How will the Fed’s policy path weigh on the dollar?

Global market indices

US Stock Indices Price Performance

Nasdaq 100 +1.34% MTD and +22.67% YTD

Dow Jones Industrial Average -0.33% MTD and +11.79% YTD

NYSE +0.50% MTD and +14.85% YTD

S&P 500 +0.55% MTD and +17.09% YTD

The S&P 500 is +0.54% over the past seven days, with 5 of the 11 sectors up MTD. The Equally Weighted version of the S&P 500 is +0.80% over this past week and +9.91% YTD.

The S&P 500 Information Technology is the leading sector so far this month, +2.54% MTD and +26.81% YTD, while Utilities is the weakest sector at -5.86% MTD and +12.04% YTD.

Over the past seven days, Information Technology outperformed within the S&P 500 at +2.05%, followed by Industrials and Energy at +1.18% and +0.80%, respectively. Conversely, Utilities underperformed at -2.58%, followed by Health Care and Consumer Staples at -1.95% and -1.51%, respectively.

The equal-weight version of the S&P 500 was +1.37% on Wednesday, outperforming its cap-weighted counterpart by 0.70 percentage points.

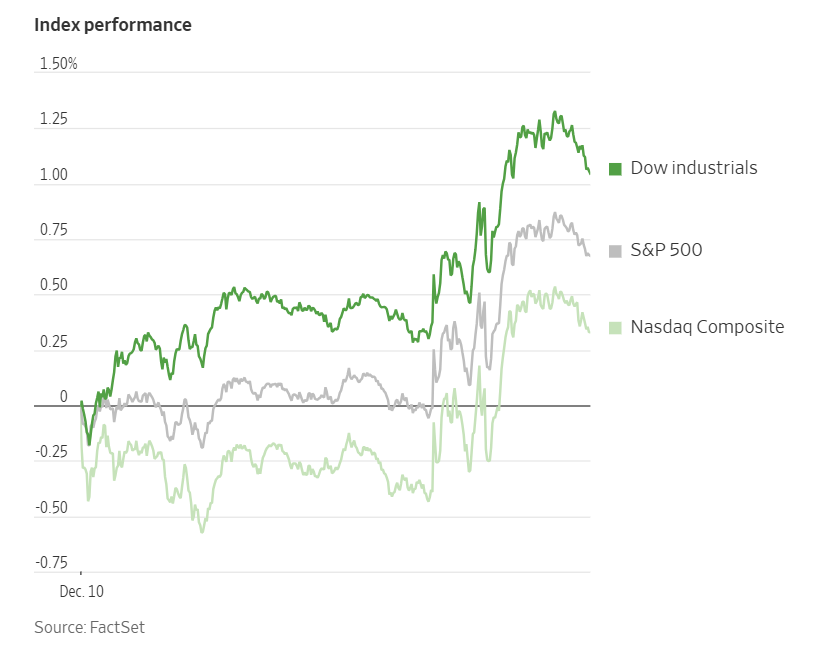

Wall Street cheered the Fed’s decision to lower interest rates and keep the door open for further easing. Equity markets initially posted moderate gains following the FOMC’s announcement. Momentum began building after Fed Chair Jerome Powell acknowledged that the labour market ‘seems to have significant downside risks’ — a statement widely interpreted by investors as dovish.

Shares of companies sensitive to economic conditions surged, highlighted by the Russell 2000 index, which advanced +1.32% to finish at a new record level of 2,559.61. The S&P 500 was +0.67% to 6,888.68, nearly reaching its all-time high, while the Dow Jones Industrial Average climbed +1.05%, or 497.46 points, marking its strongest Fed-decision day performance since 2023. The Nasdaq Composite Index was +0.33%.

Over the past seven days, the S&P 500 is +0.54%, the Dow Jones +0.37%, and the Nasdaq Composite +0.85%.

In corporate news, SpaceX is proceeding with plans for an initial public offering that, according to sources cited by Bloomberg news, aims to raise in excess of $30 billion — potentially making it the largest IPO on record.

GE Vernova shares reached a new peak after the company expanded its share buyback programme and doubled its dividend.

Amazon announced a commitment to invest $35 billion in India over the coming five years, seeking to accelerate growth in sectors ranging from quick commerce to cloud computing.

Mega caps: The Magnificent Seven had a mostly positive performance over the past week. Over the last seven days, Meta Platforms +1.65%, Tesla +1.05%, Nvidia +0.22%, and Alphabet +0.18%, while Amazon -0.26%, Microsoft -0.47%, and Apple -1.89%.

Energy stocks had a mixed performance this week, with the Energy sector itself +0.70%. WTI and Brent prices are -0.25% and -0.21%, respectively, over the past week. Over the last seven days, Halliburton +5.99%, ConocoPhillips +5.44%, Phillips 66 +3.15%, ExxonMobil +2.05%, and Marathon Petroleum +0.99%, while Chevron -0.12%, Occidental Petroleum -1.65%, APA -2.34%, Shell -3.23%, BP -4.68%, Baker Hughes -4.85%, and Energy Fuels -9.89%.

Materials and Mining stocks had a mixed performance this week, with the Materials sector -0.85%. Over the past seven days, Albemarle +5.31%, Newmont Corporation +5.30%, Freeport-McMoRan +4.31%, Celanese Corporation +3.39%, Sibanye Stillwater +3.05%, and Yara International +1.05%, while Nucor -0.23%, CF Industries -1.90%, and Mosaic -5.16%.

European Stock Indices Price Performance

Stoxx 600 +0.30% MTD and +13.90% YTD

DAX +1.23% MTD and +21.20% YTD

CAC 40 -1.23% MTD and +8.70% YTD

IBEX 35 +2.39% MTD and +44.57% YTD

FTSE MIB +0.50% MTD and +27.46% YTD

FTSE 100 -0.81% MTD and +17.97% YTD

This week, the pan-European Stoxx Europe 600 index is +0.34%. It was +0.07% Wednesday, closing at 578.17.

So far this month in the STOXX Europe 600, Retail is the leading sector, +3.65% MTD and +6.82% YTD, while Chemicals is the weakest at -2.97% MTD and -8.61% YTD.

Over the past seven days, Banks outperformed within the STOXX Europe 600, at +2.13%, followed by Financial Services and Industrial Goods & Services at +1.93% and +1.54%, respectively. Conversely, Utilities underperformed at -1.93%, followed by Food & Beverages and Chemicals at -1.92% and -1.60%, respectively.

Germany's DAX index was -0.13% Wednesday, closing at 24,130.14. It was +1.84% over the past seven days. France's CAC 40 index was -0.37% Wednesday, closing at 8,022.69. It was -0.80% over the past week.

The UK's FTSE 100 index was -0.52% over the past seven days to 9,642.01. It was -0.03% on Wednesday.

According to LSEG I/B/E/S data, third quarter earnings are expected to increase 7.6% from Q3 2024. Excluding the Energy sector, earnings are expected to increase 8.0%. Q3 revenue is expected to decrease 1.1% from Q3 2024. Excluding the Energy sector, revenues are expected to increase 0.2%. Of the 284 companies in the STOXX 600 that have reported earnings by 9th December for Q3 2025, 54.3% reported results exceeding analyst estimates. In a typical quarter 54% beat analyst EPS estimates. Of the 339 companies in the STOXX 600 that have reported revenue by 9th December for Q3 2025, 47.8% reported revenue exceeding analyst estimates. In a typical quarter 58% beat analyst revenue estimates.

The estimated earnings growth rate for the STOXX 600 for Q3 2025 is 7.6%. Eight of the ten sectors in the index expect to see an improvement in earnings relative to Q3 2024. The Real Estate sector has the highest earnings growth rate for the quarter, while the Consumer Cyclicals has the weakest anticipated growth compared to Q3 2024. Analysts expect positive earnings growth from 12 of the 16 countries represented in the STOXX 600 index. Poland (45.2%) and Germany (29.0%) have the highest estimated earnings growth rates, while Norway (-28.5%) and Denmark (-19.1%) have the lowest estimated growth.

During the week of 15th December, one company is expected to report quarterly earnings.

In Wednesday's trading session, the Basic Resources sector emerged as the outperformer. Market attention was also drawn to China, where consumer inflation reached its highest level since January, although factory-gate deflation unexpectedly intensified. Additionally, the IMF raised its outlook for China's economic growth.

The Oil & Gas sector traded higher amid firmer crude prices, with Shell advancing on reports of advanced negotiations to acquire LLOG Offshore in a transaction exceeding $3 billion. Alternative Energy continued its positive momentum, supported by recent contract wins in the US. Retail traded higher, particularly specialty retailers, with Fnac Darty rising after successfully de-risking its balance sheet by executing a full pension buy-in. The Technology sector benefited from strength in semiconductor and industrial technology companies, driven by major investments in India by Amazon and Microsoft.

In contrast, the Automobiles & Parts sector underperformed, with Ferrari declining following a downgrade related to a slower ramp-up of its F80 model and valuation compression, while Continental eased as Barclays adopted a more cautious stance, noting that anticipated value realisation is largely priced in. The Insurance sector also traded lower, with Aegon declining after announcing a shift of its US headquarters, a rebranding initiative, and a complex restructuring plan. Lastly, Chemicals traded lower in line with declines across industrial and construction-related names.

Other Global Stock Indices Price Performance

MSCI World Index +0.04% MTD and +18.67% YTD

Hang Seng -1.23% MTD and +27.32% YTD

Over the past seven days, the MSCI World Index and Hang Seng Index are -0.05% and -0.85%, respectively.

Currencies

EUR +0.83% MTD and +13.02% YTD to $1.1694

GBP +1.13% MTD and +6.98% YTD to $1.3382

The US dollar depreciated against major counterparts — including the euro, Swiss franc, and Japanese yen — on Wednesday, following the Fed’s widely anticipated decision to cut interest rates. Despite the rate cut, the Fed signalled a likely pause in its easing cycle at the upcoming January policy meeting.

The dollar index retreated -0.58% to 98.65. Over the week the index declined -0.22%. The dollar index is -0.83% MTD and -8.94% YTD.

In afternoon trading, the euro strengthened, closing +0.60% to $1.1694. Over the course of the past seven days, the euro was +0.21%.

Additionally, the British pound advanced against the dollar, +0.64%, to $1.3382, marking an increase of +0.23% over the past seven days.

The Japanese yen advanced +0.55% against the dollar to ¥156.01. Over the past seven days, the yen has declined -0.50%, however it has advanced +0.11% so far MTD. Year-to-date, the US dollar has fallen -0.66% against the Japanese yen.

Note: As of 5:00 pm EST 10 December 2025

Cryptocurrencies

Bitcoin +1.62% MTD and -1.81% YTD to $92,408.96

Ethereum +10.17% MTD and -0.49% YTD to $3,341.60

Bitcoin is -1.42% over the last seven days, while Ethereum is up +5.55%. On Wednesday, Bitcoin was -0.30% to $92,408.96 and Ethereum was +1.23% to $3,341.60.

Cryptocurrencies, particularly Bitcoin, are still in a weakened position after enduring a weeks-long selloff stemming from the 10 October liquidation event, which wiped out about $19 billion in levered bets. Cryptocurrencies fluctuated on Wednesday before the widely expected Fed decision to cut interest rates by 25bps. The language used in its statement signalled a higher bar for additional easing. Fed Chair Jerome Powell did suggest during the press conference that interest rates were “now within a broad range of estimates of its neutral value, and we are well positioned to wait to see how the economy evolves”

Any resurgence in Bitcoin pricing in particular will likely depend on how quickly the Fed signals it will cut next year and what it projects for inflation. However, as noted by Decrypt, the rate cut and future rate cut projection, is aligning with a steady spike in bullish options bets.The most active strike in the options market is the $100,000 call option expiring on 26 December, with over 18,360 bullish contracts open compared to just 2,540 bearish puts, according to a Wednesday tweet from options analytics platform Laevitas.

Note: As of 5:00 pm EST 10 December 2025

Fixed Income

US 10-year yield +13.7 bps MTD and -42.1 bps YTD to 4.155%

German 10-year yield +16.3 bps MTD and +48.6 bps YTD to 2.855%

UK 10-year yield +6.2 bps MTD and -5.9 bps YTD to 4.509%

US Treasury yields declined on Wednesday after the Fed reduced interest rates, but indicated it would likely pause further cuts. The Fed lowered rates by 25 bps and its updated economic projections revealed that the median policymaker expects just one additional 25 bps reduction in 2026, consistent with the September outlook. The 25 bps cut was met with three dissents.

The yield on the US 10-year Treasury note was -3.2 bps to 4.155%, having fluctuated between a session low of 4.137% and a three-month high of 4.209%. This decline ended a four-session streak of gains for the 10-year yield, marking its longest such run in five weeks.

The yield on the 30-year bond fell -2.6 bps to 4.783%. On the short-end of the curve, the two-year US Treasury yield, which often reflects expectations for Fed policy, dropped -6.4 bps to 3.553%, marking its largest single-day decline since 16th October.

The Treasury yield curve, measured by the spread between the two- and 10-year notes, stood at 60.2 bps after reaching 60.7 bps — its highest level since 3rd September — and 3.3 bps above the prior week’s 56.9 bps.

Following strong auctions for 3-year and 10-year notes earlier in the week, the market is set to receive an additional $22 billion in 30-year bonds today.

Over the past seven days, the yield on the 10-year Treasury note was +8.8 bps higher. The yield on the 30-year Treasury bond was +5.0 bps. On the shorter end, the two-year Treasury yield was +5.5 bps.

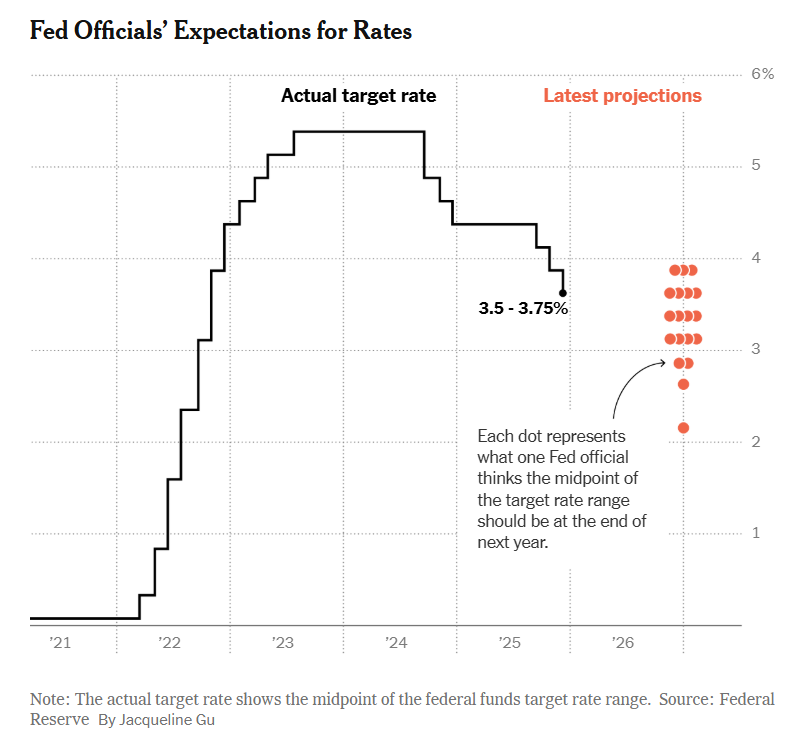

Following Wednesday’s FOMC statement, traders are pricing in 55.0 bps of cuts in 2026 according to CME Group's FedWatch Tool, lower than the 64.9 bps priced in last week. Fed funds futures traders are now pricing in a 22.1% probability of a 25 bps rate cut at January’s FOMC meeting, down from 27.9% last week.

Across the Atlantic, in the UK, on Wednesday the 10-year gilt was +0.5 bps to 4.509%. Over the past seven days, it was +5.8 bps.

On Wednesday, Germany's 10-year borrowing costs reached new multi-month highs as market sentiment now indicates no likelihood of an ECB rate cut next year.

The yield on Germany's 10-year bonds edged lower by -0.2 bps to 2.855%, after briefly touching 2.894%, its highest level since March, following Germany's decision to significantly increase borrowing and government spending.

Germany’s two-year yield, more responsive to shifts in the ECB policy rate outlook, was +3.4 bps higher at 2.193%. At the longer end of the curve, the German 30-year yield declined slightly -0.6 bps to 3.457% on Wednesday.

Over the past seven days, the German 10-year yield was +10.5 bps. Germany's two-year bond yield was +13.4 bps, and, on the longer end of the maturity spectrum, Germany's 30-year yield was +7.0 bps.

The yield spread between German Bunds and 10-year UK gilts reached 165.4 bps on Wednesday, a contraction of 4.7 bps over the past seven days.

The spread between US 10-year Treasuries and German Bunds is now 130.0 bps, 1.7 bps lower from last week’s 131.7 bps.

French 10-year yields increased by +0.2 bps to 3.577%, remaining near their highest levels since March. French lawmakers narrowly approved the 2026 social security budget on Tuesday, delivering a significant victory to Prime Minister Sebastien Lecornu, though at a substantial political and financial cost that could still jeopardise his vulnerable government.

Italy's 10-year yield was -0.5 bps lower at 3.560%, having previously risen to 3.600%, its highest level since late September, resulting in a spread of 70.5 bps over the German 10-year yield.

The spread between Italian BTP 10-year yields and German Bund 10-year yields stood at 70.5 bps, an expansion of 1.2 bps from last week’s 69.3 bps. The Italian 10-year yield was +11.7 bps over the last week.

Commodities

Gold spot +0.27% MTD and +61.30% YTD to $4,227.29 per ounce

Silver spot +14.61% MTD and +114.39% YTD to $61.79 per ounce

West Texas Intermediate crude +0.67% MTD and -18.06% YTD to $58.87 a barrel

Brent crude +0.55% MTD and -16.24% YTD to $62.66 a barrel

Gold prices reversed earlier declines and moved higher on Wednesday following the Federal Reserve’s decision to cut interest rates. Spot gold rose +0.49% to $4,227.29 per ounce.

It was +0.58% over the last seven days and +0.27% MTD. Year-to-date, spot gold is +61.30% due to a combination of factors such as escalating geopolitical tensions, expectations of monetary easing, and increased central bank and retail purchases.

Silver reached a new all-time high during the session, with spot silver climbing to a record $61.85 per ounce before closing +1.89% higher at $61.79. Silver prices have soared +114.39% year-to-date, driven by robust industrial demand, declining inventories, and its classification as a critical mineral by the US.

Oil prices closed higher on Wednesday after reports emerged that the US had seized an oil tanker off the coast of Venezuela, intensifying concerns over near-term supply disruptions.

Brent crude futures advanced 59 cents, or +0.95%, to settle at $62.66 per barrel, while US WTI crude gained 52 cents, or +0.89%, closing at $58.87 per barrel.

Over the past seven days, WTI and Brent prices are -0.25% and -0.21%, respectively.

The US action against the oil tanker heightened apprehension regarding immediate supply availability, particularly in a market already unsettled by uncertainties surrounding Venezuelan, Iranian, and Russian crude shipments. Market participants anticipate that oil prices may respond even more sharply should additional seizures occur.

Adding to supply anxieties, a Ukrainian official stated earlier on Wednesday that the nation's sea drones had struck and disabled a tanker involved in the transport of Russian oil. This was the third such incident attributed to Ukraine within the past two weeks.

EIA report. According to the EIA, US crude oil inventories declined last week, while gasoline and distillate stockpiles increased, reflecting robust refining activity. Specifically, crude inventories decreased by 1.8 million barrels, reaching 425.7 million barrels as of the week ending 5th December. In contrast, crude stocks at the Cushing, Oklahoma delivery hub rose by 308,000 barrels during the same period. Net US crude imports increased by 212,000 bpd, bringing the total to 2.6 million bpd.

The EIA’s weekly Petroleum Status Report, which is closely monitored by market participants for insights into supply and demand trends, was released with a slight delay on Wednesday — marking the second consecutive week the report was not published as scheduled.

Refinery crude runs experienced a modest decline of 16,000 bpd, although refinery utilisation rates improved by 0.4 percentage points, reaching 94.5%. Refinery utilisation on the East Coast attained its highest level last week since January 2023.

Gasoline inventories increased by 6.4 million barrels, totaling 220.8 million barrels, while distillate stockpiles — which include diesel and heating oil — rose by 2.5 million barrels to 116.8 million barrels. Additionally, total product supplied, a proxy for demand, grew by 893,000 bpd, amounting to 21.1 million bpd.

Note: As of 5:00 pm EST 10 December 2025

Key data to move markets

EUROPE

Friday: German Harmonised Index of Consumer Prices, French CPI, and Spanish Harmonised Index of Consumer Prices

Monday: Eurozone Industrial Production

Tuesday: German, French and Eurozone HCOB Composite, Services and Manufacturing PMIs, Italian CPI, Eurozone ZEW Economic Sentiment survey, German ZEW Current Situation and Economic Sentiment surveys

Wednesday: German IFO Business Climate, Current Assessment, and Expectations surveys and Eurozone Harmonised Index of Consumer Prices

UK

Thursday: A speech by BoE Governor Andrew Bailey

Friday: GDP, Industrial Production, Manufacturing Production, and Consumer Inflation Expectations

Tuesday: Average Earnings, Claimant Count Change, Claimant Count Rate, ILO Unemployment Rate, and S&P Global Composite, Services and Manufacturing PMIs

Wednesday: CPI, PPI, and RPI

USA

Thursday: Initial and Continuing Jobless Claims

Friday: Speeches by Philadelphia Fed President Anna Paulson, Cleveland Fed President Beth Hammack, and Chicago Fed President Austan Goolsbee

Monday: NY Empire State Manufacturing Index

Tuesday: ADP Employment Change 4-week average, Nonfarm Payrolls, Average Hourly Earnings, Labour Force Participation Rate, Unemployment Rate, Underemployment Rate, Retail Sales and S&P Global Composite, Services and Manufacturing PMIs

Wednesday: A speech by Atlanta Fed President Raphael Bostic

JAPAN

Sunday: Tankan Large All Industry Capex, Large Manufacturing Index, and Large Manufacturing Outlook

Tuesday: Adjusted Merchandise Trade Balance, Exports, Imports, Merchandise Trade Balance Total

CHINA

Monday: Industrial Production and Retail Sales

Global Macro Updates

The Fed sets the tone, but the ECB could tip the scales in 2026. The December FOMC meeting concluded with a widely anticipated 25 bps rate cut, lowering the federal funds rate to the 3.50% - 3.75% range. The decision was not unanimous, as three dissents were recorded: Fed Governor Stephen Miran advocated for a more aggressive 0.50% cut, while Chicago Fed President Austan Goolsbee and Kansas City Fed President Jeffrey Schmid preferred to maintain rates at their current levels. According to the Fed's latest Summary of Economic Projections (SEP), officials continue to project a 25 bps adjustment for 2026, consistent with the September meeting.

Four FOMC members foresee at least three 0.25 percentage point rate cuts for 2026, although the projections reveal considerable divergence regarding the future rate path. The federal funds rate is expected to remain unchanged at 3.6% by the end of 2025, decrease to 3.4% in 2026, and stabilise at 3.1% for both 2027 and 2028.

Policymakers anticipate an unemployment rate of 4.4% in 2026, unchanged from prior estimates, while Personal Consumption Expenditures (PCE) inflation is expected to ease to 2.4% from the previous projection of 2.6%. Gross Domestic Product (GDP) growth is forecasted to rise to 2.3%, up from 1.8%. Additionally, the Fed announced it will begin purchasing Treasury bills starting 12th December.

The FOMC statement underwent notable revisions, specifically the removal of language asserting that unemployment had ‘remained low.’ Instead, the statement now includes a reference to the ‘extent and timing’ of further rate adjustments, a hawkish adjustment. During the subsequent press conference, Fed Chair Jerome Powell minimised inflation risks and attributed persistent upward price pressures to US tariffs. He also highlighted that potential negative payroll adjustments of around 20,000 per month may not be fully reflected in current data.

Analysts broadly anticipated a ‘hawkish cut,’ expecting the Fed to set a higher threshold for additional rate reductions. However, initial reactions suggest the outcome was somewhat less hawkish than anticipated, with some pointing to dovish elements in the Fed's balance sheet announcement.

Although the Fed's decision has dominated financial headlines, a broader shift in global monetary policy is underway, leading to an increase in global bond yields. In parallel, Australia, Canada, and New Zealand joined Japan last week in pricing rate hikes into their projections.

This shift in monetary policy sentiment may soon be felt by the ECB. Current pricing in swap markets now suggests that the ECB is more likely to raise interest rates in 2026 rather than cut them, with investors increasing their bets on rate hikes in the Eurozone — even as the US continues to lower borrowing costs. This policy divergence poses additional downward pressure on the already weakened US dollar.

Earlier this week, ECB’s Executive Board Member Isabel Schnabel expressed comfort with market expectations that the next move would be a rate hike, not a cut. This was a significant departure from recent easing cycles and highlighted increased upside risks to both the economy and inflation. Stronger-than-expected economic data and pockets of inflation, such as elevated services inflation in the euro area, have undermined the case for further monetary easing.

Next year could be a potential turning point for central banks, with hawkish voices growing more prominent. Global bond yields have surged, reaching sixteen-year highs as central bankers shift away from dovish rhetoric. This pivot has resulted in a sharp repricing across bond markets since Monday. Germany’s two-year yield registered its largest daily increase since July, and traders now anticipate virtually no further rate cuts from the ECB in 2026. Governor of the Bank of Lithuania, Gediminas Šimkus, reinforced this sentiment, stating that rates need not be lowered further given stronger-than-expected economic activity and inflation remaining near the 2.0% target.

The absence of language supporting further rate cuts marks a significant change from the dovish positioning earlier this year, reflecting improved eurozone data: business activity reached a thirty-month high, German industrial output surpassed expectations, and inflation rose to 2.2%.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。