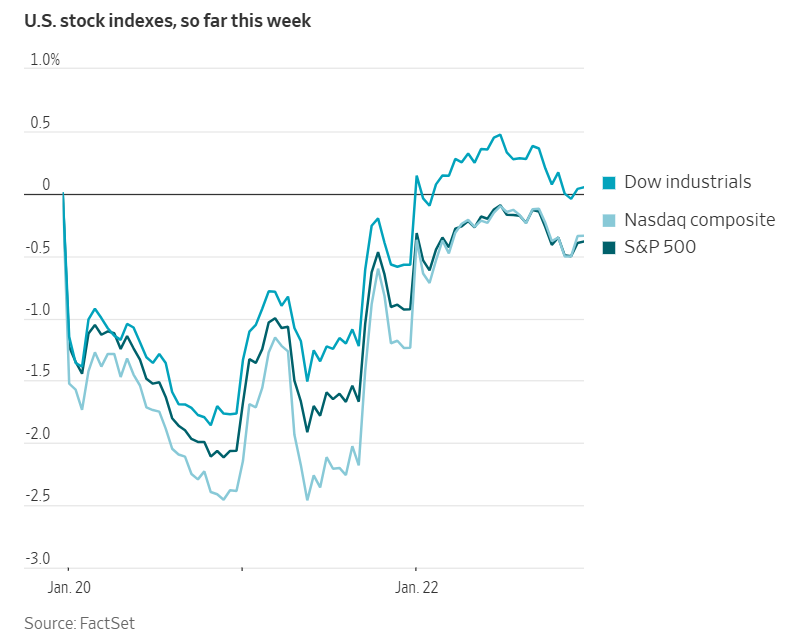

The week commenced with renewed concerns over a possible trans-Atlantic trade conflict, yet ended with the US equity market largely unchanged. Despite the initial volatility, by Friday’s close, major indices exhibited minimal reaction to the threat of trade disruptions.

By last week’s end, the Dow Jones Industrial Average fell -0.53% for the week, the S&P 500 edged -0.35% lower for the week, and the Nasdaq Composite slipped -0.06% for the week.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q4 is projected to be +9.2%. This jumps to 9.6% when excluding the Energy sector. Of the 64 companies in the S&P 500 that have reported earnings to date for Q4 2025, 79.7% have reported earnings above analyst estimates, with 68.8% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be 7.3% in Q4, increasing to 8.1% when excluding the Energy sector.

Information Technology (8 out of 70 reported), Materials (1 out of 26), and Communication Services (1 out of 20) at 100.0%, are the sectors with most companies reporting above estimates. Materials with a surprise factor of 63.6%, is the sector that has beaten earnings expectations by the highest surprise factor. Within Real Estate (1 out of 31), 100.0% of companies have reported below estimates and is the sector with the lowest surprise factor at 0.1%. The S&P 500 surprise factor is 7.0%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 22.2x.

103 S&P 500 companies (including 12 Dow Jones constituents) are scheduled to release their Q4 earnings reports this week.

In the corporate news, Apple publicly accused the European Commission of employing ‘political delay tactics’ to stall new app policy implementations, allegedly as a means to justify further investigation and possible fines against the company.

DoorDash and Uber Technologies were unsuccessful in their legal challenge to stop a New York City law mandating that customers be presented with a tipping option at checkout, with the regulation set to take effect on today.

Capital One reported Q4 adjusted EPS that fell short of analyst expectations. Additionally, the company announced an agreement to acquire Brex, an enterprise specialising in corporate credit cards, expense management, and rewards, for $5.15 billion in cash and stock, aiming to bolster its services to corporate clients. Founded in 2017, Brex has quickly established itself as a key player in business financial solutions.

Affirm Holdings disclosed that it has applied for a limited bank charter, a move intended to facilitate the rollout of new financial-technology offerings for its US buy-now, pay-later customers.

In Europe, Ericsson proposed its inaugural share buyback after reporting Q4 earnings that exceeded analyst forecasts. The Swedish telecommunications company attributed this outperformance to successful cost-cutting measures and improved profit margins in what remains a subdued market.

Thyssenkrupp is reportedly considering the sale of approximately a 30% stake in its Rothe Erde bearings division. According to sources cited by Bloomberg news, this transaction could value the business at around €1.5 billion.

S&P 500 Best performing sector

Materials +0.86%, with Smurfit Westrock +4.83%, Amcor +3.53%, and CF Industries +3.53%

S&P 500 Worst performing sector

Financials -1.38%, with Capital One -7.56%, Goldman Sachs -3.75%, and Erie Indemnity -3.33%

Mega Caps

Alphabet -0.73%, Amazon +2.06%, Apple -0.12%, Meta Platforms +1.72%, Microsoft +3.35%, Nvidia +1.59%, and Tesla -0.07%

Information Technology

Best performer: Fortinet +5.18%

Worst performer: Intel -17.03%

Materials and Mining

Best performer: Smurfit Westrock +4.83%

Worst performer: PPG Industries -1.42%

Corporate Earnings Reports

Posted on Friday, 23rd January

SLB quarterly revenue -1.5% to $9.745 bn vs $9.555 bn estimate

EPS at $0.78 vs $0.74 estimate

Olivier Le Peuch, CEO, said, “SLB concluded the year with very strong fourth-quarter results driven by Production Systems, Digital and Reservoir Performance. Fourth-quarter revenue increased sequentially across all four geographies for the first time since the second quarter of 2024, reflecting stabilized global upstream activity. We saw revenue growth both in North America and international markets, further supported by an additional month of ChampionX revenue. Strong year-end product and digital sales in Latin America, the Middle East & Asia, Sub-Saharan Africa and offshore North America also contributed to this performance.” — see report.

European Stock Indices

CAC 40 -0.07%

DAX +0.18%

FTSE 100 -0.07%

Commodities

Gold spot +0.96% to $4,982.57 an ounce

Silver spot +7.06% to $102.95 an ounce

West Texas Intermediate +2.70% to $61.28 a barrel

Brent crude +2.83% to $66.19 a barrel

On Friday, silver prices exceeded $100 per ounce for the first time. Gold continued to rise, reaching a new record on Friday, en route to $5,000 per ounce.

Spot silver advanced +7.06%, closing at $102.95 per ounce. It has experienced a remarkable +224.38% rise over the past year, attributed to persistent difficulties in expanding refining capacity and continued supply shortages in the market. For the week, silver posted a gain of +14.46%.

Spot gold rose +0.96% to $4,982.57 per ounce, after setting a new intraday record of $4,988.17 earlier in the session. Gold has achieved significant milestones over the past year, surpassing $3,000 per ounce in March and $4,000 per ounce in October. Gold was +8.44% over the last week.

Oil prices reached their highest levels in over a week on Friday, following the US President’s decision to intensify measures against Iran. Brent crude futures rose $1.82 or +2.83%, settling at $66.19 per barrel the highest since 14th January. US WTI crude gained $1.61, or +2.70%, to settle at $61.28 per barrel, a more than one-week high. Both benchmarks posted gains for the week, with WTI advancing +3.34% and Brent climbing +3.39%.

The administration imposed additional sanctions on vessels transporting Iranian oil and announced the deployment of a naval armada to the Middle East. The President’s remarks included renewed warnings to Tehran against targeting protesters or resuming its nuclear programme. These developments, combined with continuing tensions, escalated concerns over potential disruptions to oil supplies from the Middle East. Meanwhile, Kazakhstan has faced difficulties resuming production at one of the world's largest oilfields, exacerbating global supply uncertainties.

According to US officials, warships, including an aircraft carrier and guided-missile destroyers, are expected to arrive in the Middle East in the coming days. In addition to military measures, the US Treasury announced sanctions on nine vessels and eight associated firms engaged in the transport of Iranian oil and petroleum products.

Iran, OPEC’s fourth-largest crude oil producer with an output of approximately 3.2 million barrels per day as reported by OPEC, remains a significant exporter to China — the world’s second-largest oil consumer.

Compounding these supply-side challenges, Chevron reported that oil production at Kazakhstan's Tengiz oilfield has not yet resumed. Operations at the site were halted last Monday after a fire, according to the Chevron-led Tengizchevroil consortium. This incident has aggravated existing problems within Kazakhstan's oil sector, which is already hindered by bottlenecks at its primary export gateway on the Black Sea that have been damaged by Ukrainian drone attacks.

Note: As of 4 pm EST 23 January 2026

Currencies

EUR +0.61% to $1.1826

GBP +1.07% to $1.3641

Bitcoin +0.08% to $89,258.85

Ethereum -0.05% to $2,941.90

The US dollar experienced its most pronounced weekly decline since June. Heightened geopolitical tensions unsettled investor sentiment across global markets and US assets suffered losses. By Friday, the dollar index had fallen -0.87% to 97.46, culminating in a -1.93% decline for the week.

The euro advanced +0.61% on Friday to $1.1826, ending the week +1.97% higher. Sterling also strengthened, gaining +1.07% to $1.3641 and posting a +1.94% weekly increase. However, economic indicators released last week showed a weakening labour market and accelerating inflation. Despite an unexpected 0.4% m/o/m rise in UK retail sales for December, the BoE’s MPC is widely expected to maintain its current policy rates at its next meeting in February, with markets fully pricing in a quarter-point rate cut by June.

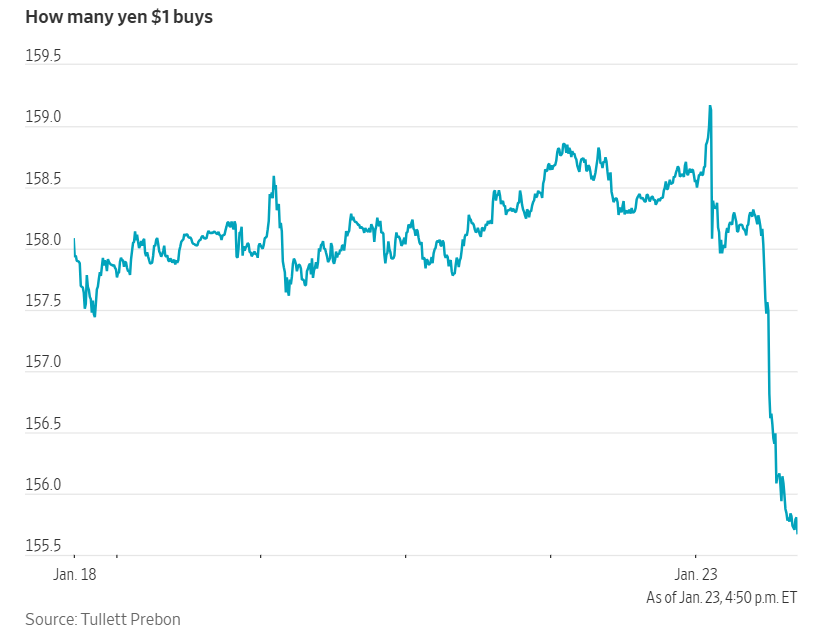

Yen surges as New York Fed, Tokyo signal possible intervention. On Friday, the Japanese yen surged sharply against the US dollar, as market participants grew increasingly vigilant regarding the possibility of intervention by Japanese authorities. It followed reports that the New York Fed, acting as the fiscal agent for the US Treasury, conducted rate checks on the dollar/yen pair around midday, according to a source cited by Reuters.

This led to a rapid depreciation of the US dollar, which dropped from approximately ¥157.60 to as low as ¥156.02 — its weakest level in three weeks — within about 90 minutes. By the end of Friday, the dollar had fallen -1.70% to ¥155.71.

A rate check involves an authority, such as a central bank, reaching out to market participants to inquire about the price they would receive if they entered the market, thereby assessing current market conditions. Checks are often considered a precursor to direct intervention in the currency markets.

By asking what price it would receive if it were to intervene, Japanese authorities can signal their readiness to take action in the market. These checks may prompt banks to close positions that would incur losses should the yen strengthen abruptly, which could explain the sudden appreciation of the yen during the session.

While it is uncommon for US monetary authorities to become involved in matters that originate as Japanese concerns, this was not without precedent.

Earlier in the session, Japanese Finance Minister Satsuki Katayama declined to comment on the rumours of rate checks, but affirmed that officials were closely monitoring developments in the currency markets.

Earlier on Friday, the BoJ opted to maintain its policy rates. The yen started to weaken during the subsequent press conference held by Governor Kazuo Ueda. Evidence of any actual intervention may be deduced from data that the BoJ is scheduled to release on the next business day at 6:00 pm JST (9:00 am GMT), which will be today.

Fixed Income

US 10-year Treasury -1.6 basis points to 4.230%

German 10-year bund +2.0 basis points to 2.908%

UK 10-year gilt +5.4 basis points to 4.529%

On Friday, US Treasury yields moved slightly lower, trading within narrow ranges as investors consolidated their positions ahead of the upcoming Fed policy meeting. During afternoon trading, the yield on the 10-year Treasury note declined -1.6 bps to 4.230%, while the yield on the 30-year US bond slipped -0.6 bps to 4.830%. At the shorter end, the two-year Treasury yield fell -1.1 bps to 3.605%.

The FOMC is widely anticipated to maintain its benchmark overnight interest rate within the current target range of 3.50% to 3.75% at the conclusion of its two-day meeting scheduled for Wednesday.

For the week, the 10-year yield registered a modest increase of +0.3 bps, the two-year yield rose +1.3 bps, while the 30-year yield posted a decline of -0.8 bps. The yield spread between the two-year and 10-year notes narrowed to as little as 61.6 bps before settling at 62.5 bps on Friday, representing a 1.0 bps contraction from the previous week’s level of 63.5 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 45.1 bps of cuts in 2026, equal to the 45.1 bps priced in the previous week. Fed funds futures traders are now pricing in a 2.8% probability of a 25 bps rate cut at the FOMC meeting on Wednesday, down from 4.4% a week ago.

German long-dated bond yields experienced their most significant weekly increase in nearly two months on Friday, as market participants prepared for sustained supply pressures.

Germany’s 10-year government bond yield rose +2.0 bps to 2.908%. The yield on the 30-year bond climbed +1.4 bps to 3.512%, marking a weekly gain of +8.7 bps — the largest rise since early December. On the short end of the curve, the two-year yield advanced +1.8 bps to 2.139%.

Across the maturity spectrum, German yields increased for the week. The 10-year Bund yield rose +6.9 bps, the two-year Schatz advanced +1.7 bps, and the 30-year yield gained +8.7 bps.

Although net bond issuance remains manageable at the aggregate level, investors continue to closely monitor the market’s absorption capacity amid ongoing supply concerns. This segment of the German yield curve has shown particular sensitivity to fiscal expectations, typically steepening, with the 30-year yield rising more sharply than the 10-year maturity, when there is expected increased fiscal spending and an elevated supply of long-term government bonds.

The yield spread between French OATs and German Bunds narrowed by 9.1 bps last week to 59.1 bps, after reaching 58 bps, its tightest level since June 2024. France’s 10-year OAT yield declined -2.2 bps on Friday, contributing to a weekly reduction of the same magnitude.

Italy’s 10-year government bond yield edged lower by -0.3 bps to 3.510%. The spread versus Bunds narrowed to 60.2 bps, a decline of 2.1 bps from the previous week’s 62.3 basis points. Notably, the yield spreads for both Spain and Greece approached their narrowest levels in nearly two decades earlier in the week.

Note: As of 5 pm EST 23 January 2026

Global Macro Updates

January PMI: UK outperforms, eurozone faces headwinds. Eurozone business activity in January expanded at a slower pace than anticipated. The HCOB Flash Composite PMI remained steady at 51.5, falling short of the 51.8 consensus forecast. The moderation was primarily attributed to a deceleration in the services sector. The Services PMI declined to a four-month low of 51.9 from 52.4, missing expectations of 52.6.

New orders increased at the weakest rate since September 2025. Notably, firms reduced employment for the first time since September. HCOB commented that the recovery continues to appear rather fragile. On a more positive note, manufacturing activity exceeded expectations, with the index rising to 49.4 from 48.8, signalling emerging domestic resilience despite ongoing weakness in export orders. The manufacturing PMI briefly returned to expansionary territory at 50.2 during the month. However, inflationary pressures intensified, as input costs rose at the fastest pace since February and output charges registered their most significant increase in nearly two years.

In contrast, the UK reported a marked acceleration in business activity for January. The UK composite PMI reached a 21-month high of 53.9, substantially outperforming both the consensus estimate of 51.5 and the previous reading of 51.4. The services sector PMI advanced to 54.3 (versus a 51.7 forecast and 51.4 prior), while manufacturing climbed to 51.6 (compared to a consensus of 50.6 and the previous 50.6), marking its strongest level in 17 months. S&P Global noted that these PMI figures point to a 0.4% quarterly growth rate.

The robust upturn in services was largely driven by financial services and technology. Manufacturers reported a resurgence in demand and a rise in goods exports for the first time in four years. The period following the Budget saw renewed project launches and increased investment in services. Private sector new orders grew for the third time in four months. Price pressures persisted, as average prices charged recorded the fastest increase since April 2025, reflecting firms’ efforts to offset higher input costs. Despite improved business activity, companies continued to report a notable reduction in employment levels.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。