Can Europe finally unite in 2026?

What to look out for today

Companies reporting on Friday, 23rd January: SLB

Key data to move markets today

EU: French, German and Eurozone HCOB Composite, Manufacturing and Services PMIs and a speech by ECB President Christine Lagarde

UK: GfK Consumer Confidence, Retail Sales, S&P Global Composite, Manufacturing and Services PMIs, and a speech by BoE External Member Megan Greene

USA: S&P Global Composite, Manufacturing and Services PMIs, Michigan Consumer Expectations Index, Michigan Consumer Sentiment Index, and UoM 1- and 5-year Inflation Expectations

JAPAN: BoJ Interest Rate Decision, Monetary Policy Statement, Outlook Report (Q4), and Press Conference

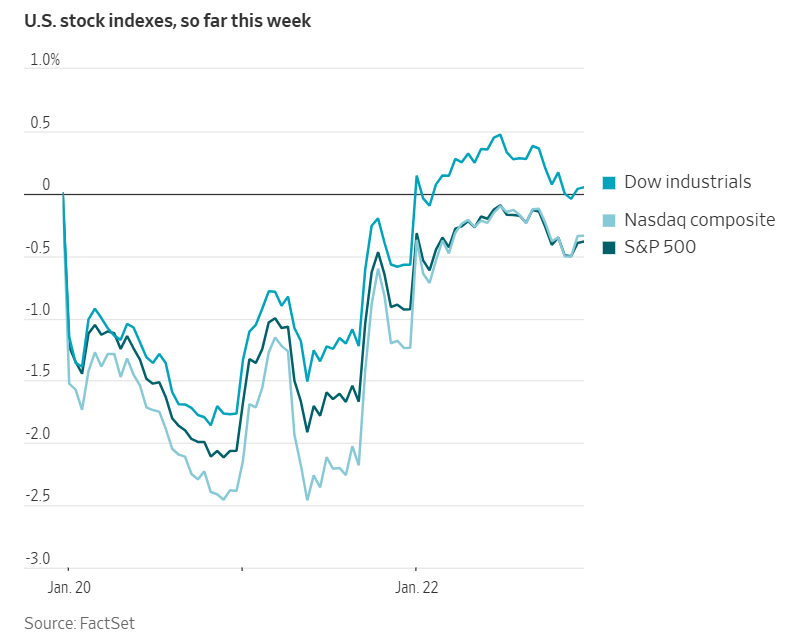

US Stock Indices

Dow Jones Industrial Average +0.63%

Nasdaq 100 +0.76%

S&P 500 +0.55%, with 7 of the 11 sectors of the S&P 500 up

The relief rally observed in US equities extended to smaller companies on Thursday, propelling the Russell 2000 Index to a record closing level.

The Russell 2000 advanced +0.76%, outperforming the broader S&P 500 for the fourteenth consecutive trading day — a streak not seen since May 1996, according to Dow Jones Market Data.

Widespread buying activity contributed to gains across both major technology firms and mid-sized industrial manufacturers. The Nasdaq Composite rose +0.91%, the S&P 500 increased +0.55%, and the Dow Jones Industrial Average added +0.63%, gaining 307 points to finish at 49,384.01.

In corporate developments, according to Bloomberg news, SpaceX has engaged four banks to lead its forthcoming initial public offering, according to individuals familiar with the matter, as the company moves forward with plans for what could become the largest listing to date.

Alphabet’s Google is introducing a new feature that will allow users to personalise their search results by utilising data from the company’s other applications. This initiative represents Google’s latest effort to maintain its competitive edge over emerging rivals such as OpenAI.

Netflix Co-CEO Ted Sarandos is scheduled to testify before a US Senate committee in February regarding the company’s proposed $82.7 billion acquisition of the streaming and studio operations of Warner Bros. Discovery.

General Motors has announced plans to shift production of its next-generation Buick Envision compact SUV, currently manufactured in China, to a facility in Kansas by 2028. This decision reflects the growing trend among automakers to reshore production for vehicles sold in the US.

Waymo, a subsidiary of Alphabet, is set to launch its autonomous ride-hailing service to the public in Miami beginning Thursday. This will be the first of a dozen cities the company intends to expand its offerings in this year.

Canada’s General Fusion has announced its intention to go public through a merger with Spring Valley Acquisition Corp. III, a special purpose acquisition company (SPAC), in response to rising demand for energy and growing public interest in fusion technology. The transaction values the combined entity at approximately $1 billion. General Fusion anticipates being listed on the Nasdaq Composite under the ticker symbol GFUZ by midyear.

S&P 500 Best performing sector

Communication Services +1.57%, with Meta Platforms +5.66%, Charter Communications +2.83%, and News Corporation +2.31%

S&P 500 Worst performing sector

Real Estate -1.10%, with Prologis -3.41%, Welltower -2.17%, and Camden Property -1.81%

Mega Caps

Alphabet +0.75%, Amazon +1.31%, Apple +0.28%, Meta Platforms +5.66%, Microsoft +1.58%, Nvidia +0.91%, and Tesla +4.15%

Information Technology

Best performer: Enphase Energy +12.54%

Worst performer: Lam Research -3.37%

Materials and Mining

Best performer: Albemarle +4.59%

Worst performer: CF Industries -2.63%

Corporate Earnings Reports

Posted on Thursday, 22nd January

Freeport-McMoRan quarterly revenue -1.5% to $5.633 bn vs $5.294 bn estimate

EPS at $0.47 vs $0.29 estimate

Kathleen Quirk, President and CEO, said, “Freeport is strongly positioned for the future as a leading producer of copper with large scale, geographically diverse operations and an exciting portfolio of growth projects to provide additional supplies of copper to a growing market. As we enter 2026, our team has a clear focus on restoring operations at Grasberg safely and sustainably, and on continuing to build values in the Americas through our innovative growth and efficiency initiatives. Our experienced team is committed to value creation through strong execution of our plans, operational excellence and advancing opportunities for long-term organic growth.” — see report.

GE Aerospace quarterly revenue +20.1% to $11.865 bn vs $11.189 bn estimate

EPS at $1.57 vs $1.43 estimate

H. Lawrence Culp, Jr., Chairman and CEO, said, “With a strong fourth quarter, GE Aerospace delivered an outstanding year as revenue grew 21%, EPS was up 38%, and free cash flow conversion exceeded 100%. Our performance demonstrates how FLIGHT DECK is taking hold as we accelerated services and equipment output to fulfill our growing backlog of roughly $190 billion. We enter 2026 with solid momentum to build upon these results and are well positioned to create greater value for our customers. This supports another year of substantial EPS and cash growth, and I'm confident our team will deliver." — see report.

Intel quarterly revenue -4.1% to $13.674 bn vs $13.674 bn estimate

EPS at $0.15 vs $0.15 estimate

Lip-Bu Tan, CEO, said, “Our conviction in the essential role of CPUs in the AI era continues to grow. We delivered a solid finish to the year and made progress on our journey to build a new Intel. The introduction of our first products on Intel 18A – the most advanced process technology developed and manufactured in the United States – marks an important milestone, and we’re working aggressively to grow supply to meet strong customer demand. Our priorities are clear: sharpen execution, reinvigorate engineering excellence, and fully capitalize on the vast opportunity AI presents across all of our businesses." — see report.

European Stock Indices

CAC 40 +0.99%

DAX +1.20%

FTSE 100 +0.12%

According to LSEG I/B/E/S data, fourth quarter earnings are expected to decrease 4.2% from Q4 2024. Excluding the Energy sector, earnings are expected to decrease 4.9%. Fourth quarter revenue is expected to decrease 3.5% from Q4 2024. Excluding the Energy sector, revenues are expected to increase 1.0%.

As of 22 January two companies in the STOXX 600 have reported earnings to date for Q4 2025. Of these, 100.0% reported results exceeding analyst estimates. In a typical quarter 54% beat analyst EPS estimates. Eight companies in the STOXX 600 have reported revenue to date for Q4 2025. Of these, 37.5% reported revenue exceeding analyst estimates. In a typical quarter 58% beat analyst revenue estimates.

During the week of 26 January, 29 companies are expected to report quarterly earnings.

Commodities

Gold spot +2.13% to $4,935.01 an ounce

Silver spot +3.27% to $96.16 an ounce

West Texas Intermediate -1.65% to $59.67 a barrel

Brent crude -1.42% to $64.37 a barrel

Gold surpassed the $4,900 per ounce mark for the first time on Thursday, driven by persistent geopolitical tensions and a weakening US dollar. Spot gold rose +2.13% to reach an all-time high of $4,935.01 per ounce.

The US dollar declined -0.49%, enhancing the appeal of dollar-denominated bullion for international buyers.

Spot silver closed the day +3.27 at $96.16 after soaring to a record $96.58 per ounce.

Oil prices fell more than a percent on Thursday, reaching their lowest levels in a week.

Brent crude futures fell $0.93, or -1.42%, settling at $64.37 per barrel. US WTI crude dropped by $1.00, or -1.65%, to close at a one-week low of $59.67 per barrel.

In Venezuela, following the ouster of dictator Nicolas Maduro, trading firms Vitol and Trafigura exported fuel oil under a US-backed agreement.

Drafts reviewed by Reuters on Thursday indicate that proposed reforms to Venezuela's hydrocarbons law would permit both foreign and domestic companies to independently operate oilfields through a new contract structure, market their output, and receive proceeds from sales — even as minority partners of the state-owned company PDVSA.

A US official stated on Thursday that the Trump administration is allowing China to purchase Venezuelan oil, but not at the 'unfair, undercut' prices at which Caracas sold crude prior to the US removal of Maduro.

Note: As of 4 pm EST 22 January 2026

Currencies

EUR +0.60% to $1.1754

GBP +0.53% to $1.3497

Bitcoin -1.12% to $89,188.86

Ethereum -2.89% to $2,943.43

The safe-haven US dollar depreciated on Thursday, while major currencies including the euro and the British pound strengthened.

The dollar fell -0.60% against the euro to $1.1754 per euro, and -0.69% against the Swiss franc to 0.7899 Swiss franc. The British pound also gained ground against the dollar, rising +0.53% to $1.3497.

However, the Japanese yen remained under pressure following Prime Minister Sanae Takaichi’s announcement of a snap election and her commitment to implementing more expansive fiscal policies. The yen weakened -0.08% to ¥158.402 per US dollar, hovering close to last week’s 18-month low of ¥159.45.

Fixed Income

US 10-year Treasury +0.1 basis points to 4.246%

German 10-year bund +0.4 basis points to 2.888%

UK 10-year gilt +1.2 basis points to 4.475%

On Thursday, US Treasury yields flattened as broadly robust economic data highlighted the enduring strength of the US economy.

During afternoon trading, the yield on the US 10-year Treasury note edged up +0.1 bps to 4.246%, following a climb earlier in the week to its highest level since late August.

At the front end of the curve, the 2-year Treasury yield rose +1.9 bps to 3.616%. Conversely, the yield on the 30-year Treasury bond fell -2.6 bps to 4.836%. It had reached the highest level since early September on Tuesday. The spread between two-year and ten-year yields narrowed to 63.0 bps from 64.8 bps in the prior session.

A $21 billion auction for 10-year Treasury Inflation-Protected Securities (TIPS) on Thursday was met with lukewarm demand, pricing at 1.94%. This was above the anticipated yield at the bid deadline. The bid-to-cover ratio stood at 2.38x, lower than the previous 10-year TIPS auction.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 43.0 bps of cuts in 2026, lower than the 47.6 bps priced in the previous week. Fed funds futures traders are now pricing in a 5.0% probability of a 25 bps rate cut at January’s FOMC meeting, up from 4.4% a week ago.

Eurozone sovereign bonds remained steady on Thursday, with yields on long-term securities registering a slight decrease, whereas yields on short-term instruments recorded a marginal increase.

The yield on Germany's 10-year government bond increased +0.4 bps to 2.888%, following an earlier dip in the session after advancing over the preceding five trading days.

The yield on 30-year German debt — which had risen substantially earlier in the week — fell -1.6 bps to 3.498%. The two-year yield advanced +2.7 bps to reach 2.121%.

Other eurozone government bonds outperformed their German counterparts slightly on Thursday, reversing the trends observed earlier in the week.

The Italian 10-year yield fell -0.9 bps to 3.513%, narrowing the spread over German Bunds to 62.5 bps, a contraction of 1.3 bps compared to the previous session.

Note: As of 5 pm EST 22 January 2026

Global Macro Updates

EU's wake up call is here. The ECB and the European Systemic Risk Board (ESRB) have jointly published a report highlighting geoeconomic fragmentation and geopolitical risk as primary sources of uncertainty. This assessment aligns with findings from a recent Bank of America (BofA) survey, which, according to Bloomberg news, indicates that for the first time since October 2024, investors view geopolitical conflict as the greatest threat to financial markets.

As noted by Reuters, the ESRB report emphasised that sustained high geopolitical uncertainty could make it increasingly difficult for euro area banks to secure market financing, especially in US dollars and other foreign currencies. The report further noted that elevated geopolitical risks are estimated to lower expected growth outcomes and introduce considerable downside risks to the real economy, while also significantly affecting the interconnectedness among bonds, commodities, equities, and exchange rates.

Despite the uncertain geopolitical environment, the BofA report revealed a record level of bullish sentiment toward equities, with cash allocations among European survey participants dropping to a 12-year low of 2.8%. Investors have increased their overweight positions in European assets, with the majority anticipating that Europe will outperform the US. Upgrades to earnings forecasts are identified as the most likely catalyst for further gains in European equities, with Technology and Banking sectors representing the largest overweight allocations.

November personal spending, income, and PCE index meet expectations. Headline PCE increased by 0.2% m/o/m, matching both market forecasts and the prior month's reading. Similarly, core PCE rose by 0.2%, in line with consensus and consistent with the 0.2% increase observed in October. Core PCE has now registered a 0.2% monthly gain for five consecutive months.

On an annualised basis as of November, both headline and core PCE stand at 2.8%, aligning precisely with consensus estimates.

Personal spending for November advanced by 0.5% on a monthly basis, aligning with both expectations, and October's figure. Personal income for the month increased by 0.3%, slightly below the anticipated 0.4%, but higher than the 0.1% rise recorded in October.

Thursday’s consumer spending data reinforces the narrative of ongoing consumer resilience. Furthermore, the final reading of Q3 GDP, released yesterday morning, also indicated solid personal consumption.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。