What could Trump’s framework include?

Corporate Earnings Calendar

Thursday: Abbott Laboratories, Freeport-McMoRan, GE Aerospace, Huntington Bancshares, McCormick, Procter & Gamble, Northern Trust, CSX, Intel, Capital One Financial, Intuitive Surgical

Friday: SLB

Monday: Steel Dynamics, Brown & Brown, Nucor, W.R. Berkley, Alexandria Real Estate Equities, Ryanair Holdings

Tuesday: General Motors, HCA Healthcare, Northrop Grumman, Sysco, UnitedHealth Group, Synchrony Financial, UPS, RTX, Invesco, Boeing, NextEra Energy, Union Pacific, PACCAR, PPG Industries, Texas Instruments, F5, Logitech

Wednesday: Microsoft, Meta Platforms, Tesla, IBM, GE Vernova, Corning, ADP, General Dynamics, Otis Worldwide, AT&T, Danaher, Textron, Lennox International, Starbucks, ServiceNow, Fair Isaac, ASML Holding

Global market indices

US Stock Indices Price Performance

Nasdaq 100 +0.30% YTD

Dow Jones Industrial Average +0.88% YTD

NYSE +3.28% YTD

S&P 500 +0.44% YTD

The S&P 500 is -0.74% over the past seven days, with 8 of the 11 sectors up MTD. The Equally Weighted version of the S&P 500 is +0.37% over this past week and +4.00% YTD.

The S&P 500 Energy is the leading sector so far this month, +9.14% YTD, while Financials is the weakest sector at -2.59% YTD.

Over the past seven days, Energy outperformed within the S&P 500 at +1.49%, followed by Industrials and Materials at +1.27% and +0.96%, respectively. Conversely, Communication Services underperformed at -1.78%, followed by Information Technology and Financials at -1.40% and -1.28%, respectively.

The equal-weight version of the S&P 500 was +1.67% on Wednesday, performing its cap-weighted counterpart by 0.51 percentage points.

On Wednesday the S&P 500 was +1.16% to 6,875.62, while the Dow Jones Industrial Average +1.21%, or 588.64 points. The Nasdaq Composite Index was +1.18%.

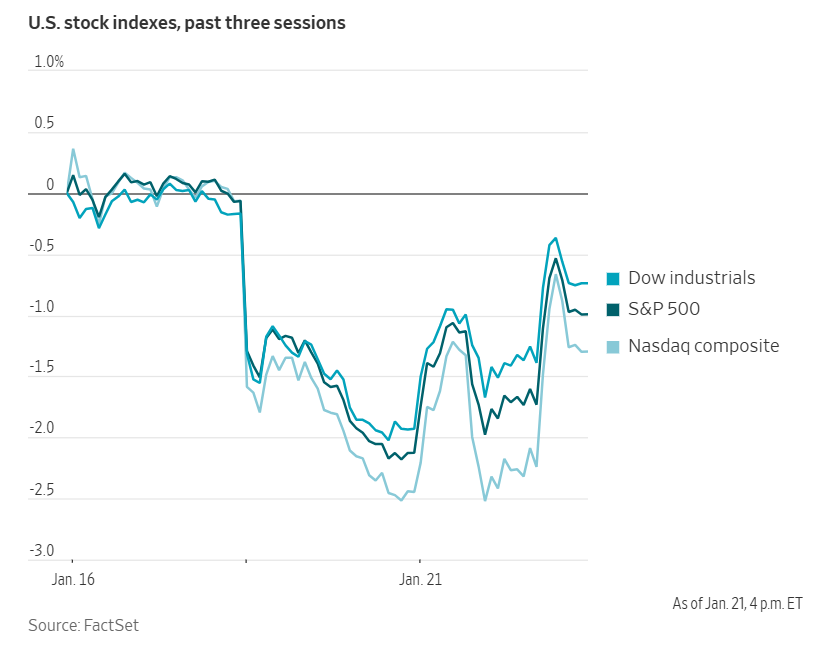

Over the past seven days, the S&P 500 is -0.74%, the Dow Jones -1.34%, and the Nasdaq Composite -1.05%.

Following a day of volatile trading, the Dow Jones Industrial Average advanced 588 points, a +1.21% increase. Similarly, the S&P 500 and Nasdaq Composite gained +1.16% and +1.18%, respectively. This rebound followed Tuesday’s selloff, during which the Nasdaq Composite had its worst day since October.

Economically sensitive equities also performed strongly. The Dow Jones Transportation Average, which tracks 20 leading companies across industries such as railroads and airlines, rose +3.10%. Additionally, the Russell 2000 index advanced +2.00%, marking its most sustained period of outperformance relative to the S&P 500 since June 2008.

The Cboe Volatility Index, commonly referred to as Wall Street’s ‘fear gauge’, dropped below 17 on Wednesday.

In corporate news, Johnson & Johnson suffered a setback in court, losing a key attempt to prevent expert witnesses from associating its discontinued baby powder products with cancer.

Berkshire Hathaway, the largest shareholder in Kraft Heinz, is reportedly considering the sale of part or all of its holdings in the food company. This development comes only months after the firm announced plans to split into two companies.

Halliburton is prepared to promptly resume operations in Venezuela upon receiving approval from the US government and securing appropriate payment safeguards, CEO Jeff Miller stated.

Charles Schwab reported a notable increase in average daily trading volume during Q4, as retail investors sought to capitalise at the end of a robust year for equity markets.

Blue Origin announced on Wednesday that it is developing a satellite communications network aimed at providing connectivity to data centres, government entities, and businesses.

Deutsche Boerse has agreed to acquire Allfunds Group, a leading European fund distribution platform, for approximately €5.3 billion in a combination of cash and stock.

L’Occitane Groupe, the skincare retailer taken private by billionaire Reinold Geiger in 2024, is reportedly considering an initial public offering in the United States as early as this year, according to sources cited by Bloomberg news.

Mega caps: The Magnificent Seven had a negative performance over the past week. Over the last seven days, Nvidia +0.10%, while Meta Platforms -0.42%, Tesla -1.77%, Alphabet -2.22%, Amazon -2.26%, Microsoft -3.32%, and Apple -4.74%.

Energy stocks had a mixed performance this week, with the Energy sector itself +1.49%. WTI and Brent prices are -0.62% and -0.40%, respectively, over the past week. Over the last seven days, Energy Fuels +7.53%, Baker Hughes +7.22%, ExxonMobil +2.62%, Halliburton +0.97%, BP +0.38%, and Phillips 66 +0.18%, while Shell -0.20%, Chevron -0.30%, APA -0.56%, Occidental Petroleum -1.83%, Marathon Petroleum -1.99%, and ConocoPhillips -3.18%.

Materials and Mining stocks had a mostly positive performance this week, with the Materials sector +0.96%. Over the past seven days, CF Industries +8.01%, Nucor +4.61%, Newmont Corporation +4.17%, Celanese Corporation +2.47%, Albemarle +1.41%, Freeport-McMoRan +0.38%, and Mosaic +0.04%, while Yara International -0.19%, and Sibanye Stillwater -1.85%.

European Stock Indices Price Performance

Stoxx 600 +1.77% YTD

DAX +0.29% YTD

CAC 40 -0.99% YTD

IBEX 35 +0.76% YTD

FTSE MIB -1.01% YTD

FTSE 100 +2.08% YTD

This week, the pan-European Stoxx Europe 600 index is -1.45%. It was -0.02% Wednesday, closing at 602.67.

So far this month in the STOXX Europe 600, Basic Resources is the leading sector, +11.49% YTD, while Insurance is the weakest at -5.44% YTD.

Over the past seven days, Basic Resources outperformed within the STOXX Europe 600, at +2.12%, followed by Oil & Gas and Travel & Leisure at +0.59% and +0.53%, respectively. Conversely, Personal & Household Goods underperformed at -4.41%, followed by Autos & Parts and Food & Beverages at -4.24% and -3.14%, respectively.

Germany's DAX index was -0.58% Wednesday, closing at 24,560.98. It was -2.87% over the past seven days. France's CAC 40 index was +0.08% Wednesday, closing at 8,069.17. It was -3.14% over the past week.

The UK's FTSE 100 index was -0.45% over the past seven days to 10,138.09. It was +0.11% on Wednesday.

In Wednesday's trading session, the Basic Resources sector emerged as the outperformer, supported by rising prices for gold, silver, and copper, underpinned by safe-haven inflows and strong corporate results. Rio Tinto reported fourth-quarter production that exceeded expectations, with Pilbara iron ore shipments reaching 91.3 million tonnes compared to the consensus estimate of 88.1 million tonnes, and the company reaffirmed its full-year 2026 guidance. Hochschild Mining’s full-year production surpassed guidance at 311,509 gold equivalent ounces, with an outlook for 2026 set at 300,000 to 328,000 ounces.

The Travel & Leisure sector benefitted from resilient consumer spending signals within the industry, despite broader macro caution. Air France KLM was initiated at ‘Sector Perform’ by RBC, which highlighted a balanced risk-reward profile stemming from potential macroeconomic improvements and planned internal efficiency gains aimed for fiscal year 2027.

In contrast, Banks, Insurance, and Financial Services underperformed. Aberdeen reported assets under management and administration (AUMA) as of 31st December at £556.0 billion, compared to the FactSet estimate of £547.42 billion. ICG disclosed Q3 AUM of $127 billion, with fee-earning assets of $85 billion, representing an increase of 1% q/o/q and 11% y/o/y.

The Food & Beverage sector also traded lower. Barry Callebaut exceeded Q1 revenue expectations, reaffirmed its outlook for fiscal years 2025 and 2026, and saw positive momentum following the appointment of former Unilever CEO Hein Schumacher. In contrast, Nestlé came under pressure after Le Parisien published a negative article concerning an infant formula recall in France following the suspicious death of a baby.

Other Global Stock Indices Price Performance

MSCI World Index +1.38% YTD

Hang Seng +3.72% YTD

Over the past seven days, the MSCI World Index and Hang Seng Index are -0.76% and -1.54%, respectively.

Currencies

EUR -0.52% YTD to $1.1684

GBP -0.35% YTD to $1.3426

The dollar moved sharply higher against the euro and the Swiss franc on Wednesday following the US President’s decision to retract a previously issued tariff threat against several EU nations. The President announced that a framework for a future agreement concerning Greenland had been established with NATO, alleviating trade-related concerns and supporting the dollar’s performance.

The dollar index advanced +1.25% to 98.78. However, over the week the index declined -1.29%. The dollar index is +0.73% YTD.

The euro declined -0.33%, settling at $1.1684 on Wednesday, after rising in the preceding two sessions. It reached $1.1723 on Tuesday — its highest since 30th December. Over the past seven days, the euro was +0.35%.

The Swiss franc, considered a safe-haven currency, depreciated -0.77% to CHF 0.7958 per US dollar, reversing gains of more than one percent recorded between Monday and Tuesday.

The British pound traded slightly lower on Wednesday, -0.09% to $1.3426. This marked a decline of -0.12% over the last seven days. This may be attributable to data released by the Office for National Statistics on Tuesday, Britain’s labour market softened in December, with UK firms cutting jobs at the fastest pace since 2020 and wage growth easing to its lowest in 3 1/2 years. The number of employees on payrolls fell 43,000 in December and the unemployment rate was near a 5-year high at 5.1% in the three months through November.

Sterling exhibited minimal movement throughout the day and remained close to levels observed prior to the release of the December inflation report on Wednesday. Investor sentiment remained unchanged regarding expectations for the BoE to reduce interest rates later this year, supported by service-sector price inflation aligning with analyst forecasts.

The US dollar also strengthened against the Japanese yen, which once again came under selling pressure following Prime Minister Sanae Takaichi announcement for snap elections scheduled for 8th February and her pledges to loosen fiscal policy. The yen fell -0.08% against the dollar to ¥158.28 on Wednesday. However, for the week, the yen advanced +0.09% versus the greenback. Year-to-date, the Japanese yen is -1.04% against the US dollar.

Note: As of 5:00 pm EST 21 January 2026

Cryptocurrencies

Bitcoin +2.86% YTD to $90,197.13

Ethereum +1.76% YTD to $3,030.91

Bitcoin is -7.50% over the last seven days and Ethereum is -9.95%. On Wednesday, Bitcoin was +0.87% to $90,197.13 and Ethereum was +1.34% to $3,030.91.

Bitcoin, Ethereum, and other large-cap cryptocurrencies recovered on Wednesday following the announcement by President Trump that he would not impose threatened tariffs on eight European nations. However, during the week it was down as the “sell America trade” took hold, with the concurrent shift back into a higher-volatility environment.

During his speech at the World Economic Forum in Davos on Wednesday, President Trump reiterated his commitment to making sure the US remains the "crypto capital of the world." However, the Senate Banking Committee has, according to Bloomberg news, decided to delay by at least several weeks the Clarity bill and shift their focus to potential housing legislation in support of President Donald Trump’s affordability push ahead of the US mid-terms. The bill had already been postponed by the Senate Banking Committee last week after Coinbase Global Inc. withdrew support.

Note: As of 5:00 pm EST 21 January 2026

Fixed Income

US 10-year yield +7.3 bps YTD to 4.245%

German 10-year yield +2.4 bps YTD to 2.884%

UK 10-year yield -1.5 bps YTD to 4.463%

US Treasury yields moderated on Wednesday, retreating from multi-month highs as investor risk appetite improved.

Earlier in the trading session, Treasuries experienced a rally following the US President’s announcement ruling out the use of force to acquire Danish territory. This positive sentiment was further reinforced by a successful 20-year government bond auction, underscoring stable demand for US government debt.

In afternoon trading, the yield on the US 10-year Treasury note declined -5.5 bps to 4.245%, a reversal from Tuesday when it reached its highest level since late August after a significant selloff. The 30-year Treasury yield also fell, dropping -6.2 bps to 4.862%, having previously climbed to its highest point since early September.

The 20-year Treasury yield fell -4.8 bps to 4.829%, extending its decline after a well-received auction. The auction’s pricing at 4.846% came in below the expected yield at the bid deadline. The bid-to-cover ratio stood at 2.86x, surpassing both the December auction result and the average of the past three auctions.

On the short end of the yield curve, the US 2-year Treasury yield edged down -0.8 bps, settling at 3.597%.

The spread between two-year and ten-year Treasury yields narrowed to 64.8 bps from 69.5 bps in the previous session. It represents an increase of 3.1 bps compared to last week’s 61.7 bps level.

Over the past seven days, the yield on the 10-year Treasury note was +10.6 bps. The yield on the 30-year Treasury bond was +7.5 bps. On the shorter end, the two-year Treasury yield was +7.5 bps.

According to CME Group's FedWatch Tool, traders are pricing in 45.3 bps of cuts in 2026, lower than the 55.0 bps priced in last week. Fed funds futures traders are now pricing in a 5.5% probability of a 25 bps rate cut at January’s FOMC meeting, up from 4.4% last week.

Across the Atlantic, in the UK, on Wednesday the 10-year gilt was +0.1 bps to 4.463%. Over the past seven days, it was +11.9 bps.

On Wednesday, long-term German bond yields advanced for the fourth consecutive session, as investors continued to digest the ramifications of this week’s pronounced selloff in Japanese debt and assess the ever-evolving geopolitical landscape.

The yield on Germany’s 30-year bond climbed +6.0 bps to 3.514%, reversing an earlier decline. This brings the weekly increase to +8.9 bps, which, if sustained, would mark the largest weekly rise since early December.

The German 10-year bond yield rose +2.3 bps, reaching 2.884%. Shorter-dated, rate-sensitive yields remained steady, with the two-year Schatz yield edging up +0.2 bps to 2.094%.

Eurozone countries also kept up the pace of what's been a busy period for sales of new bonds, though these offerings had minimal effect on secondary market pricing.

On Wednesday, Germany issued 30-year bonds at an average yield of 3.49%, up from the 3.45% achieved earlier this month. Demand was notably stronger, as reflected in a bid-to-cover ratio of 2.4x, compared to 2.1x previously.

Over the past seven days, the German 10-year yield was +6.5 bps. Germany's two-year bond yield was +1.6 bps, and, on the longer end, Germany's 30-year yield was +8.9 bps.

The yield spread between German Bunds and 10-year UK gilts reached 157.9 bps on Wednesday, an expansion of 152.5 bps over the past seven days.

The spread between US 10-year Treasuries and German Bunds is now 136.1 bps, 4.1 bps higher from last week’s 132.0 bps.

Italy’s 10-year yield traded +2.0 bps higher to 3.522%. The spread between Italian BTP 10-year yields and German Bund 10-year yield stood at 63.8 bps, equal to last week’s spread. The Italian 10-year yield was +6.5 bps over the last week.

France’s 10-year yield rose by +1.1 bps to 3.537%, following the easing of domestic tensions regarding the national budget earlier in the week. Over the course of the week, it has risen by +4.3 bps.

Commodities

Gold spot +12.00% YTD to $4,831.94 per ounce

Silver spot +30.66% YTD to $93.11 per ounce

West Texas Intermediate crude +5.68% YTD to $60.67 a barrel

Brent crude +7.21% YTD to $65.30 a barrel

On Wednesday, gold prices pared earlier gains, retreating from a record high, following the US President’s decision to retract some of his most forceful threats concerning Greenland.

Spot gold advanced +1.45% on the day to end the trading session at $4,831.94 per ounce after reaching an all time high of $4,887.82 earlier in the session.

Spot silver declined -1.55% to $93.11 per ounce, having touched a record high of $95.87 on Tuesday. Silver prices have soared +30.66% year-to-date.

Spot gold was +4.42% over the last seven days and is +12.00% YTD due to a combination of factors such as escalating geopolitical tensions between the US and Europe, attacks on Fed independence, and expectations of increased central bank purchases.

Oil prices ended more than one percent higher on Wednesday, supported by optimism regarding tighter supply conditions. This sentiment followed a temporary shutdown at two major oil fields in Kazakhstan and was further reinforced by persistently low Venezuelan oil export volumes, which underscore the slow pace of reversing production cuts in the South American nation.

Brent crude futures rose $1.40, or +2.19%, settling at $65.30 per barrel. US WTI crude increased $1.15, or +1.93%, to close at $60.67 per barrel.

Over the past seven days, WTI and Brent prices are -0.62% and -0.40%, respectively.

On Tuesday, both contracts finished slightly higher as Kazakhstan, a member of OPEC+, halted output at the Tengiz and Korolev oilfields on Sunday, citing issues with power distribution.

Additionally, crude from the extensive Kashagan field was redirected to Kazakhstan’s domestic market for the first time due to logistical constraints at the Black Sea CPC terminal, which suffered significant equipment damage from recent drone attacks.

On Wednesday, Tengizchevroil (TCO), the operator of the Tengiz oilfield, declared force majeure on crude deliveries into the CPC pipeline system, as confirmed by a TCO letter. According to industry sources cited by Reuters on Tuesday, oil production at the two Kazakh fields could remain suspended for an additional seven to ten days.

Additionally, data from vessel tracking and documents from PDVSA indicated that Venezuelan oil exports under a $2 billion supply agreement with the US reached approximately 7.8 million barrels on Wednesday, highlighting the gradual progress that has hindered the state-run oil company from fully reversing production reductions.

The US Energy Information Administration (EIA) will release its crude inventories report at 12 pm EST today, a day later than usual due to the Martin Luther King Jr. Day holiday.

IEA sees higher oil demand growth and smaller surplus in 2026. In its latest monthly Oil Market Report issued on Wednesday, the International Energy Agency (IEA) revised its forecast for global oil demand growth in 2026 upward, indicating a slightly reduced surplus in the oil market for the current year.

The IEA now anticipates that worldwide oil demand will increase by 930,000 barrels per day (bpd) this year, compared to its previous projection of 860,000 bpd growth. This adjustment implies that global oil supply will surpass demand by 3.69 million bpd in 2026, a slight decrease from the 3.84 million bpd surplus noted in the Paris-based agency's December report.

The IEA remarked, "For now, bloated balances provide some comfort to market participants and have kept prices in check."

Note: As of 5:00 pm EST 21 January 2026

Key data to move markets

EUROPE

Thursday: ECB Monetary Policy Meeting Accounts, German Bundesbank “Buba” Monthly Report, and Eurozone Consumer Confidence

Friday: French, German and Eurozone HCOB Composite, Manufacturing and Services PMIs and a speech by ECB President Christine Lagarde

Monday: German IFO Business Climate, Sentiment and Expectations Surveys

Wednesday: GfK Consumer Confidence Survey

UK

Friday: GfK Consumer Confidence, Retail Sales, S&P Global Composite, Manufacturing and Services PMIs, and a speech by BoE External Member Megan Greene

USA

Thursday: Initial and Continuing Jobless Claims, GDP, Personal Consumption Expenditures Prices, Personal Consumption Expenditures Price Index, Personal Income, and Personal Spending

Friday: S&P Global Composite, Manufacturing and Services PMIs, Michigan Consumer Expectations Index, Michigan Consumer Sentiment Index, and UoM 1 and 5-year Inflation Expectations

Monday: Durable Goods Orders and Non-Defence Capital Goods Orders

Tuesday: ADP Employment Change 4-week Average, Housing Price Index, and Consumer Confidence

Wednesday: Fed Interest Rate Decision, Fed Monetary Policy Statement, and FOMC Press Conference

JAPAN

Thursday: National CPI

Friday: BoJ Interest Rate Decision, Monetary Policy Statement, Outlook Report (Q4), and Press Conference

Monday: BoJ Monetary Policy Meeting Minutes

Global Macro Updates

Can Trump reach a negotiated agreement on Greenland? On Wednesday President Trump spoke at the World Economic Forum in Davos, Switzerland. During his speech, he continued to suggest that the US would acquire Greenland for its national security. However, after discussions with NATO chief Mark Rutte, it appears that a “framework” deal has been agreed and that the US will rely on diplomatic channels to address the issue, as President Trump ruled out military options. He will also not push ahead with the threatened tariffs on eight European countries that have objected to the US’ demands. He added that the framework could involve Greenland’s natural resources. “They’re going to be involved in mineral rights and so are we.”

If this is indeed the case, one possibility is that the US works out a long term leasing agreement with Denmark which still says it will not cede its territory to the US. Lars Løkke Rasmussen, Denmark’s foreign minister, has insisted that “it is not going to happen that the USA will own Greenland. That is a red line”. The US already has long-term leases or status-of-forces agreements (SOFAs) for numerous military bases worldwide. Additionally, the US may seek an agreement with Denmark and Greenland that may include private investors as well, to create a fund, similar to the Alaska Permanent Fund structure, that allows for the mining of rare earth and other minerals and metals. This fund could manage these assets and provide annual dividends to Greenland residents. This may prove popular with Greenlanders as they have the highest poverty rate in the Nordics, at around 17%. An alternative may be the creation of a sovereign wealth fund from part of the expected profits of any agreed mining ventures, which can, similar to the Norwegian Sovereign Wealth Fund, fund public services like healthcare, education, and infrastructure, creating indirect benefits and ensuring future generations benefit from this resource wealth.

EU leaders are expected to meet in Brussels on Thursday to discuss their approach to talks on Greenland.

Rating agencies weigh in on Japan’s fiscal stance and yen intervention signals. Nikkei Asia has published excerpts from an interview with S&P’s director of sovereign ratings, Rain Yin, highlighting that strong tax revenue growth continues to keep Japan’s interest rate obligations manageable, even as the Takaichi administration signals potential fiscal expansion. Yin noted that most risks are already reflected in the current ratings and even if Japan’s fiscal position were to weaken somewhat, this would not likely result in negative rating action within the next one to two years. She also downplayed the impact of Prime Minister Takaichi’s proposed move away from annual primary balance reviews, emphasising S&P’s primary focus on a sustained reduction in the net debt-to-GDP ratio. However, this interview appeared on the Japanese-language website on 15th January, prior to Prime Minister Takaichi’s announcement of a possible two-year suspension of the consumption tax on food — an initiative that competes with the Centrist Reform Alliance’s new policy platform ahead of the 8th February lower house election.

In a subsequent emailed statement to Bloomberg news, Yin expressed concern that a prolonged decline in government revenues could amplify challenges created by ongoing increases in expenditures. The ratings agency Fitch indicated that these developments were in line with its prior expectations for greater fiscal expansion. In a separate interview with Nikkei, Moody's senior credit officer for sovereign risk, Martin Petch, underscored the interplay between nominal economic growth and tax revenues as a key consideration. He acknowledged that fiscal consolidation will be a gradual process given the range of challenges.

In terms of yen valuation, there appears to be a lack of coordination in the Ministry of Finance’s foreign exchange messaging. It has been inconsistent among officials and has lacked the usual nuanced buildup designed to prepare markets for possible intervention. This inconsistency has made it challenging for market participants to assess the Ministry’s evolving tolerance for exchange rate movements.

Ministry sources affirmed that Finance Minister Katayama’s statements reflect a clear willingness to intervene if necessary, but cautioned that overusing strong language could undermine its effect. Officials emphasised the importance of gradually escalating rhetoric, with some suggesting that Katayama’s consistently forceful communication may be a strategic attempt to influence markets through verbal warnings alone, avoiding the need for actual intervention.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。