Will it be a chilling NFP report?

Key data to move markets today

EU: German, French and Eurozone HCOB Composite, Services and Manufacturing PMIs, Italian CPI, Eurozone ZEW Economic Sentiment survey, German ZEW Current Situation and Economic Sentiment surveys

UK: Average Earnings, Claimant Count Change, Claimant Count Rate, ILO Unemployment Rate, and S&P Global Composite, Services and Manufacturing PMIs

USA: ADP Employment Change 4-week average, Nonfarm Payrolls, Average Hourly Earnings, Labour Force Participation Rate, Unemployment Rate, Underemployment Rate, Retail Sales and S&P Global Composite, Services and Manufacturing PMIs

JAPAN: Adjusted Merchandise Trade Balance, Exports, Imports, and Merchandise Trade Balance Total

US Stock Indices

Dow Jones Industrial Average -0.09%

Nasdaq 100 -0.51%

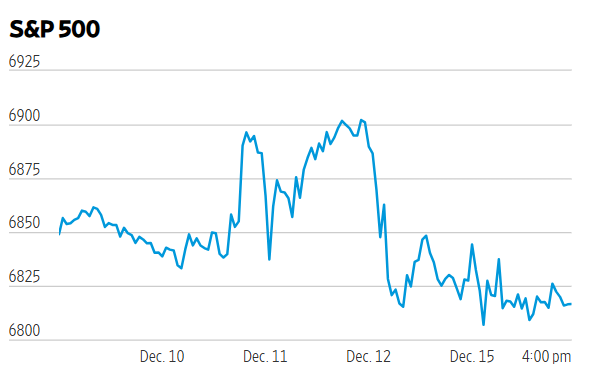

S&P 500 -0.15%, with 3 of the 11 sectors of the S&P 500 down

Source: Wall Street Journal

Stock market volatility has intensified this month as investors have grown more cautious about the future prospects of AI and the broader economic outlook. Despite these concerns, all three major US equity indexes remain close to their respective all-time highs.

On Monday, the Nasdaq Composite closed down -0.59%, while the S&P 500 was -0.15%. The Dow Jones Industrial Average declined -0.09%, or 41.49 points.

Ford shifts gears: hits brakes on EVs, and accelerates hybrids. Ford has announced a projected pre-tax charge of $19.5 billion as it discontinues its flagship F-150 all-electric pickup truck and other large electric vehicle (EV) models. As reported by the Financial Times, the company is shifting its strategic focus toward producing more profitable hybrids and combustion engine vehicles, following recent regulatory changes, including the cancellation of federal tax credits for EV purchases by the US administration. According to Cox Automotive, this policy shift has had a notable impact on consumer behaviour, with a surge in EV purchases in September preceding a 49% decline in October.

Ford will redirect investments into manufacturing additional trucks and vans, affordable EVs, and expanding its energy storage business, initially targeting enterprise customers such as utilities. Andrew Frick, head of Ford’s petrol engine and electric divisions, emphasised that capital will be allocated to higher-return areas. The company cited lower-than-expected demand, elevated costs, and ongoing regulatory changes as reasons for this strategic overhaul.

Of the total $19.5 billion charge, $12.5 billion will be recorded in Q4 to streamline Ford’s EV assets, including a $3 billion writedown related to the termination of its battery joint venture with South Korea’s SK On. The remaining charges are expected to be recognised through 2027. Despite the writedown, Ford has revised its full-year financial guidance upward, forecasting adjusted earnings before interest and tax of $7 billion, an increase from the previous estimate of $6 billion to $6.5 billion.

This announcement coincides with the European Commission’s proposal to relax the EU’s 2035 ban on combustion engines. Under the revised legislation, carmakers may continue producing a limited number of petrol and diesel vehicles, capped at 10 percent of 2021 emissions levels, provided certain sustainability criteria — such as utilising green steel — are met. Additionally, range extenders in EVs, previously set for prohibition, may be permitted under the new framework.

In corporate news, Bloomberg news reported that ServiceNow, an AI-driven platform, was nearing an agreement to acquire the cybersecurity firm Armis.

Sanofi's investigational treatment for multiple sclerosis encountered another delay from US regulators, compounded by the failure of a late-stage clinical trial.

Italy’s Agnelli family declined an offer from stablecoin issuer Tether to purchase its majority stake in Juventus; as a result, Juventus shares surged over 18% in Milan.

JPMorgan Chase played an advisory and financing role in a $7.4 billion transaction for Korea Zinc, facilitating the construction of the largest zinc smelter in the US. The Wall Street Journal reported that, according to sources familiar with the matter, this initiative aligns with the bank’s broader national-security funding strategy. To support the development of the Tennessee smelter, the US government and external investors will contribute approximately $2.2 billion in equity capital. JPMorgan Chase and the federal government are covering the remaining project costs through debt financing, sources said.

S&P 500 Best performing sector

Health Care +1.27%, with Bristol-Myers Squibb +3.59%, Incyte +3.39%, and Eli Lilly & Co +3.38%

S&P 500 Worst performing sector

Information Technology -1.04%, with ServiceNow -11.54%, Broadcom -5.59%, and Workday -4.27%

Mega Caps

Alphabet -0.39%, Amazon -1.61%, Apple -1.50%, Meta Platforms +0.59%, Microsoft -0.78%, Nvidia +0.73%, and Tesla +3.56%

Information Technology

Best performer: Gartner +5.33%

Worst performer: ServiceNow -11.54%

Materials and Mining

Best performer: Newmont +1.58%

Worst performer: FMC -5.68%

European Stock Indices

CAC 40 +0.70%

DAX +0.18%

FTSE 100 +1.06%

Commodities

Gold spot +0.03% to $4,303.29 an ounce

Silver spot +3.18% to $63.98 an ounce

West Texas Intermediate -1.60% to $56.61 a barrel

Brent crude -1.44% to $60.34 a barrel

Spot gold ended Monday’s session slightly up, +0.03%, at $4,303.29 per ounce, following an advance of more than one percent earlier in the day.

Spot silver increased +3.18% to $63.98 per ounce, after setting a record high of $64.65 on Friday and remaining within close proximity to the unprecedented $65 per ounce threshold.

Oil prices declined on Monday as investors weighed the impact of escalating US - Venezuelan tensions against concerns over global oversupply and the potential results of a Russia - Ukraine peace agreement.

Brent crude futures closed 88 cents lower, or -1.44%, at $60.34 per barrel. US WTI crude fell 92 cents, or -1.60%, to settle at $56.61 per barrel.

Venezuela’s oil exports have dropped markedly since the US seized a tanker last week and imposed new sanctions on shipping companies and vessels trading with it, according to maritime sources, shipping data, and official documents. Reuters reported that the US administration intends to intercept additional shipments of Venezuelan oil to increase pressure on President Nicolas Maduro. Additionally, Venezuela’s state oil company, PDVSA, reported a cyberattack on Monday, prompting tankers scheduled to load crude to reverse course amid rising tensions.

Despite the recent tanker seizure, significant volumes of oil already allocated for China — Venezuela’s primary client — combined with ample global supply and restrained demand, continue to reduce the impact of these supply disruptions.

Note: As of 4 pm EST 15 December 2025

Currencies

EUR +0.10% to $1.1749

GBP +0.02% to $1.3373

Bitcoin -2.75% to $86,034.91

Ethereum -4.57% to $2,941.43

The US dollar weakened on Monday in a week dominated by central bank decisions. The ECB and the BoE are due to meet on Thursday and the BoJ on Friday. With inflation in the UK showing signs of moderation, market participants have largely priced in a rate cut by the BoE, while the ECB is expected to maintain its current policy stance.

Sterling declined -0.02% to $1.3373, whereas the euro advanced by +0.10% to $1.1749, marking its fourth consecutive session of increases amid volatile trading. The dollar fell -0.35% against the yen, trading at ¥155.23.

The BoJ is broadly anticipated to raise interest rates on Friday, potentially strengthening the yen relative to the US dollar. The BoJ is expected to reaffirm its commitment to further rate hikes, while underscoring that the pace of increases will be data-dependent.

Fixed Income

US 10-year Treasury unchanged at 4.184%

German 10-year bund -0.6 basis points to 2.856%

UK 10-year gilt -1.7 basis points to 4.508%

US Treasury yields edged lower on Monday as market participants awaited key releases on employment and inflation scheduled for this week, which will serve as the final major economic indicators of the year.

The November jobs report and October retail sales figures are expected today, followed by consumer price inflation data on Thursday and Personal Consumption Expenditures for October on Friday.

The yield on the two-year Treasury note — sensitive to Fed policy outlook — declined -1.9 bps to 3.516%. The 10-year yield was unchanged at 4.184%, while the 30-year yield rose +0.3 bps to 4.847%.

The spread between two- and 10-year notes widened by 1.9 bps to 66.8 bps, marking the steepest curve since 9th April.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in 58.5 bps of cuts in 2026, higher than the 51.3 bps priced in last week. Fed funds futures traders are now pricing in a 24.4% probability of a 25 bps rate cut at January’s FOMC meeting, up from 23.5% a week ago.

Eurozone government bond yields fell Monday. Germany’s 10-year yield fell by -0.6 bps to 2.856%, after reaching 2.894% last week—its highest level since mid-March.

The forthcoming ECB forecasts, due Thursday, and now extending out to 2028, are expected to indicate that economic growth will exceed potential, approaching 1.4%, and that inflation will align with the 2% target. These projections convey two key messages: the region is progressing in the desired direction, and market participants should prepare for a potentially more hawkish monetary policy stance moving forward.

Traders have now largely dismissed the likelihood of further easing from the ECB. They’ve assigned approximately a 20% probability of a quarter-point rate hike by December 2026, and nearly a 50% chance by March 2027. The ECB deposit rate is currently 2%.

Attention will also centre on the Deutsche Finanzagentur’s (DFA) issuance calendar, scheduled for release on Thursday. Commerzbank anticipates that total Bund issuance will reach approximately €350 billion in the coming year, compared to 291 billion euros this year.

Germany’s 30-year yield declined by -0.7 bps to 3.474% on Monday, having reached 3.498% on Friday — the highest level since July 2011. The yield on the two-year German Schatz fell -1.9 bps to 2.159%.

Italy’s 10-year yield dropped -3.3 bps to 3.527%, with the spread against Bunds at 67.1 bps. Additionally, yields on France’s OATs declined by -2.1 bps to 3.566%, as the country’s 2026 budget bill remains under discussion.

Note: As of 5 pm EST 15 December 2025

Global Macro Updates

Miran and Williams lead Monday's Fedspeak. In their first public comments following the December FOMC meeting, Fed officials offered contrasting perspectives on the trajectory of the US economy and the appropriate path for monetary policy. While Fed Governor Stephen Miran advocated for a forward-looking, dovish approach to avert unnecessary economic damage, New York Fed President John Williams signalled that the bar for further rate cuts remains high.

Fed Governor Stephen Miran, a vocal proponent of lower rates, argued that the central bank’s decision-making is currently distorted by ‘phantom inflation,’ causing interest rates to remain restrictively high. Speaking at Columbia University and subsequently to CNBC, Miran contended that policymakers must disregard near-term ‘noise’ and calibrate policy for the long-term economic landscape of 2027.

Miran posited that excess measured inflation does not reflect current supply-demand dynamics. ‘A better measure of underlying inflation would account for distortions from shelter and imputed prices,’ he noted. Specifically, he highlighted that once ‘imputed phantom inflation’ — such as portfolio management fees — is removed, market-based core inflation is tracking below 2.6%. Furthermore, excluding shelter costs, he argued that underlying inflation is running below 2.3%, placing it ‘within noise’ of the Fed’s target.

Warning that the current restrictive stance risks inducing unnecessary job losses, Miran asserted that if the Fed maintains its current path despite cooling labour and inflation trends, the bank risks falling behind the curve. He also dismissed concerns regarding tariffs, viewing their inflationary potential as minimal and not a driver of core goods inflation.

In marked contrast, New York Fed President John Williams presented a more sanguine outlook during remarks in New Jersey. Williams characterised the current monetary policy as ‘well positioned as we head into 2026,’ implying a high threshold for additional easing. He projected that following a ‘year of uncertainty’ in 2025, the economy is poised to regain momentum and return to solid growth and price stability.

Regarding trade policy, Williams suggested that the impact of tariffs appears more muted and prolonged than initially anticipated. He emphasised that inflation expectations remain well-anchored and that the future policy path will continue to depend on the totality of incoming data and the balance of risks.

The gap between Miran and Williams underscores the broader debate within the FOMC. Their comments contrast sharply with those of Kansas City Fed President Jeff Schmid, who dissented last week in favour of holding rates steady. Schmid cited persistent price concerns from constituents and described the labour market as largely balanced, warning that inflation remains too high.

Meanwhile, the political backdrop remains fluid as the US President prepares to name a replacement for Chair Jerome Powell, whose term ends in May. President Trump has indicated that National Economic Council Director Kevin Hassett and former Governor Kevin Warsh are currently the frontrunners for the position.

NFP preview. The November nonfarm payrolls report is scheduled for release Tuesday at 8:30 am EST. Market consensus anticipates headline job growth of 50,000, with the unemployment rate projected at 4.4%. However, previews have highlighted an upward risk to the unemployment figure due to September's unrounded rate of 4.44%. Most analysts expect September’s reported increase of 119,000 jobs to be revised downward.

This report will also incorporate October data from the establishment survey, though it will not include the household survey, which covers the unemployment rate. There is no clear consensus regarding the October headline figure, but many analysts predict softness, attributing this to the federal government’s deferred resignation buyout offers. Conversely, the latest JOLTS report suggests that this weakness may be less pronounced than initially anticipated.

Previews generally forecast moderate job growth for November, with continued drag from federal employment, a slight boost from resolved labour strikes, and possible seasonal support. Growth in leisure and hospitality is expected to be subdued, while the late timing of Thanksgiving may have negatively impacted holiday retail hiring. The potential effects of the government shutdown are considered modest, as federal employees began returning to work during the reporting period.

However, the upcoming report is expected to be complicated by several distortions. Analysts anticipate multiple revisions in the December release, scheduled for 9th January. Additionally, the November report will likely be discussed in the context of remarks by Fed Chair Jerome Powell, who noted last week that job growth may have been overstated by about 60,000 monthly.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。