Is the global economy flexible enough to withstand US tariffs?

Key data to move markets today

EU: German IFO Business Climate, Current Assessment and Expectations Surveys

UK: A speech by BoE External Member Megan Greene

USA: New Home Sales Change and a speech by San Francisco Fed President Mary Daly

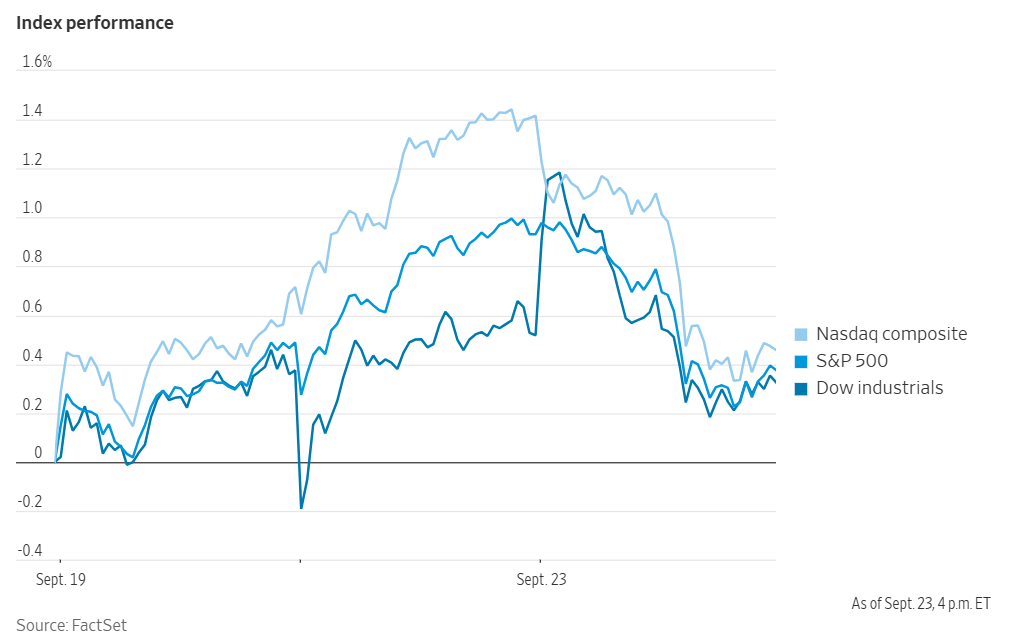

US Stock Indices

Dow Jones Industrial Average -0.19%

Nasdaq 100 -0.73%

S&P 500 -0.55%, with 5 of the 11 sectors of the S&P 500 down

A retreat in technology stocks Tuesday weighed on the broader US equity markets, bringing a three-day winning streak for the S&P 500 to a close. Shares of the Magnificent Seven technology firms all declined, reversing the previous session's momentum where they had driven the major US stock indexes to record highs.

The S&P 500 fell -0.55% and the Dow Jones Industrial Average was -0.19%. The downturn occurred despite a majority of stocks within the S&P 500 posting gains, highlighting the significant influence of the large-cap technology sector. Losses were partially offset by advances in other areas of the market, including the Energy, Utilities, and Consumer Staples sectors.

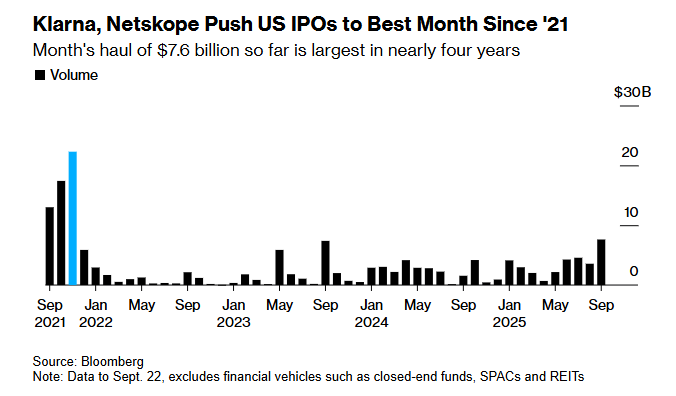

A surge in activity is propelling the US IPO market toward its most active month since the latter part of 2021.

Successful debuts by Klarna Group and Netskope have been key drivers, lifting the total volume for September to $7.6 billion, excluding financial vehicles such as blank-check firms. Furthermore, these newly-public companies have performed well, delivering a weighted-average return of 17%.

In corporate news, ASM International revised its sales outlook downward for the second half of the year, citing weaker-than-expected demand from key clients.

Boeing announced a partnership with Palantir Technologies to integrate AI into its defence programmes and factory operations. Boeing also secured an agreement with Uzbekistan Airways for the sale of up to 22 of its 787 Dreamliner jets, marking the largest single order in the airline's history.

Private equity firms KKR and Blackstone are spearheading a combined $17 billion investment in the natural gas sector to help meet the massive energy demands of AI firms.

Separately, Lowe’s successfully issued $5 billion in bonds to help finance its pending acquisition of Foundation Building Materials. This transaction was one of the few buyout-related financings in the US investment-grade market during a month of record-setting overall issuance.

Walt Disney announced upcoming price increases for its Disney+ streaming service, effective 21st October. The cost of its ad-free plan will rise by $3 to $19 per month, while the plan with advertising will increase by $2 to $12 per month.

S&P 500 Best performing sector

Energy +1.71%, with Halliburton +7.34%, Texas Pacific Land +6.19%, and Targa Resources +2.98%

S&P 500 Worst performing sector

Consumer Discretionary -1.44%, with Amazon -3.04%, Tesla -1.93%, and Airbnb -1.55%

Mega Caps

Alphabet -0.21%, Amazon -3.04%, Apple -0.64%, Meta Platforms -1.28%, Microsoft -1.01%, Nvidia -2.82%, and Tesla -1.93%

Information Technology

Best performer: Corning +2.32%

Worst performer: Synopsys -4.75%

Materials and Mining

Best performer: CF Industries +2.45%

Worst performer: Air Products and Chemicals -3.79%

European Stock Indices

CAC 40 +0.54%

DAX +0.36%

FTSE 100 -0.04%

Commodities

Gold spot +0.47% to $3,763.82 an ounce

Silver spot -0.15% to $43.96 an ounce

West Texas Intermediate +2.28% to $63.65 a barrel

Brent crude +1.89% to $67.86 a barrel

Geopolitical uncertainty and demand for safe-haven assets drove gold prices to a new record high on Tuesday. Spot gold settled +0.47% to $3,763.82 per ounce after reaching an intraday peak of $3,790.82.

These gains occurred amid escalating global tensions, with NATO condemning Russia for repeated violations of Estonian airspace. In response to what it called ‘a pattern of increasingly irresponsible behaviour,’ NATO warned that it would use ‘all necessary military and non-military tools’ to defend itself.

Additionally, reports from Bloomberg indicated that the PBoC is utilising the Shanghai Gold Exchange to encourage allied central banks to purchase and store gold bullion within China's borders.

Global oil prices rose Tuesday. The increase was attributed to a delay in the resumption of oil exports from Iraq's Kurdistan region, which eased market concerns about a potential oversupply.

Brent crude futures were up $1.26, or +1.89%, to settle at $67.86 a barrel. US WTI crude rose $1.42, or +2.28%, closing at $63.65 a barrel.

The planned restart of a pipeline that would export approximately 230,000 barrels per day (bpd) from Kurdistan to Turkey has been stalled since March 2023. The most recent delay was a result of two major producers requesting debt repayment guarantees before resuming operations.

In its latest monthly report, the International Energy Agency (IEA) forecasts faster global oil supply growth this year. The IEA anticipates that a surplus could expand in 2026 as OPEC+ members increase their output and non-OPEC+ supply grows.

Despite these projections, the market remains subject to several risks. Traders are closely monitoring potentially stricter EU sanctions on Russian oil exports and any escalation of geopolitical tensions in the Middle East.

Note: As of 5 pm EDT 23 September 2025

Currencies

EUR +0.14% to $1.1814

GBP +0.07% to $1.3517

Bitcoin -0.73% to $112,223.17

Ethereum -0.36% to $4,186.08

On Tuesday, the US dollar edged lower against its major counterparts as investors reacted to commentary from Fed officials, including Chair Jerome Powell. The US Dollar Index fell -0.09% to 97.21.

The euro ended the day +0.14% to $1.1814 and the British pound gained +0.07% to settle at $1.3517. The dollar also fell against the Swiss franc and the Japanese yen, declining -0.11% to 0.7910 CHF and -0.13% to ¥147.55, respectively.

Fixed Income

US 10-year Treasury -4.6 basis points to 4.107%

German 10-year bund +0.3 basis points to 2.755%

UK 10-year gilt -3.4 basis points to 4.683%

US Treasury yields retreated across the curve on Tuesday due to Fed Chair Jerome Powell remarks about the FOMC’s October interest rate decision.

The 10-year Treasury note yield fell -4.6 bps to 4.107%, after reaching its highest level since 5th September on Monday. The 30-year bond yield decreased -4.8 bps to 4.719%, ending four consecutive sessions of gains. At the short end, the two-year yield, highly sensitive to monetary policy expectations, was -2.8 bps to 3.594%.

This shift in yields resulted in a modest flattening of the yield curve. The spread between the two- and 10-year notes narrowed by 1.8 bps to 51.3 bps, while the gap between the two- and 30-year notes contracted by 2.0 bps to 112.5 bps.

On the supply side, the Treasury Department conducted a $69 billion auction of two-year notes, which was met with solid demand as reflected by a bid-to-cover ratio of 2.51x. The Treasury is also scheduled to auction $70 billion in five-year notes and $44 billion in seven-year notes later this week.

Fed funds futures traders are pricing in a 89.8% probability of a 25 bps rate cut at October’s FOMC meeting, up from 74.3% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating 68.7 bps of cuts by year-end, matching the 68.7 bps expected last week.

Across the Atlantic, eurozone bond yields remained largely stable on Tuesday, influenced by a combination of mixed business activity data from the bloc and a substantial volume of new government bond issuance.

Germany's 10-year yield saw a marginal increase, rising +0.3 bps to 2.755%, just below the two-week peak of 2.762% recorded on Monday. Germany's policy-sensitive 2-year yield was +1.2 bps to 2.034%, reaching a five-and-a-half-month high. Conversely, the 30-year yield fell -0.9 bps to 3.346%.

Futures markets are currently factoring in a potential 10 bps rate cut from the ECB by June of next year, implying a 40% probability of another reduction.

Attention was also focussed on the supply side of the bond market on Tuesday, as the Netherlands successfully issued €5 billion in 30-year bonds, achieving the top end of its targeted sale amount.

This long-dated bond auction comes before a major overhaul of the Dutch pension system next year. The transition from a defined benefit to a defined contribution system is expected to reduce demand for long-dated bonds from pension funds, as they will no longer be obligated to promise specific long-term benefits.

French and Italian bond yields mirrored the movements of their German equivalents. Italy's 10-year yield was +0.9 bps to 3.555%, leaving the spread over German Bunds at 80.0 bps. The 10-year French yield finished +0.6 bps higher, with its spread over Germany’s standing at 81.6 bps.

Note: As of 5 pm EDT 23 September 2025

Global Macro Updates

OECD: US economy to slow less sharply than expected. On Tuesday, the Organisation for Economic Cooperation and Development (OECD) released a quarterly report indicating that the US and global economies are projected to slow less than previously anticipated in the current year. However, the report warns of a continued loss of momentum into 2026, largely attributed to the escalating impact of higher tariffs.

The Paris-based organisation now forecasts the US economy will expand by 1.8% this year and 1.5% in 2026, following a growth rate of 2.8% in 2024. This represents an upward revision for the current year from the 1.6% growth projected in June, while the 2026 forecast remains unchanged.

Alvaro Pereira, the OECD’s chief economist, acknowledged this unexpected strength, stating, “Growth has been a bit more resilient than we expected.” He cautioned, however, that “in spite of that resilience, some indicators are weakening.”

Globally, the economy is projected to grow by 3.2% this year, a modest decrease from the 3.3% expansion in 2024 but a notable improvement from the 2.9% forecast in June. The projection for 2026 holds steady at 2.9% growth. The OECD anticipates the slowdown will become more pronounced in the latter half of this year as the temporary boost from businesses stockpiling inventories ahead of tariff increases diminishes.

A primary concern highlighted in the analysis is the significant increase in US tariffs. The OECD estimates that the overall effective tariff rate on imports climbed from 15.4% in mid-May to 19.5% by the end of August, reaching its highest point since 1933. The policy is expected to boost inflation, which is forecast to average 3.0% in 2026, up from 2.7% this year. The report notes the full economic impact of these tariffs have been delayed.

While the report acknowledges that high levels of investment in new technologies have provided a boost to US economic activity, it asserts this has not been sufficient to offset the negative effects of the tariffs. The OECD also identified additional factors expected to moderate growth: ‘A drop in net immigration and reductions in the federal workforce are also anticipated to soften economic growth.’

Finally, the OECD, which provides policy advice to its member governments, reiterated its call for measures to control and reverse rising government debt, a trend that has contributed to higher bond yields this year.

‘There is growing concern about future fiscal risks,’ the report states, noting that these concerns are particularly focused on advanced economies such as the US and France. As evidence of this shifting risk perception, the organisation pointed out that the borrowing premium for developing economies over their advanced-economy counterparts has fallen to its lowest level since 2007.

Fedspeak highlights uncertainty over future policy path: from 'decisive' to 'gradual'. In an address to the Greater Providence Chamber of Commerce, Fed Chair Jerome Powell largely reiterated the FOMC established positions on the economy and monetary policy. He noted that near-term risks to inflation are skewed toward the upside, while risks to employment are tilted to the downside. Powell confirmed the recent 25 bps rate cut was prompted by emerging signs of a weakening labour market. While acknowledging that no path is without risk, he asserted that the recent adjustment leaves the Fed well positioned to respond to future developments. Additionally, he commented that the economic impact of tariff increases will likely manifest as gradually higher prices over the coming quarters rather than as an immediate shock.

Other Fed officials also shared their perspectives on Tuesday, revealing a range of views on the appropriate policy path. In a speech, Governor Michelle Bowman adopted a more urgent tone, warning that the Fed must ‘act decisively’ with rate cuts as the labour market weakens. She expressed concern that the central bank risks ‘falling behind the curve’ in addressing a deteriorating employment situation.

In an interview with CNBC, Chicago Fed President Austan Goolsbee indicated his support for a ‘gradual pace’ of easing. He suggested that rates could be reduced substantially if stagflationary risks dissipate, though he cautioned against cutting ‘too aggressively.’

On the Macro Musings podcast, Atlanta Fed President Raphael Bostic offered a view consistent with the Chair's concerns. He stated that more inflation is likely forthcoming and observed that sentiment regarding employment risks has ‘notably deteriorated.’

US PMI declines as eurozone expansion led by Germany. The flash S&P Global Composite PMI for September registered at 53.6, falling short of the consensus forecast of 54.9 and down from the previous reading of 55.4. This slowdown was reflected across the economy, with the Flash Manufacturing PMI registering at 52.0 (versus a 52.2 consensus and 53.0 prior) and the Services PMI at 53.9 (versus a 54.0 consensus and 54.5 prior).

The data indicates that US business activity growth decelerated for a second successive month, primarily due to a softening of demand. While both the manufacturing and service sectors continued to expand, both categories reported weaker growth, resulting in a slower pace of hiring. Nevertheless, employment still recorded its seventh consecutive month of growth.

Inflationary pressures remained a significant concern, with tariffs again widely cited as the principal cause of sharply higher business costs. While manufacturing input prices eased slightly m/o/m, they remained elevated. Conversely, inflation in the services sector accelerated to its second-highest level recorded in the past 27 months. The report also noted that firms faced difficulty in passing these higher costs on to their customers.

In the eurozone, business activity accelerated in September to its fastest pace in 16 months. The HCOB Flash Composite PMI rose to 51.2 from 51.0 in August, surpassing analyst expectations for the reading to remain stable. The expansion was primarily driven by Germany's services sector, which matched its fastest growth rate this year. This strength compensated for a deepening contraction in France, which is contending with political instability. While Germany recorded its joint-fastest activity growth since May 2023, France suffered its thirteenth consecutive monthly decline at the sharpest pace since April.

However, the bloc’s manufacturing sector showed renewed weakness, slipping back below the 50.0 growth threshold to 49.5. August’s reading of 50.7 had briefly suggested a recovery from a multi-year malaise. In contrast, the services sector remained robust, with its PMI reaching a nine-month high of 51.4.

Despite the headline growth, forward-looking indicators raised concerns about the sustainability of the recovery. New orders remain at the 50.0 mark after a brief expansion in August. Furthermore, employment growth ceased, ending a six-month period of job creation as manufacturers continued to reduce staff. On the inflation front, price pressures eased, though services cost inflation was described as remaining ‘unusually high’ despite a slight moderation.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。