Is oil demand underpriced for 2026?

Key data to move markets today

EU: German Harmonised Index of Consumer Prices, French CPI, and Spanish Harmonised Index of Consumer Prices

UK: GDP, Industrial Production, Manufacturing Production, and Consumer Inflation Expectations

USA: Speeches by Philadelphia Fed President Anna Paulson, Cleveland Fed President Beth Hammack, and Chicago Fed President Austan Goolsbee

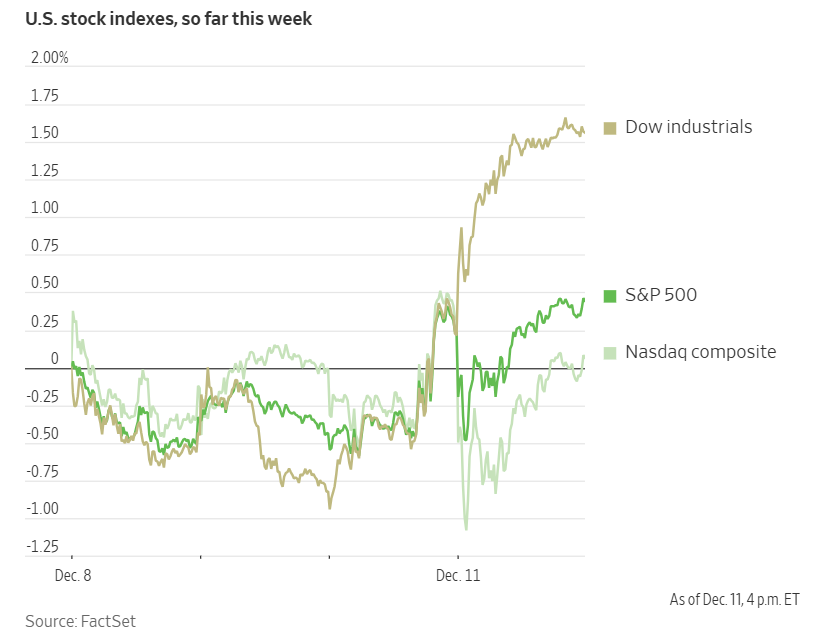

US Stock Indices

Dow Jones Industrial Average +1.38%

Nasdaq 100 -0.48%

S&P 500 +0.13%, with 8 of the 11 sectors of the S&P 500 up

Optimism in the broader equity markets continued on Thursday following Wednesday’s rate cut and comments from Fed Chair Jerome Powell. The Dow Jones Industrial Average and the S&P 500 hit new record highs. The Dow climbed 646 points, or +1.34%, to close at 48,704.01. The S&P 500 gained +0.21% to reach 6.901.00. The Russell 2000 index, representing smaller companies, rose +1.21%, achieving its second consecutive all-time high and marking its ninth record of 2025 at 2,590.61. However, Oracle shares exerted downward pressure on the tech-focussed Nasdaq Composite.

In corporate news, Walt Disney announced a $1 billion investment in OpenAI and a licensing agreement that will allow characters from Disney, Marvel, Pixar, and Star Wars to appear on the Sora generative video platform.

Eli Lilly & Co reported that its next-generation obesity treatment enabled patients to lose nearly 25% of their body weight. This positions the experimental drug as potentially the most effective weight-loss medication to date. The company’s stock rose in premarket trading.

Due to Oracle’s CapEx exceeding expectations, stoking concerns regarding excessive investment in the rapidly expanding AI data centre sector, the company’s shares closed down -10.83%.

Coca-Cola announced that CEO James Quincey will step down at the end of March and be succeeded by Henrique Braun, the current COO.

S&P 500 Best performing sector

Materials +2.23%, with Mosaic +6.06%, Newmont +5.32%, and Freeport-McMoRan +3.57%

S&P 500 Worst performing sector

Communication Services -1.01%, with Paramount Skydance -4.08%, Alphabet -2.43%, and Match Group -1.86%

Mega Caps

Alphabet -2.43%, Amazon -1.01%, Apple -0.32%, Meta Platforms +0.17%, Microsoft +1.10%, Nvidia -1.88%, and Tesla -1.46%

Information Technology

Best performer: Fair Isaac +4.20%

Worst performer: Oracle -10.83%

Materials and Mining

Best performer: Mosaic +6.06%

Worst performer: International Flavors & Fragrance -3.27%

European Stock Indices

CAC 40 +0.79%

DAX +0.68%

FTSE 100 +0.49%

Commodities

Gold spot +1.21% to $4,278.60 an ounce

Silver spot +2.84% to $63.54 an ounce

West Texas Intermediate -1.63% to $57.91 a barrel

Brent crude -1.72% to $61.58 a barrel

On Thursday, gold advanced to its highest level since 21st October, driven by the Fed's quarter-point rate cut on Wednesday, which led to the dollar declining to an eight week low. Spot gold increased +1.21% to $4,278.60 per ounce.

Spot silver surged +2.84% to $63.54 per ounce, trading near the record high of $64.31 hit earlier in the session.

Oil prices declined on Thursday to levels last seen in October, with Brent crude futures closing down $1.08 or -1.72% to $61.58 per barrel. US WTI crude settled at $57.91 per barrel, down $0.96, or -1.63%.

The drop in prices came despite ongoing attacks by Ukrainian drones on Russian oil facilities. According to a Reuters report, Ukrainian drones targeted a Russian oil rig in the Caspian Sea for the first time, halting the facility’s oil and gas extraction.

Russian Foreign Minister Sergei Lavrov said a recent visit to Moscow by US envoy Steve Witkoff helped resolve misunderstandings between the two nations. Lavrov further noted that Moscow has presented its proposals regarding collective security guarantees for Ukraine to Washington.

On Wednesday both Brent and WTI benchmarks had risen after the US announced the seizure of an oil tanker off the coast of Venezuela, fuelling concerns over potential supply disruptions amid escalating tensions between Washington and Caracas.

Industry sources and traders indicated that Asian buyers are now seeking significant discounts on Venezuelan crude. This is due to an influx of sanctioned oil from Russia and Iran and increased loading risks in Venezuela, particularly as the US expands its military presence in the Caribbean.

IEA Oil Market Report. The International Energy Agency (IEA) reduced its projection for next year's global oil supply surplus. It cited stronger demand prospects due to a more robust global economy and diminished output from countries under sanctions. According to the Paris-based IEA’s latest monthly Oil Market Report, global oil supply is expected to surpass demand by 3.84 million barrels per day (bpd), down from the 4.09 million bpd surplus forecasted in November.

Supply has climbed this year due to increased production from OPEC+ members and growth by US and other producers. The IEA revised its estimates for global oil demand growth upwards for both this year and the next, attributing the change to improved macroeconomic conditions and the easing of concerns surrounding tariffs.

World oil demand in 2026 is now anticipated to rise by 860,000 bpd, up 90,000 bpd from November’s outlook. The 2025 forecast was raised 40,000 bpd to 830,000 bpd. The IEA noted that declining oil prices and a weaker US dollar — both near four-year lows — will further support oil demand in the coming year. It emphasised that demand growth in 2025 will stem almost entirely from non-OECD countries.

Additionally, the agency expects supply growth to be marginally lower than previously projected for 2025 and 2026, as ongoing sanctions on Russia and Venezuela continue to constrain exports. The IEA forecasts global oil supply in 2026 to increase by 2.4 million bpd, revising down its earlier estimate of 2.5 million bpd.

OPEC Monthly Oil Market Report. According to the latest Monthly Oil Market Report released by OPEC on Thursday, global oil supply and demand are expected to be closely aligned in 2026. OPEC+ plans to halt any increases in production during Q1 2026, responding to widespread forecasts of a potential oversupply.

In its monthly report, OPEC said the group produced 43.06 million bpd of crude in November, up 43,000 bpd from the previous month, following the implementation of its latest output agreement. The organisation anticipates that demand for OPEC+ crude will average 43 million bpd in 2026, unchanged from last month’s forecast and closely mirroring November’s output levels. For the first quarter, OPEC projects its crude demand at 42.6 million bpd.

Furthermore, OPEC maintained its forecasts for world oil demand growth in 2025 and 2026, emphasising that the global economy remains fundamentally strong.

Note: As of 4 pm EST 11 December 2025

Currencies

EUR +0.38% to $1.1738

GBP +0.03% to $1.3386

Bitcoin +0.21% to $92,605.41

Ethereum -2.73% to $3,250.50

On Thursday, the US dollar extended losses, reaching multi-month lows against the euro, Swiss franc, and British pound. This followed the Fed’s release of a less hawkish policy outlook than many market participants had anticipated.

The dollar fell -0.60% against the Swiss franc to CHF 0.7947 — its lowest level since mid-November after the Swiss National Bank kept rates on hold.

The euro was +0.38% to $1.1738 after touching its highest point since 3rd October. Similarly, the British pound was +0.03% higher at $1.3386, marking its highest level in approximately two months. The US dollar also weakened against the Japanese yen, -0.28% to ¥155.58.

Additional pressure on the dollar came as demand for US Treasuries drove yields lower following the Fed’s announcement that it would commence purchases of short-term government bonds on 12th December. This action is being taken to support market liquidity, beginning with an initial tranche of about $40 billion in Treasury bills. This initiative supplements the $15 billion that the Fed will reinvest in Treasury bills this month from maturing mortgage-backed securities (MBS).

Fixed Income

US 10-year Treasury +0.6 basis points to 4.161%

German 10-year bund -0.8 basis points to 2.847%

UK 10-year gilt -1.7 basis points to 4.492%

US Treasury yields declined for a second consecutive session as market participants evaluated the Fed’s rate decision and more dovish policy outlook.

The yield on the US 10-year Treasury note rose +0.6 bps to 4.161%. On Wednesday, the 10-year yield had snapped a four-session streak of gains — the longest such run in the five weeks.

The yield on the 30-year bond increased +1.9 bps to 4.802%. Analysts described an auction of $22 billion in 30-year bonds as robust, with a bid-to-cover ratio of 2.36x, aligning with the long-term average.

On the short-end of the curve, the two-year US Treasury yield, which typically tracks expectations for Fed interest rate outlook, edged lower by -0.2 bps to 3.551%.

The US yield curve, measuring the spread between the two- and 10-year Treasury notes, stood at 61.0 bps after reaching 61.7 bps earlier in the day — the steepest level since 3rd September.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 54.9 bps of cuts in 2026, lower than the 58.8 bps priced in last week. Fed funds futures traders are now pricing in a 24.4% probability of a 25 bps rate cut at January’s FOMC meeting, down from 25.4% a week ago.

Eurozone benchmark government bond yields remained near nine-month highs in late trading on Thursday, as market participants turned their attention to the upcoming ECB meeting following the Fed’s anticipated rate cut.

Earlier in the week, robust economic data and remarks from ECB policymaker Isabel Schnabel, who indicated comfort with market expectations for a rate hike rather than a cut, propelled Bund yields to levels not seen since March.

The yield on the German 10-year Bunds declined -0.8 bps to 2.847% on Thursday, after reaching 2.894% on Wednesday, its highest level since mid-March. The spread between US and German yields narrowed to 131.4 bps, marking its lowest point since June 2023. The 30-year yield slipped -0.4 bps to 3.453% after climbing to its highest point since summer 2011 during Wednesday’s session. The German 2-year Schatz fell -2.4 bps to 2.169%.

The Italian I0-year yield decreased -2.7 bps to 3.533%, resulting in the spread between BTPs and Bunds narrowing by 0.7 bps to 68.6 bps.

On Wednesday ECB President Christine Lagarde said that the eurozone economy continues to demonstrate resilience. She suggested that the central bank may revise growth projections upward next week, reiterating that monetary policy remains ‘in a good place.’

Traders are currently assigning approximately a 5% probability to an ECB rate cut next summer, down from 40% in late November and nearly 70% in mid-October. Since Tuesday, Derivatives markets have implied a roughly 55% likelihood of a rate hike by March 2027.

Note: As of 5 pm EST 11 December 2025

Global Macro Updates

Highest jobless claims since September, smallest trade deficit since 2020. Initial jobless claims increased to 236,000, exceeding the consensus estimate of 213,000 and rising from the previous week’s upwardly revised figure of 192,000 (previously reported as 191,000). The four-week moving average climbed to 216,750, up by 2,000 from the prior week. In contrast, continuing claims declined to 1,838,000, below the consensus forecast of 1,932,000 and the prior week’s downwardly revised total of 1,937,000 (previously 1,939,000).

The latest data indicate that initial jobless claims have reached their highest level since early September, while continuing claims have fallen to their lowest point since mid-April. Last week’s initial claims were the lowest in three years, a trend attributed to seasonal adjustment challenges around the Thanksgiving holiday. Analysts emphasise that weekly initial claims data are often volatile during the holiday season and are expected to remain variable through year-end.

Additionally, the US trade deficit for September narrowed to $52.8 billion, compared with a consensus expectation of $66.6 billion and the prior month’s figure of $59.3 billion. This marks the smallest trade deficit since June 2020. Exports rose by 3.0% to $289.31 billion (from $280.92 billion in August), while imports increased by 0.6% to $342.13 billion (from $340.19 billion in August).

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。