EXANTE Quarterly Macro Insights Q3 2025

Q3 review

Q3 2025 was characterised by a powerful risk-on sentiment across global markets, extending the recovery that began in Q2. This rally was propelled by a potent and self-reinforcing trifecta of catalysts: euphoria surrounding AI, a dovish pivot by the Fed, and a crucial de-escalation in global trade tensions. Investors demonstrated a notable ability to overlook emerging economic challenges, such as a cooling labour market in the US and increasing fiscal uncertainty, instead concentrating on these positive factors. As a result, robust returns were observed across most asset classes, although notable differences emerged by region and investment style.

The positive sentiment was most evident in global equities, which delivered substantial gains throughout the period. Emerging markets outperformed developed peers, with the MSCI Emerging Markets Index returning +11.61%, compared to a +7.19% gain for the MSCI World Index. The strong performance of Chinese technology stocks, driven by the extension of the US – China trade truce, was a key contributor to this outperformance. Within the equity universe, growth-oriented stocks maintained their dominance; the Russell 1000 Growth Index posted a return of +10.36%, more than twice that of the Russell 1000 Value Index at +4.82%. Additionally, US small-cap stocks experienced a resurgence, buoyed by expectations of lower borrowing costs in anticipation of the Fed’s policy adjustment.

In fixed income, US government bonds rallied on the prospect of further monetary easing, while European and Japanese sovereign debt struggled amid ongoing political and policy uncertainty. Credit markets also performed strongly, with tightening spreads across various credit qualities signalling increased risk appetite. Among commodities, gold emerged as a standout, reaching new highs due to a weaker US dollar and elevated demand for safe-haven assets. In contrast, oil prices declined amid expectations of an oversupplied market, resulting in a notable divergence within the commodity space.

Q3 concluded with major equity indices at or near record levels, yet the outlook grew increasingly complex and uncertain. Challenges included elevated valuations in the technology sector, the onset of fiscal uncertainty following the US government shutdown on 1st October, and persistent political instability across Europe.

US Indices for Q3 2025 and YTD

S&P 500 +7.79% Q3 and +14.83% YTD

Nasdaq 100 +8.82% Q3 and +19.63% YTD

Dow Jones Industrial Average +5.22% Q3 and +9.54% YTD

NYSE +5.56% Q3 and +13.76% YTD

According to the S&P Sector and Industry Indices, 10 of the 11 S&P 500 sectors were up in Q3. The best performing sector in Q3 2025 was Information Technology at +13.04%, followed by Communication Services at +11.82%, and Consumer Discretionary at +9.36%, whereas Consumer Staples was -2.90%.

It was a mostly positive Q3 for the Magnificent Seven: Tesla +40.00%, Alphabet +37.94%, Apple +24.11%, Nvidia +18.10%, Microsoft +4.13%, and Amazon +0.08%, while Meta Platforms -0.50%.

In Q3 Energy stocks were +5.26% due to better than expected Q2 earnings reports, despite heightened concerns about potential over supply in Q3 and Q4. Baker Hughes +27.07%, Halliburton +20.71%, BP Plc +16.42%, Marathon Petroleum +16.03%, Phillips 66 +14.02%, Occidental Petroleum +12.47%, Chevron +8.45%, ExxonMobil +4.59%, and Shell +3.64%.

Basic materials stocks were +2.63% in Q3. Performance was mixed with Sibanye Stillwater +52.79%, Newmont Mining +44.71%, Albemarle Corporation +29.38%, and Nucor Corporation +4.55%, while Yara International -1.99%, CF Industries Holdings -2.50%, Mosaic -4.93%, and Freeport-McMoRan -9.53%.

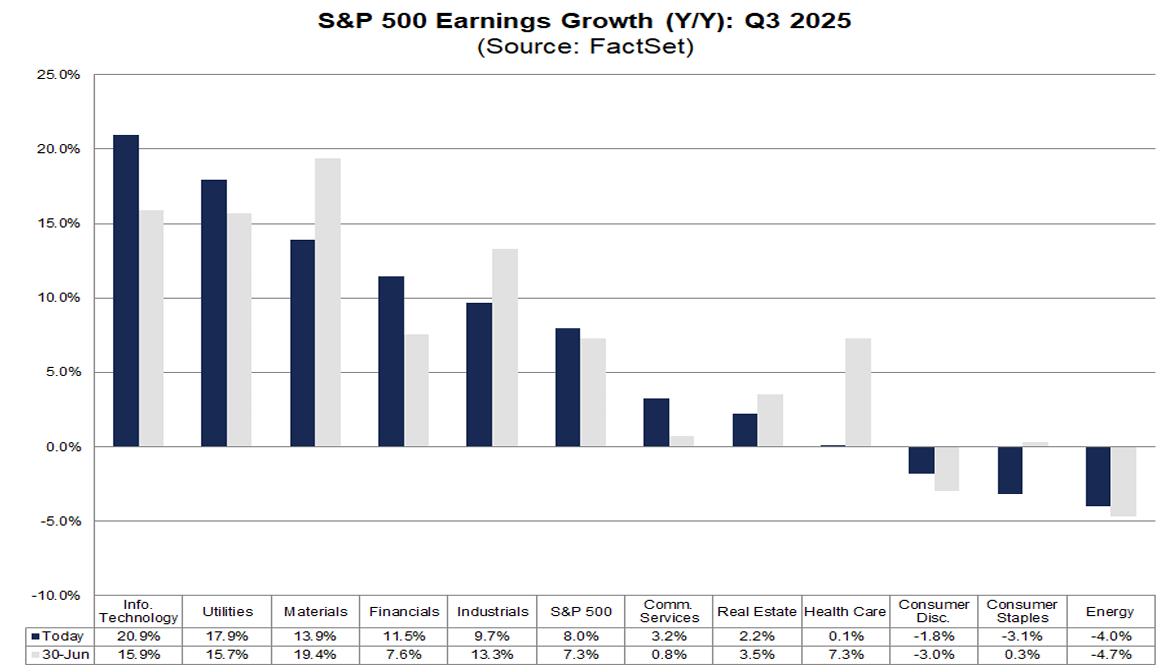

According to FactSet, for Q3 2025, the estimated y/o/y earnings growth rate is 8.0%. The proportion of S&P 500 companies issuing positive EPS guidance is above historical averages. Of the 112 companies in the index that have provided guidance for Q3 2025 to date, 56 have issued negative EPS guidance, while 56 have issued positive guidance. The resulting rate of 50.0% for positive guidance is higher than both the 5-year average of 43.0% and the 10-year average of 39.0%.

The estimated net profit margin for the S&P 500 in Q3 2025 is 12.7%. While lower than Q2’s 12.8%, it remains above the year-ago margin of 12.5% and the 5-year average of 12.1%.

Sector-specific analysis indicates that five sectors are projected to see a y/o/y increase in their net profit margins for Q3 2025 compared to the same period in 2024. Utilities is expected to lead this growth with a 1.6 percentage point rise, moving from 14.8% to 16.4%.

Conversely, six sectors are anticipated to report y/o/y declines in their net profit margins. Real Estate is projected to lead these declines with a 0.9 percentage point decrease, falling from 35.2% to 34.1%.

Six sectors are anticipated to report net profit margins for Q3 2025 that exceed their 5-year averages. Utilities are expected to demonstrate the most significant increase, with a 2.8 percentage point difference, reaching 16.4% in Q3 2025 compared to its 5-year average of 13.6%.

Conversely, four sectors are projected to report Q3 2025 net profit margins below their respective 5-year averages. Health Care is the most notable in this group, with an anticipated decrease of 1.7 percentage points, from 9.3% to 7.6%.

European Indices Q3 2025

Stoxx 600 +3.11% Q3 and +13.04% YTD

DAX -0.12% Q3 and +23.55% YTD

CAC 40 +3.00% Q3 and +9.20% YTD

IBEX 35 +10.60% Q3 and +35.22% YTD

FTSE MIB +7.37% Q3 and +25.99% YTD

FTSE 100 +6.73% Q3 and +16.83% YTD

As of 7th October, according to LSEG I/B/E/S data for the STOXX 600, Q3 2025 earnings are expected to decrease 0.2% from Q3 2024. Excluding the Energy sector, earnings are expected to increase 0.1%. Q3 2025 revenue is expected to decrease 0.3% from Q3 2024. Excluding the Energy sector, revenues are expected to increase 0.6%. Two companies in the STOXX 600 have reported earnings to date for Q3 2025. Both companies reported results exceeding analyst estimates. In a typical quarter 54% beat analyst EPS estimates. Two companies in the STOXX 600 have reported revenue to date for Q3 2025. Both reported revenue exceeding analyst estimates. In a typical quarter 58% beat analyst revenue estimates.

The STOXX 600 expects to see shareweighted earnings of €122.7 bn in Q3 2025, compared to share-weighted earnings of €123.0 bn (based on the year-ago earnings of the current constituents) in Q3 2024.

Three of the ten sectors in the index expect to see an improvement in earnings relative to Q3 2024. The Real Estate sector has the highest earnings growth rate (5.6%) for the quarter, while Utilities has the weakest anticipated growth (-5.6%) compared to Q3 2024.

The forward four-quarter price-to-earnings ratio (P/E) for the STOXX 600 sits at 14.9x, above the 10-year average of 14.2x.

During the week of 13th October, 11 companies are expected to report quarterly earnings.

Analysts expect positive Q3 earnings growth from nine of the sixteen countries represented in the STOXX 600 index. Poland (59.2%) and Ireland (27.2%) have the highest estimated earnings growth rates, while Denmark (-19.1%) and Netherlands (-17.2%) have the lowest estimated growth.

Global Indices for Q3 and YTD

Hang Seng +11.56% Q3 and +33.75% YTD

MSCI World +7.19% Q3 and +16.82% YTD

Fixed Income for Q3 and YTD

US Treasuries 10-year yield -7.6 bps Q3 and -44.2 bps YTD to 4.134%

Germany’s 10-year yield +10.9 bps Q3 to and +31.3 bps YTD to 2.682%

Great Britain’s 10-year yield +21.2 bps Q3 to and +15.3 bps YTD to 4.721%

Volatility for US bonds decreased in Q3 due to the easing of trade tensions and increased clarity regarding US fiscal policy following the passage of the ‘One Big Beautiful Bill’ through US Congress. US yields declined across the maturity spectrum throughout Q3, with US 1- and 2-year bond yields decreasing 33.9 bps and 10.4 bps, respectively. Fed Chair Jerome Powell’s speech at Jackson Hole Economic Annual Symposium in August organised by the Kansas City Fed signalled the possibility of the FOMC to proceed to consider changes to its policy stance due to a shifting balance of risks, highlighting the stability of the labour market. This prompted investors’ animal spirits amidst expected imminent easing monetary policy. The yields on the 10-year Treasury note ended Q3 at 4.152%, after climbing as high as 4.480% on 15th July. By the end of Q3 the spread between the 10-year and two-year Treasury yields was 53.5 bps, 3.0 bps wider than at the end of the Q2. The Fed's latest economic projections show slightly higher growth by year-end. The FOMC is also concerned about the impact of tariff policies on US growth and inflation in Q4 and Q1 2026. Fed chair Jerome Powell has admitted that the Fed would have cut rates already if not for the tariffs.

Across the Atlantic, European government bonds underperformed their US counterparts over the quarter. The 10-year German Bund yield increased by +10.9 bps, closing at 2.716%. With the ECB's policy rate now widely considered neutral, the 10-year yield is likely to reflect this by trading in narrower ranges going forward. While a sudden risk-off shock would undoubtedly fuel volatility, the eurozone economy is currently on a more stable footing, with Germany's fiscal policy poised for significant expansion and European defence spending expected to reach 5.0% of GDP by 2035, a landmark commitment expressed at the 2025 NATO summit.

As economic growth prospects for the eurozone improved, expectations for elevated inflation also intensified, as evidenced by rising yields throughout the curve. This trend was further exacerbated by growing concerns regarding fiscal discipline in France, which particularly impacted long-dated OATs. During this period, the 10-year Bund yield predominantly fluctuated within a range of 2.600% to 2.800%, reaching a peak of 2.780% on 2nd September. However, this figure remained below the year’s highest yield of 2.910% observed on 6th March.

Commodities in Q3 and YTD

Gold spot +16.89% Q3 and +53.26% YTD to $4,037.90 an ounce

Silver spot +29.33% Q3 and +69.58% YTD to $48.88 an ounce

West Texas Intermediate crude -3.71% Q3 and -13.26% YTD to $62.21 a barrel

Brent crude -0.84% Q3 and -11.47% YTD to $66.04 a barrel

Q3 presented contrasting narratives for the global commodities markets, with oil experiencing downward pressure amid oversupply concerns, while gold achieved remarkable gains driven by monetary policy shifts and geopolitical uncertainties. Oil faced a confluence of factors including accelerated OPEC+ production increases, robust US shale output, and weakening global demand growth, resulting in Brent crude declining -0.84% and WTI falling -3.71% during the quarter. Conversely, gold emerged as an outperformer in the commodities space, appreciating +16.89% in Q3, as central bank purchases, in an effort to diversify away from the US dollar, and persistent geopolitical tensions reinforced its safe-haven status.

Gold: record inflows, and central banks’ reserves diversification. Gold’s performance in Q3 represented the continuation of bullion's strongest annual rally since 1979. The precious metal achieved several record highs during the quarter, demonstrating remarkable resilience despite technical indicators suggesting overbought conditions for extended periods.

Central bank gold purchases remained a fundamental driver of market dynamics throughout Q3, though the pace of accumulation moderated compared to earlier quarters. Global central banks added a net 15 tonnes to reserves in August after a pause in July, signalling a return to buying activity following temporary price-driven hesitation.

The World Gold Council reported that central banks had purchased approximately 64 tonnes of gold per month during 2025, below Goldman Sachs Research's forecast of 80 tonnes monthly but maintaining the structural shift in reserve management behaviour that began in 2022.

Kazakhstan's National Bank emerged as the largest official sector purchaser in August, while other central banks including Bulgaria's National Bank and El Salvador's Central Reserve Bank joined the list of buyers. Poland's National Bank, the largest purchaser year-to-date, reaffirmed its commitment to gold by increasing its target allocation share.

The Reserve Bank of India reduced its gold purchases during Q3 2025, buying only 3.8 tonnes during the January-August period compared to 45.4 tonnes in the corresponding period of 2024.

Investment demand for gold experienced a dramatic surge during Q3, with ETF inflows reaching extraordinary levels. The third quarter alone witnessed inflows of $5.4 billion into gold mining funds, representing the largest quarterly movement since December 2009, according to a report by Forbes. Gold ETFs added 146 tonnes of the precious metal in September, according to World Gold Council data, contributing to record-breaking monthly inflows.

Despite gold's strong investment performance, jewelry demand faced significant headwinds throughout Q3 2025 due to record-high prices. Global jewelry consumption fell 14% to 341.0 tonnes in Q2 2025, marking the lowest level since the pandemic-affected Q3 2020.

China and India, the world's largest jewelry markets, bore the brunt of price-sensitive demand destruction. Chinese jewelry demand declined 28% to 194 tonnes in H1 2025, reaching its lowest level for a first half since 2009, excluding the pandemic year of 2020. Indian jewelry demand fell to just 160 tonnes in H1 2025, representing a 20% decline and the second-lowest level in at least 25 years.

Oil: crude’s reality check amid concerns of oversupply. The quarterly performance reflected a challenging environment for oil prices, and exhibited significant volatility. This downward pressure materialised despite persistent geopolitical tensions, including the brief 12-day conflict between Israel and Iran at the end of Q2, which initially supported prices through risk premiums.

OPEC+ production decisions dominated the supply narrative throughout Q3, with the cartel implementing an accelerated unwinding of voluntary production cuts that significantly exceeded market expectations. In July, eight OPEC+ producers agreed to increase crude output by 548,000 barrels per day (bpd) in August, surpassing the anticipated 411,000 bpd increase. This group, comprising Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman, continued their aggressive production restoration strategy with a further 547,000 bpd increase in September.

The production increases represented a fundamental shift in OPEC+ strategy from price defence to market share recovery. This aggressive production restoration occurred against a backdrop of already robust global oil supply, with total production reaching record levels of 106.9 million bpd in August.

US crude oil production achieved new milestones during Q3, with July output averaging over 13.6 million bpd, establishing a new monthly record. This production surge was driven by continued efficiency gains in major shale basins, particularly the Permian Basin of Texas and New Mexico, which maintained robust output levels despite price pressures.

The Energy Information Administration (EIA) revised its 2025 US crude production forecast upward to 13.53 million bpd, reflecting the stronger-than-expected July performance. Notably, offshore Gulf of Mexico production contributed significantly to the revised forecasts, with several projects ramping up faster than anticipated, leading the EIA to increase Gulf production estimates to 1.89 million bpd for 2025.

Geopolitical tensions continued to induce volatility throughout Q3, though their impact proved less significant than supply-demand fundamentals. Ongoing sanctions on Russian energy exports remained a persistent theme, with the US tightening restrictions and European nations implementing lower price caps on Russian crude. These measures contributed to supply chain disruptions and maintained geopolitical risk premiums, though their market impact was often overshadowed by broader supply growth.

The outlook for oil markets beyond Q3 remained predominantly bearish, with major forecasting agencies projecting continued price declines through 2026. The EIA expected Brent crude to fall to an average of $62 per barrel in Q4 2025 and $52 per barrel in 2026, driven by persistent oversupply conditions. Global oil inventories were projected to increase by an average of 2.1 million bpd through 2026, creating sustained downward pressure on prices.

Note: As of 5:00 pm EDT 8 October 2025

Regional news

The USA

The most consequential monetary policy development of Q3 was the FOMC decision to commence an easing cycle. During its meeting held on 16th - 17th September, the Committee reduced the federal funds rate by 25 bps, establishing a new target range of 4.00% to 4.25%.

This action represented the first rate cut of 2025 and signalled a clear shift in policy direction. The decision was underpinned by accumulating evidence of a softening US labour market, as indicated by official data from the Bureau of Labor Statistics (BLS). BLS revisions revealed a substantial downward adjustment of 911,000 payrolls for the twelve months ending March 2025, implying that previous estimates of economic strength had been overstated.

In addition, the pace of monthly job gains decelerated sharply, averaging just 29,000 positions over the three months leading up to August, according to the latest employment reports.

Despite persistent inflationary pressures - reflected in the headline Consumer Price Index (CPI) rising to 2.9% in August, as reported by the US Department of Labor - the Fed recalibrated its policy focus toward addressing emerging downside risks to the labour market. This strategic pivot was broadly endorsed by financial markets, with both equity and fixed income responding positively to the prospect of a more accommodative monetary stance.

The eurozone

Political instability escalated in Europe during the third quarter of 2025, with France experiencing acute turmoil following the collapse of Prime Minister François Bayrou’s government on 9th September, 2025, after it failed to secure parliamentary approval for the national budget. This development heightened concerns over the government’s ability to implement fiscal consolidation, especially as France’s budget deficit reached 5.8% in 2024, nearly double the EU’s 3% threshold. In response, Fitch downgraded France’s credit rating from AA- to A+ on 12th September. The crisis triggered a sharp increase in the yield spread between 10-year French OATs and German Bunds, which widened to 85 bps—the highest level since January 2025—and contributed to the underperformance in European equity markets relative to its US counterparts.

Performance across European equities was broadly positive in Q3, with the exception of Germany’s DAX. Spain's IBEX 35 was the strongest performer, rising by +10.60%, followed by Stoxx Europe 600 at +3.11% and France’s CAC 40 at +3.00%. Germany's DAX index fell by -0.12%. In Q3, European equities underperformed their US counterparts, contrasting sharply with their Q1 outperformance, which had been the strongest in 20 years.

In Q3, sector performance exhibited a distinct bias towards the basic resources and banks sectors, as well as those that would be more isolated to trade frictions, as well as those that would benefit from increased government spending. Sector-wise, Stoxx Euro 600’s top performers included Basic Resources +17.00%, Banks +13.53%, Industrial Goods & Services +5.42%, Oil & Gas +4.52%, and Retail +3.92%. Conversely, Food & Beverages -6.07%, Chemicals -5.93%, Telecom -1.48%, Construction & Materials -1.34%, and Utilities -1.33% lagged behind.

The Granolas in Q3: ASML +22.21%, LVMH +17.07%, GSK +13.27%, AstraZeneca +10.49%, Novartis +4.11%, and L'Oréal +1.49%, while Sanofi -4.45%, Roche -4.71%, Nestlé -7.31%, SAP -11.72%, and Novo Nordisk -21.60%.

The UK

Q3 2025 proved to be a challenging yet revealing quarter for UK financial markets, as the confluence of stubborn inflation, mounting fiscal pressures, and shifting central bank policy left a palpable imprint across equities, fixed income, and the British pound.

The FTSE 100 Index delivered a +6.73% return during the quarter, a performance that masked considerable sectoral divergence as domestically focused shares lagged and internationally oriented firms, which comprise approximately 75% of the index's revenues, benefited from global economic strength and the translation effects of a weaker pound.

Fixed income markets told a more cautionary tale. The UK gilt market endured another bout of pronounced volatility, the 30-year gilt yield climbed to highs not observed since the late 1990s, reflecting acute concerns about the sustainability of public finances and the implications of the BoE’s quantitative tightening policy. According to a report by Reuters, major asset managers argued publicly against the BoE’s ongoing active selling of government bonds, warning that this supply ‘flood’ risked exacerbating losses, driving up the government’s borrowing costs, and deepening the country’s fiscal quagmire. The debate was not just academic: the Treasury faces direct losses as it reimburses the central bank for its bond-market shortfall, imposing an annual cost of £22 billion on the exchequer that further complicates the fiscal outlook. The macroeconomic effect of these developments manifested in the form of a widening budget deficit, which rose to £62 billion (a 29% annual increase) in the five months leading to August.

This troubling fiscal narrative coincided with persistent inflationary pressures, especially in services. Headline CPI remained at a stubborn 3.8% in both July and August, while core inflation eased only slightly to 3.6% and 3.8%, respectively. Most concerning for BoE policymakers was the persistence of services inflation, recorded at 5.0% in July and 4.7% in August.

Confounding these policy dilemmas was the approach of a pivotal Autumn Budget, at which the government was expected to announce new spending plans, potentially leading to higher taxes in order to restore stability and placate jittery investors.

Asia ex-Japan

Q3 saw a clear leadership rotation towards Asia, which benefited disproportionately from the US - China trade truce and continued AI optimism. The MSCI Asia ex-Japan Index was the top-performing major regional index, gaining +12.27%. The epicentre of this rally was Chinese technology stocks, with the Hang Seng Tech Index soaring +22.1% as policy support for domestic chipmakers and accelerated AI spending fuelled investor excitement. Japan's TOPIX index also posted a +9.98% gain, supported by the new US - Japan trade deal and a weaker yen that boosted its export-oriented constituents.

Currencies in Q3

Q3 was marked by a notable divergence in major currency performance, shaped by the evolving stance of key central banks, shifting economic fundamentals, and geopolitical undercurrents that played out across the global monetary landscape. The US Dollar Index halted its decline, rising 1.12% to end Q3 at 97.79 even as the Fed pivoted to cautious easing. The Fed’s decision in September to cut its policy rate by 25 bps to a range of 4.00 – 4.25% was driven by a marked deceleration in labour market gains and a nascent uptick in the unemployment rate, signalling that the focus had shifted to risk management and economic stabilisation rather than limiting inflation. This cut—the first in nine months—was characterised by Fed Chair Jerome Powell as a preemptive response to downside risks in employment, even as core inflation readings remained persistently above the central bank's 2% target. Market participants interpreted this action as a signal of further policy easing to come, with the FOMC dot plot projections indicating potential for two additional cuts by year-end and divisiveness among policymakers over the path ahead.

The dollar’s shift in Q3 echoed global investors' recalibration toward other developed market currencies, though the breadth of depreciation across its G10 peers was uneven. The British pound, after trading near post-pandemic highs in early July, weakened by -2.08% to close Q3 at 1.3443 against the dollar. The pound’s challenges were multi-faceted; persistent inflation, particularly in the services sector, lingered at 4.7% in August, well above the BoE’s target. The central bank responded with a 25 bps rate cut in August, bringing the Bank Rate to 4.00%, after a narrow 5-4 vote that reflected a split among policymakers confronting rising unemployment and fiscal headwinds.

The euro also experienced a -0.37% decline versus the US Dollar in Q3, closing at 1.1735. The ECB maintained an unchanged deposit rate at 2.00% throughout Q3, contending with regionally divergent growth as German and French economic recoveries faltered. Despite headline inflation converging near the target, the ECB adopted a cautious, data-dependent approach in the face of uncertainties surrounding global trade tensions and energy disruptions. President Christine Lagarde’s statements repeatedly emphasised the unpredictability of the environment and the institution’s intent to avoid premature or sweeping policy adjustments.

In the Asia-Pacific region, the Japanese yen continued to underperform, weakening by -2.70% to ¥147.84 by quarter end. This trend was largely attributed to Japan’s continued low interest rates—steady at 0.5%—and mounting political uncertainty in anticipation of the election of a new LDP leader in early October. Markets sharply reduced the probability of a BoJ rate hike for October, with futures implying only a 26% likelihood, down from 60% prior to the leadership change. The yen’s vulnerability was compounded by robust global demand for carry trades, given Japan’s low-yield environment relative to other major economies. Core inflation in Japan remained above target, hovering around 3.7%, driven by wage pressures and food costs.

Note: As of 5:00 pm EDT 8 October 2025

What to think about in Q4 2025

Europe continues to face a series of economic, political, and structural challenges that have long weighed on its growth and competitiveness. However, there is now momentum and a growing recognition among policymakers that issues such as the energy transition, the creation of a unified regional defence strategy, and the advancement of technology and digitisation require decisive and immediate action. Challenges once regarded as chronic have become acute, spurring a sense of urgency for reform and investment across the continent.

Addressing these issues is complex and resource-intensive. Several European nations have announced multi-year investments across a diverse range of sectors, reflecting a structural, politically driven transformation rather than a fleeting cyclical uptick. This shift is reshaping the European economic and investment landscape. So far this year, European assets have performed robustly, and the euro has staged a notable recovery—trends likely to persist into 2026. Even the modest fiscal stimulus now being implemented marks a significant departure from the post-global financial crisis era of austerity, and, combined with ECB’s monetary easing (much of which is still working its way through the economy), creates a more favourable environment for European corporate profitability and credit conditions.

Short-term headwinds persist, with both the US and Europe expected to experience slower growth toward year-end as the effect of tariffs pressures US real disposable incomes and weighs on Europe’s net trade. Looking ahead to 2026, Europe stands to benefit from stronger household and government spending, while in the US, fiscal measures such as the One Big Beautiful Bill Act may support activity through front-loaded expenditures and delayed savings.

Germany’s fiscal transition and the broader EU focus on defence spending underpin an optimistic outlook for Europe. While Germany continues to face industrial challenges—particularly from heightened competition with China, sluggish global growth, and elevated energy costs—a notable cyclical rebound is anticipated in 2026, driven by significant fiscal stimulus. Projections indicate public spending could increase by up to 2.2% of GDP by 2027, with an annual growth boost of 0.5 percentage points during this period. The primary challenge lies in the pace of fiscal rollout, exacerbated by capacity constraints in Germany’s and Europe’s defence industries.

Even if the rollout of stimulus is delayed, Europe’s substantial pool of unused savings could be mobilised for consumption and investment—particularly if financial market reforms are enacted. Policymakers now have a window of opportunity to build on these improvements with structural reforms that could yield lasting gains in Europe’s economic performance. Initiatives such as the Savings and Investment Union (SIU) could unlock capital, foster innovation, and enhance long-term resilience. Despite political uncertainties, notably in France, Europe appears poised to seize significant opportunities.

In the US, recent labour market data indicate meaningful softening, particularly if the Quarterly Census of Employment and Wages (QCEW) data revisions to payrolls were to be confirmed. The baseline outlook anticipates a gradual reacceleration of the US economy in 2026, as the impact of higher tariffs fades, fiscal policy becomes more supportive, and easing financial conditions persist. Nevertheless, uncertainty around the effects of tariffs on capex and growth remains high.

In the UK, as the Autumn Budget approaches, the government faces a substantial budget gap. The Chancellor is likely to choose among adjusting fiscal rules, reducing spending, or raising taxes. Given the difficulty of spending cuts and the unlikelihood of rule changes, tax increases—possibly through extended freezes on tax thresholds—appear to be the most probable outcome. While higher taxes would accelerate fiscal consolidation, the ultimate trajectory will depend on the path of interest rates.

Since 2014, the US dollar has benefited from exceptional US asset performance and its status as a reserve currency. However, recent shifts in US trade policy and improved sentiment in other regions have raised questions about continued US exceptionalism, leading to some dollar weakness. Factors such as concerns about US fiscal sustainability, a more dovish Fed, and improved investment opportunities abroad could contribute to a gradual depreciation of the dollar. Nonetheless, the dollar’s central role in global finance and trade remains unchallenged, with a significant share of international transactions and financial assets denominated in dollars.

Despite ongoing debates about de-dollarisation, the dollar continues to serve as a core strategic asset. For non-US investors, a weaker dollar increases the need to reassess hedging strategies, as unhedged exposures have become costly and contributed to higher global equity volatility. In this context, at least a partial hedge for equity exposure appears prudent.

Economic and Geopolitical Risk Calendar

Trade policy uncertainty remains pronounced, with the possibility of new tariff measures posing ongoing risks to global supply chains. The persistent fragmentation of international trade relationships continues to shape investment strategies and influence the direction of economic policy. As these headwinds intensify, a deceleration in economic growth for both the US and Europe can be anticipated toward the end of the year, as the impact of tariffs places pressure on US real disposable incomes and adversely affects Europe’s net trade position. While the Fed proceeds with policy easing, BoJ may pursue further tightening at its December meeting, and both ECB and BoE are expected to retain a cautious approach. Market implications include the potential for continued US dollar weakness, sustained volatility in the pound, and continued strength on emerging market currencies.

Other potential policy and geopolitical risks for investors that could negatively affect corporate earnings, stock market performance, currency valuations, sovereign and corporate bond markets include:

October 2025

13th - 18th October World Bank and IMF annual meeting. IMF Managing Director Kristalina Georgieva has warned that ‘uncertainty is the new normal,’ signalling that discussions will likely focus on bolstering the resilience of the global economy. Key events will include the release of the IMF's updated World Economic Outlook, panels on debt restructuring, and discussions on the role of international financial institutions in a shifting geopolitical environment. The meetings will also address the economic crisis in Argentina and the broader implications of the US trade policies.

26th October Argentina's legislative elections. Argentina's legislative elections are poised to be a critical test for President Javier Milei's ‘chainsaw’ austerity programme. Voters will renew half of the Chamber of Deputies and one-third of the Senate, determining the government's ability to advance its free-market reforms. Milei's La Libertad Avanza coalition seeks to expand its minority representation to more effectively govern and uphold presidential vetoes. However, they face a unified Peronist opposition under the Fuerza Patria banner, which aims to capitalise on public discontent with high inflation and severe spending cuts.

26th - 28th October 47th ASEAN Summit (Kuala Lumpur). Under the theme of ‘Inclusivity and Sustainability,’ Malaysia's ASEAN Chairmanship will prioritise strengthening regional cooperation in economic development, security, digital transformation, and environmental sustainability. The summits will convene leaders from ASEAN member states and heads of government from non-ASEAN countries.

28th - 29th October FOMC meeting. The Fed's October meeting is widely expected to deliver a 25 bps rate cut, bringing the federal funds rate to 3.75% - 4.00%. This decision stems from concerns about labour market weakness, with officials aiming to stimulate hiring while maintaining inflation control. Markets have priced in this reduction with high probability, as the Fed continues its gradual easing cycle that began in September.

29th October Parliamentary elections in the Netherlands. Early general elections are being held following the collapse of the governing coalition. The government's dissolution was precipitated by the withdrawal of the far-right Party for Freedom (PVV) from the coalition, which compelled the independent Prime Minister, Dick Schoof, to submit his cabinet's resignation on 3rd June. The current political landscape indicates an increased likelihood of a political deadlock. Projections suggest a fractured electoral outcome among the three leading contenders: Geert Wilders' PVV, the liberal People’s Party for Freedom and Democracy, and the alliance of the centre-left Labour Party and the environmentalist GreenLeft.

29th - 30th October ECB Governing Council meeting (Florence). The ECB's October meeting, hosted by Banca d'Italia in Florence, occurs amid persistent services inflation and fragile eurozone growth. As eurozone growth remains uneven, the ECB is likely to maintain rates unchanged, with policymakers emphasising a cautious, meeting-by-meeting approach.

29th - 30th October BoJ monetary policy meeting. BoJ's October meeting represents a critical juncture for potential policy normalisation. With the policy rate at 0.50% since January's historic increase, market participants have tempered their expectations for potential further tightening after Sanae Takaichi won the LDP leadership election on 4th October. In July, BoJ raised its core inflation forecast to 2.7% for 2025, with underlying inflation gradually accelerating as wage pressures increase.

November 2025

6th November BoE MPC meeting. BoE faces a challenging environment with an annual inflation reading of 3.8% in August (well above the 2% target) and slowing economic growth. The MPC has cut rates three times in 2025, bringing the Bank Rate to 4.00%. Analysts will be closely watching the vote split among committee members and the tone of the meeting minutes for any indication of when the Bank might begin cutting rates.

16th November Chile’s Presidential Election. Chileans will vote for a new president in a highly polarised environment, marking a potential shift to the right. The election follows the term of leftist President Gabriel Boric. The leading candidates are Communist Party member and former labor minister Jeannette Jara, representing the governing centre-left coalition, and far-right Republican Party leader José Antonio Kast, who lost to Boric in 2021. Centre-right candidate Evelyn Matthei is polling in third. Polls indicate a tight race between Jara and Kast, making a 14th December runoff highly likely as no candidate is expected to secure an outright majority. While Jara may lead the first round due to a fragmented right-wing vote, analysts suggest that the combined conservative support could ultimately favor Kast in a second-round contest.

22nd - 23rd November G20 Summit in Johannesburg. The G20 Summit in Johannesburg marks the first G20 meeting held on the African continent, with South Africa's presidency emphasising ‘Solidarity, Equality, Sustainability’. South Africa aims to advance the development agenda and promote African interests within global economic governance. The summit’s agenda aims to establish new frameworks for Global South development and debt reform.

December 2025

9th - 10th December FOMC meeting. The year's final FOMC meeting will provide crucial insights into the Fed's 2026 policy trajectory. With total rate cuts of 107.6 bps expected by the end of 2026, this meeting will be pivotal for setting market expectations for the coming year. At stake: Establishing the Fed's longer-term policy framework and response to evolving economic conditions. A further 25 bps reduction is likely, contingent on inflation (effects of tariffs are expected to become apparent in Q4 and Q1 2026), and employment data released up to November.

17th - 18th December ECB Governing Council meeting (Frankfurt). With inflation at the 2% target but growth concerns persisting, this meeting will be critical for setting 2026 expectations. The expectation is that rates are likely to remain on hold, with focus on forward guidance for the coming year.

18th - 19th December BoJ monetary policy meeting. BoJ's final meeting of 2025 will be instrumental in shaping expectations for its continued policy normalisation into 2026. A key outcome of the meeting will be establishing the prospective pace of future rate increases and communicating the central bank's long-term policy direction. There is an expectation of a potential further rate hike, contingent upon supportive economic data that would justify continued normalisation.

While every effort has been made to verify the accuracy of this information, LHCM Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。