Key data to move markets today

EU: German PPI, EU EcoFin Meeting, Eurogroup Meeting, and a speech by President of the Dutch central bank (DNB) Olaf Sleijpen

UK: Retail Sales

USA: A speech by San Francisco Fed President Mary Daly

JAPAN: BoJ Interest Rate Decision and Monetary Policy Statement

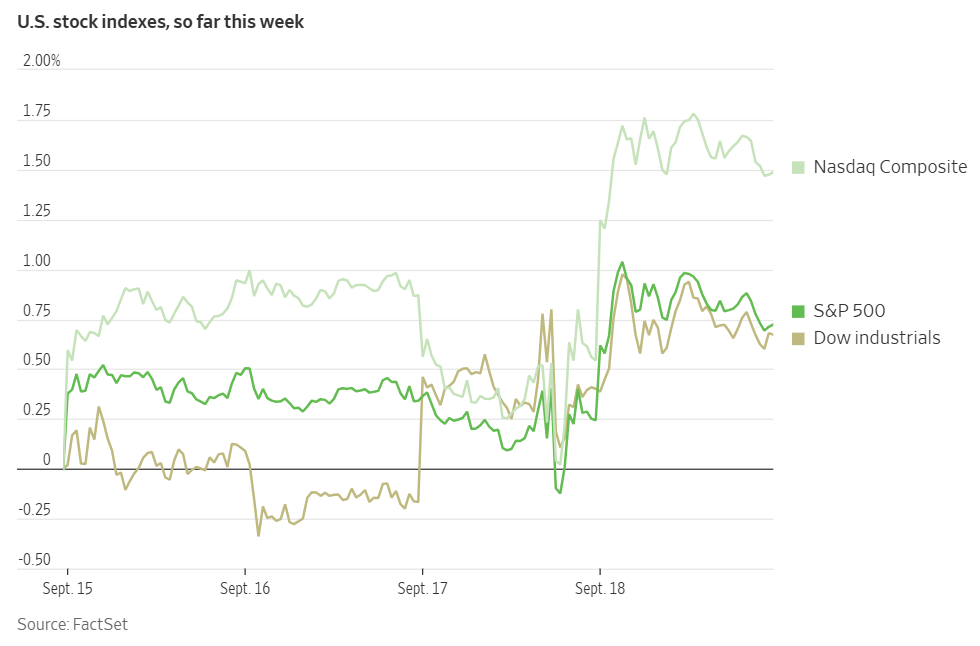

US Stock Indices

Dow Jones Industrial Average +0.27%

Nasdaq 100 +0.95%

S&P 500 +0.48%, with 7 of the 11 sectors of the S&P 500 up

Following the Fed's first interest rate reduction of the year and its signal of potential further cuts, US equity markets staged a broad rally on Thursday. The S&P 500, the Nasdaq Composite, the Dow Jones Industrial Average, and the Russell 2000 all advanced to record closing highs.

This marked the first occasion since November 2021 that all four major benchmarks achieved fresh highs simultaneously, a rare feat that has occurred on only 25 other trading days this century.

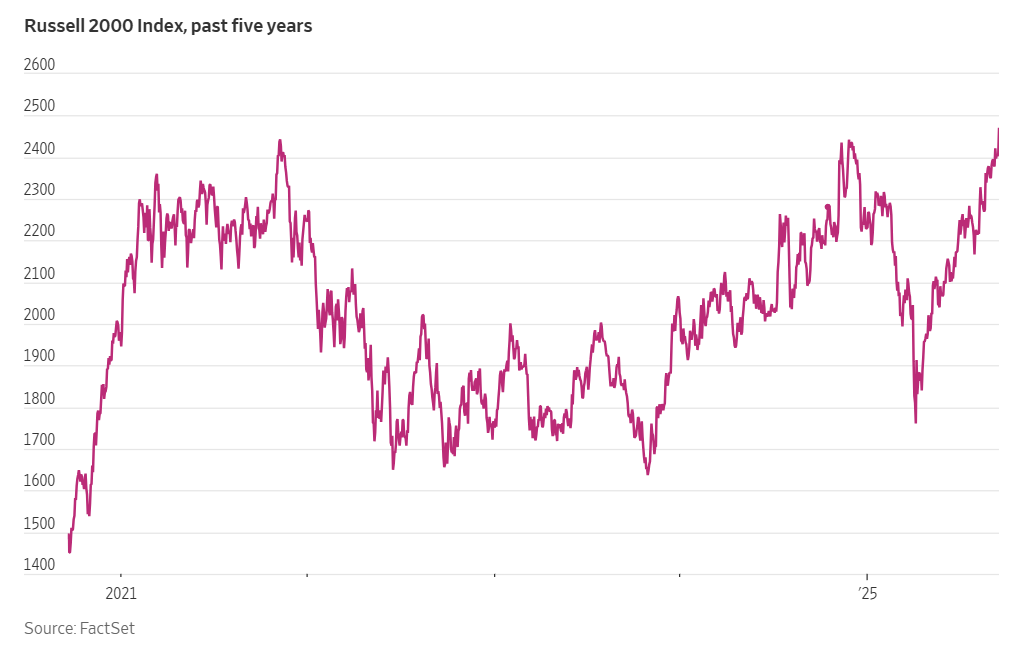

The gains were widespread, with 320 stocks in the S&P 500 rising, led by the Information Technology sector. The Nasdaq 100 climbed +0.95%, while the small-cap Russell 2000 index added +2.51% to secure its first record close since 8th November, 2021, at 2,467.70. For the Nasdaq Composite, it was the 27th record finish this year.

In corporate news, Nvidia announced a surprising strategic move, agreeing to a $5 billion investment in rival Intel. The two companies will co-develop chips for personal computers and data centres in a move intended to support the ailing chipmaker.

Alphabet is partnering with PayPal to enhance online shopping by integrating PayPal's payment infrastructure with its own AI expertise.

Meta Platforms continued its push into hardware with the unveiling of new smartglasses. Additionally, The Wall Street Journal reported that Meta is approaching media companies to negotiate potential AI content-licensing deals.

Swiss drugmaker Roche agreed to acquire 89bio, a Nasdaq-listed pharmaceutical company, for up to $3.5 billion.

Nucor said it expects sequential profit declines in its three operating segments for Q3. The company now projects EPS to be between $2.05 and $2.15 and plans to release its full earnings report after the market closes on 27th October.

The US Federal Trade Commission and seven states have filed a lawsuit against Live Nation Entertainment and its Ticketmaster subsidiary. The suit alleges that the company failed to adequately address the use of automated ticketing bots and large-scale resale operations.

S&P 500 Best performing sector

Information Technology +1.36%, with Intel +22.77%, Synopsys +12.86%, and CrowdStrike Holdings +12.82%

S&P 500 Worst performing sector

Consumer Staples -1.03%, with Monster Beverage -2.83%, Philip Morris International -2.73%, and Altria Group -2.40%

Mega Caps

Alphabet +0.99%, Amazon -0.17%, Apple -0.46%, Meta Platforms +0.58%, Microsoft -0.31%, Nvidia +3.49%, and Tesla -2.12%

Information Technology

Best performer: Intel +22.77%

Worst performer: CDW -2.64%

Materials and Mining

Best performer: Steel Dynamics +2.18%

Worst performer: Nucor -1.75%

European Stock Indices

CAC 40 +0.87%

DAX +1.35%

FTSE 100 +0.21%

Commodities

Gold spot -0.43% to $3,644.01 an ounce

Silver spot +0.35% to $41.80 an ounce

West Texas Intermediate -0.75% to $63.62 a barrel

Brent crude -0.59% to $67.50 a barrel

On Thursday, gold prices retreated after reaching a record high in the previous session. Spot gold was -0.43% at $3,644.01 per ounce, following a volatile session on Wednesday where it briefly touched an all-time peak of $3,707.40.

The decline was partly attributed to a +0.37% rise in the US dollar index.

Despite the daily loss, gold prices have increased +39.08% year-to-date, benefiting from its appeal in low-interest-rate environments and during periods of economic and geopolitical uncertainty.

In a sign of robust physical demand, data indicated that Swiss gold exports to China surged by 254% in August compared to July.

On Thursday, oil prices declined amid continuing concerns about the US economic forecast. This unease followed the Fed's decision to implement its first interest rate cut of the year.

Brent crude futures fell 40 cents, or -0.59%, closing at $67.50, while US WTI crude was down 48 cents, or -0.75%, to a settlement price of $63.62.

Exxon Mobil CEO Darren Woods stated in an interview with the Financial Times that the US oil corporation has no intentions of resuming operations in Russia. This decision is expected to have a bullish effect on prices by restricting the supply of Russian oil to the international market.

Conversely, Tariq Al-Roumi, oil minister for OPEC member Kuwait, said he anticipated increased oil demand due to the US interest rate reduction, with a notable rise expected from Asian markets.

Qatar, also an OPEC member, saw its state-owned Qatar Energy raise the term price for its November loading of al-Shaheen crude oil to its highest level in eight months.

Note: As of 5 pm EDT 18 September 2025

Currencies

EUR -0.25% to $1.1786

GBP -0.53% to $1.3551

Bitcoin +1.11% to $117,363.93

Ethereum +1.42% to $4,495.65

The US dollar appreciated against most major currencies on Thursday, following the Fed's interest rate cut, which was accompanied by signals of little urgency for further monetary easing. The dollar's advance was further supported by economic data revealing a decrease in new applications for US unemployment benefits last week, reversing a jump from the prior week.

The US dollar index rose +0.37% to 97.37. This marked a recovery from its post FOMC announcement low of 96.22 on Wednesday, a level not seen since February 2022.

The euro weakened -0.25% to $1.1786. The decline followed a brief surge to $1.1918 on Wednesday, its highest point since June 2021, in an initial reaction to the Fed's decision.

The dollar's broad strength pressured the British pound, erasing gains that had followed the BoE's decision to hold interest rates steady and slow the pace of its government bond sales. After an initial rise, the pound reversed course, ending the day -0.53% to $1.3551, well below its prior session's peak of $1.3726, its strongest level since 2nd July.

The dollar advanced +0.67% to ¥147.92 ahead of BoJ's policy decision today. While the BoJ maintained its current policy, financial markets are pricing in a quarter-point rate increase by the end of March, with approximately 50% odds of a hike occurring before the end of this year.

Investor focus is also on Japan's political landscape, specifically the 4th October vote for a new leader of the ruling Liberal Democratic Party, as Prime Minister Shigeru Ishiba is set to resign.

Fixed Income

US 10-year Treasury +2.3 basis points to 4.108%

German 10-year bund +5.1 basis points to 2.725%

UK 10-year gilt +5.1 basis points to 4.680%

US Treasury yields advanced across the curve on Thursday as investors continued to assess the path of monetary policy following the FOMC statement. On Thursday, the yield on the 10-year Treasury note rose +2.3 bps to 4.108%. Following a +5.0 bps rise in the prior session, this contributed to the largest two-day increase in a month.

At the shorter end of the curve, the two-year Treasury yield, particularly sensitive to expectations for Fed policy, edged up +0.2 bps to 3.574%. Consequently, the spread between the 10-year and two-year yields widened by 2.1 bps to 53.4 bps.

The yield on the 30-year Treasury bond also rose, advancing +3.6 bps to 4.726%.

Fed funds futures traders are pricing in a 91.9% probability of a 25 bps rate cut at October’s FOMC meeting, up from 86.8% last week, according to CME Group's FedWatch Tool. Traders are currently anticipating 70.8 bps of cuts by year-end, lower than the 72.8 bps expected last week.

Across the Atlantic, borrowing costs across the euro area advanced on Thursday, though Italy’s bond yields remained below those of France. In the UK, markets exhibited a subdued initial reaction to the BoE’s decision to maintain its key interest rate and slow the pace of its quantitative tightening program.

In a 7-2 vote, the BoE's Monetary Policy Committee held rates steady at 4%. The central bank also announced it would reduce the annual pace of gilt sales from its balance sheet to £70 billion, a decrease from the current £100 billion, aligning with economist forecasts. The BoE specified it would skew sales away from long-dated gilts to minimise disruption in the bond market, where 30-year borrowing costs had recently touched their highest levels since 1998.

The BoE remains unique among major central banks for conducting outright sales of its bond holdings, rather than simply letting them mature. Following the announcement, the UK's 10-year gilt yield rose +5.2 bps to 4.680%, while the 30-year yield advanced +7.1 bps to 5.503%.

Germany's 10-year government bond yield was +5.1 bps at 2.725%. The two-year German yield, more sensitive to ECB policy expectations, rose +1.0 bps to 2.018%. At the longer end of the curve, the 30-year yield was +7.6 bps to 3.306%.

The yield spread between 10-year French bonds and German Bunds, a key market indicator of the risk premium for French debt, stood at 80.6 bps, remaining below its six-month high of 84 bps.

On Wednesday, Italy's 10-year yield dropped below that of France for the first time, reaching 3.470%, 2.0 bps lower than France’s 10-year OAT yield. This continued on Thursday, with Italy's 10-year yield rising in line with the broader debt market, ending the day +4.5 bps to 3.515%. France's OAT yields stood at 3.531%, having risen +4.1 bps.

Looking forward, money markets are pricing a 45% chance of a 25 bps rate cut by the ECB by June 2026, which would bring its deposit rate to 1.75%. The key rate is projected to be 1.95% by December 2026.

Note: As of 5 pm EDT 18 September 2025

Global Macro Updates

BoE leaves bank rate unchanged, slows pace of QT. In a widely expected decision, the BoE's Monetary Policy Committee (MPC) voted 7-2 to maintain the key bank rate at 4.0%. The dissenting members, Swati Dhingra and Dave Taylor, called for a 25 bps rate reduction.

According to the policy statement, the central question for the majority revolved around whether the upside risk to the ongoing disinflationary process could be counteracted by a more substantial weakening in economic demand. The committee's assessment concluded that upside inflation risks remain prominent in the outlook. The central bank continues to expect inflation to peak at 4.0% in the upcoming September reading and to ease gradually thereafter.

Policymakers noted that the labour market has softened further and that risks to economic activity persist from both domestic and geopolitical sources. The MPC reiterated its guidance that ‘a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate.’

Additionally, the committee announced it would slow the annual pace of its balance sheet reduction from £100 billion to £70 billion, beginning in October. Due to fewer gilts maturing over the next year, the volume of active sales will increase from £13 billion to £21 billion to meet this target. The BoE specified that it would skew sales away from longer-dated gilts, and all members agreed that a high bar would be required to amend this plan.

BoJ holds policy rate and announces framework for ETF and J-REIT divestment. As widely expected, the BoJ maintained its policy rate at 0.50% following its latest meeting. The central bank continues to foresee a moderation in economic growth, attributing the slowdown to the impact of tariff policies on global demand and declining corporate profits.

In its economic outlook, the BoJ reaffirmed its projection for a sluggish phase in inflation, resulting from slower growth and waning pressure from food prices. The BoJ maintained its view that the inflation target will be reached in the second half of the projection period.

The policy decision was reached via a 7-2 vote. Board member Hajime Takata dissented on the grounds that the price stability target has already been more or less achieved. Separately, Kazuya Tamura dissented due to perceived upside risks to inflation, expressing a desire to move the policy rate closer to a neutral level.

The main surprise came in an appendix to the policy statement, which outlined the BoJ's plan to dispose of its ETFs and J-REITs holdings. The bank stated that for the time being, the pace of sales would be ‘roughly consistent’ with its recently completed unwinding of stock purchases, or about 0.05% of turnover.

The annual guideline for ETF sales was stipulated at approximately ¥330 billion on a book-value basis, equivalent to ¥620 billion by market value as of March 2025. The pace for J-REITs was set at about ¥5 billion in book value, or ¥5.5 billion in market value. The sales are set to commence once necessary preparations are completed, and the BoJ noted that the trajectory may be adjusted at future policy meetings.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Ця стаття надається вам лише для інформаційних цілей і не повинна розглядатися як пропозиція або запит на купівлю або продаж будь-яких інвестицій або пов'язаних послуг, які можуть бути згадані тут. Торгівля фінансовими інструментами пов'язана зі значним ризиком втрат і може підходити не всім інвесторам. Минулі результати не є надійним показником майбутньої ефективності.