Can AI stocks recover from investor unease?

Global market indices

US Stock Indices Price Performance

Nasdaq 100 -3.10% MTD and +17.30% YTD

Dow Jones Industrial Average +0.83% MTD and +13.09% YTD

NYSE -0.31% MTD and +13.92% YTD

S&P 500 -1.86% MTD and +14.28% YTD

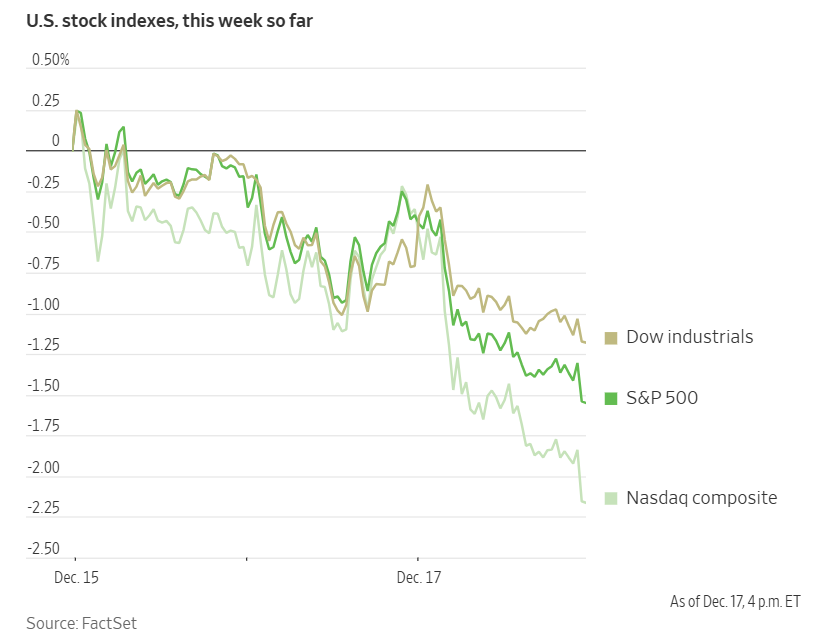

The S&P 500 is -2.40% over the past seven days, with 8 of the 11 sectors down MTD. The Equally Weighted version of the S&P 500 is -0.76% over this past week and +9.07% YTD.

The S&P 500 Financials is the leading sector so far this month, +2.34% MTD and +12.66% YTD, while Utilities is the weakest sector at -5.88% MTD and +12.02% YTD.

Over the past seven days, Materials outperformed within the S&P 500 at +2.67%, followed by Consumer Staples and Financials at +1.92% and +1.36%, respectively. Conversely, Information Technology underperformed at -6.21%, followed by Communication Services and Energy at -3.56% and -2.91%, respectively.

The equal-weight version of the S&P 500 was -0.31% on Wednesday, outperforming its cap-weighted counterpart by 0.85 percentage points.

Over the past seven days, the S&P 500 is -2.60%, the Dow Jones -1.68%, and the Nasdaq Composite -3.82%.

In corporate news, Alphabet’s Google is introducing a more efficient and cost-effective iteration of its most advanced artificial intelligence model across its suite of products, further strengthening the company’s trajectory following the successful debut of Gemini 3.

Warner Bros. Discovery has advised its shareholders to decline a hostile takeover proposal from Paramount Skydance in favour of its initial agreement with streaming leader Netflix, characterising the Paramount bid as ‘inferior’ and ‘inadequate.’

According to a recent filing by Warner Bros. Discovery, Comcast has proposed merging its NBCUniversal division with Warner Bros. Discovery, valuing the cable conglomerate’s media and theme park holdings at approximately $81 billion.

Ford Motor has terminated a 9.6 trillion won battery agreement with LG Energy Solution following the automaker’s decision to scale back its EV ambitions.

SpaceX has informed its employees that the company is entering a regulatory quiet period, according to individuals familiar with the matter, bringing the aerospace and satellite manufacturer closer to an IPO anticipated in 2026.

Mega caps: The Magnificent Seven had a mostly negative performance over the past week. Over the last seven days, Tesla +3.50%, while Meta Platforms -0.10%, Microsoft -0.51%, Apple -2.49%, Amazon -4.53%, Nvidia -6.99%, and Alphabet -7.34%.

Energy stocks had a decisively negative performance this week, with the Energy sector itself -2.91%. WTI and Brent prices are -3.35% and -3.29%, respectively, over the past week. Over the last seven days, Chevron -1.25%, ExxonMobil -1.78%, ConocoPhillips -1.90%, Shell -1.90%, Occidental Petroleum -2.68%, BP -3.99%, Halliburton -4.48%, Baker Hughes -5.72%, APA -6.42%, Phillips 66 -8.22%, Marathon Petroleum -8.78%, and Energy Fuels -9.51%.

Materials and Mining stocks had a mostly positive performance this week, with the Materials sector +2.67%. Over the past seven days, Sibanye Stillwater +8.39%, Yara International +5.55%, Newmont Corporation +5.35%, CF Industries +3.84%, Freeport-McMoRan +2.95%, Mosaic +1.18%, and Albemarle +1.13%, while Nucor -2.22%, and Celanese Corporation -3.91%.

European Stock Indices Price Performance

Stoxx 600 +0.58% MTD and +14.22% YTD

DAX +0.52% MTD and +20.35% YTD

CAC 40 -0.45% MTD and +9.56% YTD

IBEX 35 +3.46% MTD and +46.08% YTD

FTSE MIB +1.46% MTD and +28.68% YTD

FTSE 100 -0.37% MTD and +18.50% YTD

This week, the pan-European Stoxx Europe 600 index is +0.28%. It was -0.00% Wednesday, down 0.01 points, closing at 579.79.

So far this month in the STOXX Europe 600, Retail is the leading sector, +5.09% MTD and +8.30% YTD, while Oil & Gas is the weakest at -3.07% MTD and +17.56% YTD.

Over the past seven days, Travel & Leisure outperformed within the STOXX Europe 600, at +4.96%, followed by Food & Beverages and Financial Services at +2.76% and +2.52%, respectively. Conversely, Technology underperformed at -3.60%, followed by Oil & Gas and Industrial Goods at -2.90% and -0.80%, respectively.

Germany's DAX index was -0.48% Wednesday, closing at 23,960.59. It was -0.70% over the past seven days. France's CAC 40 index was -0.25% Wednesday, closing at 8,086.05. It was +0.79% over the past week.

The UK's FTSE 100 index was +0.30% over the past seven days to 9,684.79. It was -0.68% on Wednesday.

According to LSEG I/B/E/S data, Q3 earnings are expected to increase 7.3% from Q3 2024. Excluding the Energy sector, earnings are expected to increase 7.7%. Q3 revenue is expected to decrease 1.2% from Q3 2024. Excluding the Energy sector, revenues are expected to increase 0.1%. Of the 287 companies in the STOXX 600 that have reported earnings by 16th December for Q3 2025, 54.7% reported results exceeding analyst estimates. In a typical quarter 54% beat analyst EPS estimates. Of the 343 companies in the STOXX 600 that have reported revenue by 16th December for Q3 2025, 47.5% reported revenue exceeding analyst estimates. In a typical quarter 58% beat analyst revenue estimates.

The estimated earnings growth rate for the STOXX 600 for Q3 2025 is 7.3%. Eight of the ten sectors in the index expect to see an improvement in earnings relative to Q3 2024. The Real Estate sector has the highest earnings growth rate for the quarter, while the Consumer Cyclicals has the weakest anticipated growth compared to Q3 2024. Analysts expect positive earnings growth from 12 of the 16 countries represented in the STOXX 600 index. Poland (45.2%) and Germany (27.1%) have the highest estimated earnings growth rates, while Norway (-28.4%) and Denmark (-19.0%) have the lowest estimated growth.

During the week of 22nd December, no companies are expected to report quarterly earnings.

In Wednesday's trading session Basic Resources, Energy, and Banks led the performance among European equities, while Automotive & Parts, Construction & Materials, and Media lagged behind.

Basic Resources outperformed as precious metals surged, with silver reaching record highs and gold maintaining strength. Analysts attributed the rise in the commodities complex to a combination of lower real interest rates, ongoing policy uncertainty, and increased demand for inflation hedges. The Oil & Gas sector also advanced, driven by an increase in crude oil prices following President Trump’s directive to impose a comprehensive blockade on sanctioned Venezuelan oil tankers. This action has recalibrated geopolitical risk after the recent market softness related to Ukraine-Russia negotiations.

Banks traded higher as part of yesterday’s pro-cyclical upswing. Analysts highlighted that pricing in the banking sector continues to reflect strong confidence in the durability of return on equity, supported by stronger financial markets, increased M&A activity, and a lighter regulatory environment.

Real Estate benefited from cooling inflation data in the UK and declining bond yields across Europe and the UK, which reinforced valuations and alleviated refinancing concerns, according to analysts.

In contrast, the Autos & Parts sector was the principal underperformer due to concerns over EV demand, exposure to China, and margin pressures outweighing the positive impact of reports indicating that Brussels intends to abandon the 2035 ban on ICE. Construction & Materials, Media and Chemicals underperformed. Personal & Household Goods also traded lower, despite selective M&A and portfolio actions, such as Diageo’s asset sale.

Other Global Stock Indices Price Performance

MSCI World Index -1.06% MTD and +17.37% YTD

Hang Seng -1.51% MTD and +26.96% YTD

Over the past seven days, the MSCI World Index and Hang Seng Index are -1.64% and -0.28%, respectively.

Currencies

EUR +1.22% MTD and +13.41% YTD to $1.1739

GBP +1.05% MTD and +6.89% YTD to $1.3372

The US dollar strengthened as market participants weighed Fedspeak and awaited monetary policy statements from the ECB today and from BoJ tomorrow.

Sterling experienced its largest single-day decline so far in December, as interest rate futures reflected an almost certain probability of a quarter-point rate reduction by the BoE today.

British inflation dropped to 3.2% in November, lower than expected and the lowest since March, down from 3.6% in October.

The British pound retreated against the dollar, -0.36%, to $1.3372, easing away from the two-month high it touched on Tuesday. Sterling has decreased -0.07% over the past seven days.

The dollar index advanced +0.17% to 98.39. Over the week the index declined -0.26%. The dollar index is -1.10% MTD and -9.30% YTD.

In afternoon trading, the euro declined, closing -0.06% to $1.1739 after touching a 12-week high on Tuesday ahead of today’s ECB policy decision, where the central bank is expected to hold rates steady. Over the past seven days, the euro was +0.38%.

The Japanese yen weakened -0.63% against the dollar to ¥155.69. However, over the past seven days, the yen has advanced +0.21%, contributing to an increase of +0.31% so far MTD. Year-to-date, the US dollar has fallen -0.78% against the Japanese yen.

Note: As of 5:00 pm EST 17 December 2025

Cryptocurrencies

Bitcoin -5.45% MTD and -8.08% YTD to $85,983.95

Ethereum -7.05% MTD and -15.45% YTD to $2,819.21

Bitcoin is down -6.95% over the last seven days, while Ethereum is down -15.63%. On Wednesday, Bitcoin was -2.05% to $85,983.95 and Ethereum was -4.48% to $2,819.21.

Cryptocurrencies continued to fall this week due heightened volatility related to thin liquidity amid ongoing macroeconomic uncertainty, a broader risk-off sentiment, reduced ETF inflows, defensive derivatives positioning, a possible increasing correlation with equities, and uncertainty over monetary policies.

However, in a positive note for cryptocurrencies, the Federal Reserve has, as noted by Decrypt, removed a nearly three-year-old policy that had curtailed the ability for state member banks to engage in crypto-related activities, replacing it with a new framework that encourages “responsible innovation.”

The new policy is seen as a means to "facilitate innovation by state member banks in a manner that is consistent with bank safety and soundness and preserving the stability of the US financial system," the central bank said in a statement.

Note: As of 5:00 pm EST 17 December 2025

Fixed Income

US 10-year yield +13.8 bps MTD and -42.0 bps YTD to 4.156%

German 10-year yield +17.8 bps MTD and +50.1 bps YTD to 2.870%

UK 10-year yield +4.0 bps MTD and -8.1 bps YTD to 4.487%

On Wednesday, US Treasury yields remained largely unchanged as market participants reviewed economic data releases that were delayed and provided a less comprehensive view of the US economy due to the record 43-day federal government shutdown. Bond yields have remained within a relatively narrow range so far in December, as investors await news, such as today’s CPI release for November, that could influence Fed policy.

The yield on the 2-year Treasury note, which typically reflects expectations for Fed Funds rate outlook, declined -0.5 bps to 3.495%. The yield on 10-year Treasury notes increased +1.1 bps, reaching 4.156%. Over the past seven days, the yield curve between two- and ten-year maturities steepened by 5.9 bps, resulting in a spread of 66.1 bps, from the prior week’s 60.2 bps.

On the long end, the 30-year yield rose +1.4 bps on the day to 4.829%.

The US Treasury successfully auctioned $13 billion in 20-year bonds on Wednesday with robust demand. The bonds were issued at a high yield of 4.798%, nearly matching pre-auction trading levels. The bid-to-cover ratio reached 2.67x, its highest since October. Additionally, the US Treasury is set to auction $24 billion in five-year Treasury Inflation-Protected Securities (TIPS) today.

Over the past seven days, the yield on the 10-year Treasury note was +0.1 bps higher. The yield on the 30-year Treasury bond was +4.6 bps. On the shorter end, the two-year Treasury yield was -5.8 bps lower.

Following Wednesday’s FOMC statement, traders are pricing in 60.8 bps of cuts in 2026, according to CME Group's FedWatch Tool, higher than the 55.6 bps priced in last week. Fed funds futures traders are now pricing in a 26.6% probability of a 25 bps rate cut at January’s FOMC meeting, down from 24.4% last week.

Across the Atlantic, in the UK, on Wednesday the 10-year gilt was +2.4 bps to 4.487%. Over the past seven days, it was -2.2 bps.

Eurozone bond yields declined on Wednesday as investors reduced expectations for future ECB rate hikes, with the influence of hawkish remarks by board member Isabel Schnabel fading ahead of today's policy meeting. Earlier last week, borrowing costs surged after Schnabel indicated that the ECB's next policy move might be a rate hike rather than a cut.

Following Schnabel’s comments — which were reinforced by data suggesting a resilient euro area economy and projections of increased German fiscal spending supporting growth from late 2026 — traders shifted their positions. They discounted the likelihood of a rate cut in summer 2026 and instead anticipated a potential increase in early 2027.

Nevertheless, analysts warned that Schnabel’s perspective may not represent the broader stance within the ECB. They cautioned that a stronger euro and assertive Chinese trade policies could exert deflationary pressure on the eurozone economy, possibly prompting the central bank to adopt a more dovish stance.

In the money markets, the probability of a tightening move by December 2026 was priced at approximately 15%, and at 35% by March 2027, down from over 50% the previous week. The ECB deposit rate currently stands at 2%.

The German 2-year Schatz yield, which is particularly sensitive to policy rate expectations, ended the session +0.1 bps higher at 2.143%, after reaching its lowest level in about a week earlier in the day.

Germany’s 10-year yield increased by +2.4 bps to 2.870%, having touched its lowest since 8th December at 2.826% earlier in the session. Last week, yields hit 2.894%, the highest since mid-March.

At the long end of the curve, the German 30-year yield rose +1.8 bps to 3.485%. Last week, it reached 3.498%, marking the highest level since July 2011.

Over the past seven days, the German 10-year yield was +1.5 bps. Germany's two-year bond yield was -5.0 bps, and, on the longer end of the maturity spectrum, Germany's 30-year yield was +2.8 bps.

The yield spread between German Bunds and 10-year UK gilts reached 161.7 bps on Wednesday, a contraction of 3.7 bps in the last seven days.

The spread between US 10-year Treasuries and German Bunds is now 128.6 bps, 1.4 bps lower from last week’s 130.0 bps.

French 10-year yields increased by +2.0 bps to 3.577%, remaining near their highest levels since March.

Italy’s 10-year BTP yields climbed +5.2 bps to 3.568%. The spread between Italian BTP 10-year yields and German Bund 10-year yields stood at 69.8 bps, a contraction of 0.7 bps from last week’s 70.5 bps, and after reaching a new 16-year low of 64.5 bps earlier in the week. The Italian 10-year yield traded +0.8 bps higher over the past seven days.

Commodities

Gold spot +2.88% MTD and +65.30% YTD to $4,337.12 per ounce

Silver spot +22.75% MTD and +128.85% YTD to $66.17 per ounce

West Texas Intermediate crude -2.70% MTD and -20.59% YTD to $56.90 a barrel

Brent crude -2.76% MTD and -18.73% YTD to $60.60 a barrel

Spot gold prices advanced +0.81% to $4,337.12 an ounce, after rising over one percent earlier in the day on Wednesday. It was +2.60% over the last seven days and +2.88% MTD.

Year-to-date, spot gold is +65.30% due to a combination of factors such as escalating geopolitical tensions, expectations of monetary easing, and increased central bank and retail purchases.

Spot silver prices rose +3.82% to $66.17 an ounce on Wednesday, after touching an all-time high of $66.88 earlier in the session. Silver prices have soared +128.85% year-to-date, driven by robust industrial demand, declining inventories, and its classification as a critical mineral by the US.

Oil prices rallied more than two percent on Wednesday, bolstered by the US President's directive to blockade all sanctioned oil tankers entering or leaving Venezuela. The move heightened geopolitical friction and provided a reprieve from concerns regarding a burgeoning global supply surplus.

Brent crude futures increased $1.73, or +2.94%, to settle at $60.60 per barrel. WTI crude was +3.14% to settle at $56.90 a barrel.

Over the past seven days, however, WTI and Brent prices are -3.35% and -3.29%, respectively.

In the preceding session, prices had approached five-year lows amid optimism surrounding Russia-Ukraine peace negotiations. A potential diplomatic resolution could lead to the easing of Western sanctions on Moscow, thereby increasing global supply at a time when demand remains fragile.

However, focus shifted Tuesday after the US administration ordered a naval blockade of sanctioned Venezuelan vessels. The President justified the escalation by designating the administration of Nicolás Maduro as a foreign terrorist organisation. This directive comes just one week after the US seized a sanctioned tanker off the Venezuelan coast.

Significant uncertainty remains regarding the execution of the blockade. While the US has increased its naval presence in the region, it remains unclear how the Coast Guard or Navy will interdict vessels. While US actions may cause short-term noise and provide a modest risk premium, they are insufficient on their own to tighten global balances or drive a sustained rally in crude prices.

The complexity of the Venezuelan oil trade further clouds the outlook. While many vessels are targeted, others transporting crude via Iran or Russia remain unsanctioned. For instance, tankers chartered by Chevron continue to transport Venezuelan crude to the US under existing federal authorisations.

Additionally, Venezuela’s state-run PDVSA announced on Wednesday that it is resuming terminal operations following a cyberattack that had paralysed its centralised administrative systems.

EIA report. According to the EIA's report released Wednesday, US crude oil inventories declined last week, while gasoline and distillate stocks experienced increases, reflecting a rise in refining activity.

Crude oil inventories fell by 1.3 million barrels, bringing the total to 424.4 million barrels for the week ending 12th December.

At the Cushing, Oklahoma delivery hub, crude stockpiles decreased by 742,000 barrels during the same period. Refinery crude throughput increased by 128,000 bpd over the week, with refinery utilisation rates rising modestly by 0.3 percentage points to reach 94.8%.

Gasoline inventories expanded by 4.8 million barrels, totalling 225.6 million barrels for the week.

Distillate stockpiles — which include diesel and heating oil — increased by 1.7 million barrels, reaching 118.5 million barrels, according to the EIA data.

Total product supplied, a key indicator of demand, declined by 509,000 bpd to 20.57 million bpd. Additionally, net US crude imports decreased by 719,000 bpd, while crude exports increased by 655,000 barrels per day to reach 4.66 million bpd.

Note: As of 5:00 pm EST 17 December 2025

Key data to move markets

EUROPE

Thursday: ECB’s Rate on Deposit Facility, Main Refinancing Operations Rate, Monetary Policy Statement, and Press Conference

Friday: German GfK Consumer Confidence Survey, PPI, Bundesbank Monthly Report, and speeches by President of the DNB Olaf Sleijpen, and ECB Executive Board Members Piero Cipollone and Philip Lane

Tuesday: Spanish GDP

Wednesday: Markets close early for Christmas Eve

UK

Thursday: BoE’s Interest Rate Decision, Minutes, Monetary Policy Summary, and GfK Consumer Confidence

Friday: Retail Sales

Monday: GDP

Wednesday: Markets close early for Christmas Eve

USA

Thursday: CPI, Initial and Continuing Jobless Claims, and Philadelphia Fed Manufacturing Survey

Friday: Michigan Consumer Sentiment and Expectations Indices, UoM 1- and 5-year Consumer Inflation Expectations, and Existing Home Sales

Tuesday: ADP Employment Change 4-week average, GDP, Durable Goods Orders, Nondefense Capital Goods Orders ex Aircraft, Personal Consumption Expenditures Prices, Capacity Utilization, Industrial Production, Consumer Confidence, and Richmond Fed Manufacturing Index

Wednesday: Initial and Continuing Jobless Claims. Early closure of bond and equity markets for Christmas Eve

JAPAN

Thursday: BoJ’s Interest Rate Decision and Monetary Policy Statement, and National Consumer Price Index

Friday: BoJ Press Conference

Wednesday: A speech from BoJ Governor Ueda

CHINA

Sunday: PBoC Interest Rate Decision

Global Macro Updates

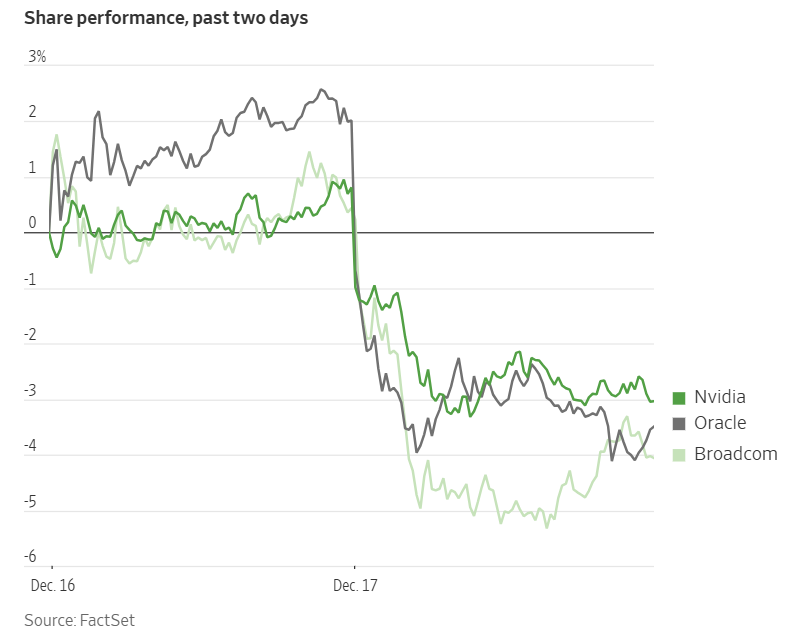

Hedging the hype: the cost of AI infrastructure ambition. The Financial Times reported that Oracle’s $10 billion data centre initiative in Michigan has been placed on hold following the collapse of its financing agreement with Blue Owl Capital. This development has heightened concerns regarding Oracle’s overall AI infrastructure strategy, its rising debt load, and the increasingly stringent leasing and debt terms being imposed by lenders.

Credit default swaps (CDS) are utilised primarily to protect against default risk, but also serve as instruments for hedging or speculating on movements in bond prices. The CDS data provides a different, less enthusiastic tone to the AI trade. Market data from the DTCC clearinghouse indicates that volumes in CDS tied to a select group of US technology firms have surged by 90% since early September. This surge reflects growing investor unease regarding the wave of bond issuances by technology companies seeking to finance AI infrastructure projects, which may require several years to deliver meaningful returns.

The increased demand for CDS protection comes amid renewed volatility in the technology sector, triggered last week by disappointing Q3 earnings from software provider Oracle and chipmaker Broadcom, both of which fell short of market expectations.

The debt and equity valuations of companies at the forefront of the technology boom have fluctuated significantly in recent months, as traders analyse earnings results and debate the impact of competing AI offerings from firms such as OpenAI, Google, and Anthropic on the demand for chips and data centres.

The uptick in CDS trading has been particularly notable for Oracle and cloud computing company CoreWeave, both of which are raising substantial amounts of debt to secure additional data centre capacity.

Earlier this year, investor demand for CDS linked to highly rated US companies was minimal, as technology firms primarily relied on their strong cash reserves and robust earnings to fund AI investments. However, interest in the CDS market increased as these companies began accessing debt markets to finance growing CapEx.

This autumn, Meta, Amazon, Alphabet, and Oracle collectively raised $88 billion for AI-related projects. According to JPMorgan, investment-grade companies are projected to raise as much as $1.5 trillion by 2030 to support AI initiatives, as reported by the Financial Times.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。