Will bond markets fly higher?

Global market indices

US Stock Indices Price Performance

Nasdaq 100 -0.00% MTD and +11.43% YTD

Dow Jones Industrial Average -0.55% MTD and +6.47% YTD

NYSE -0.68% MTD and +10.01% YTD

S&P 500 -0.19% MTD and +11.32% YTD

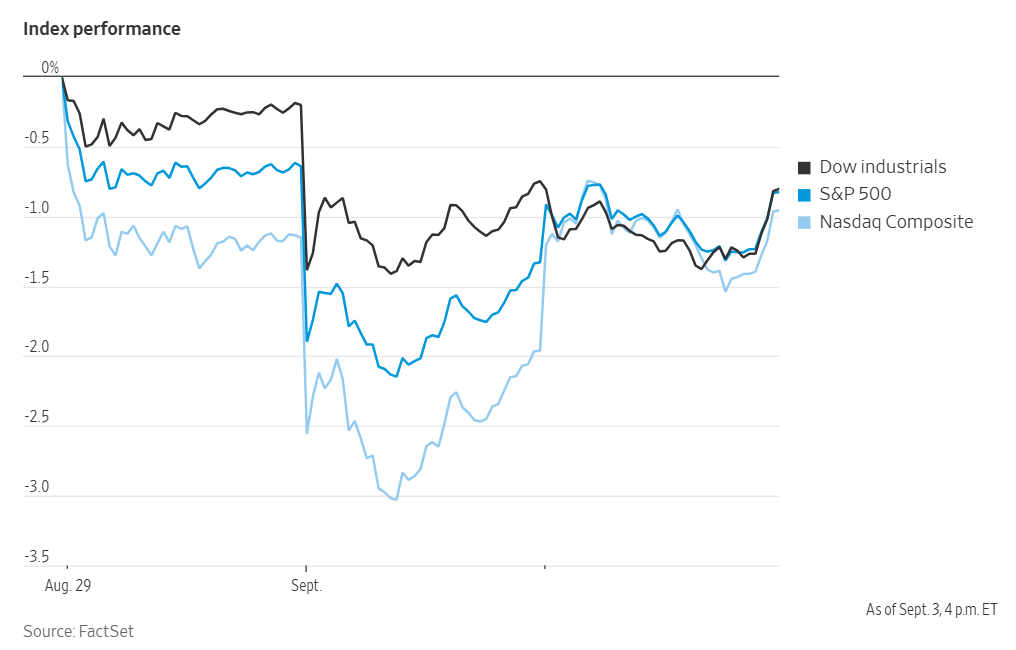

The S&P 500 is -0.82% over the past seven days, with 9 of the 11 sectors down MTD. The Equally Weighted version of the S&P 500 is -1.12% over this past week and +6.38% YTD.

The S&P 500 Communication Services sector is the leading sector so far this month, +3.33% MTD and +21.11%% YTD, while Energy is the weakest sector at -2.08% MTD and +2.64% YTD.

Over this past week, Communication Services outperformed within the S&P 500 at +3.98%, followed by Health Care and Consumer Staples at +0.39% and +0.27%, respectively. Conversely, Industrials underperformed at -2.31%, followed by Utilities and Real Estate at -1.79% and -1.65%, respectively.

The equal-weight version of the S&P 500 was -0.18% on Wednesday, underperforming its cap-weighted counterpart by 0.69 percentage points.

US stocks rebounded on Wednesday, following a difficult start to September driven by high technology valuations and concerns about global fiscal outlooks.

Market performance was mixed on Wednesday. The Dow Jones Industrial Average was relatively unchanged, down -0.05%, while the S&P 500 was +0.51%. The Nasdaq Composite was +1.02%, fuelled by rising shares of Alphabet and Apple.

However, shares of US oil producers weighed on the S&P 500, as they fell sharply amid speculation that OPEC+ might increase output at its weekend meeting, worsening the global fuel surplus.

In corporate news, Salesforce projected disappointing Q2 sales growth. This intensified Wall Street's concerns that the software giant is losing ground to emerging AI companies.

Hewlett Packard Enterprise provided a weak earnings forecast for Q3, renewing concerns about tightening margins in the server computer industry.

American Eagle Outfitters reported higher-than-expected Q2 sales, just weeks after facing a social media controversy over its advertising campaign with Sydney Sweeney.

Macy's also raised its annual outlook and recorded its best comparable sales growth in three years, signaling that consumer spending remains resilient.

Mistral AI, a French artificial intelligence startup, is nearing completion of a €2 billion investment round. This funding values the company at €12 billion, including the new investment, and firmly establishes its standing as one of Europe's most valuable technology startups.

Despite ongoing trade tensions with the US, WestJet, Canada's second-largest airline, has placed its largest-ever order with Boeing. The agreement includes the purchase of 67 aircraft, with an option for additional planes, as the airline seeks future growth.

ConocoPhillips, the largest independent oil producer in the US, intends to reduce its global workforce by up to 25%. This decision comes in response to declining crude prices and anticipated peak shale output.

Mega caps: The Magnificent Seven had mostly negative performances over the past week. Over the last seven days, Alphabet +11.17% and Apple +3.46%, while Microsoft -0.84%, Amazon -1.37%, Meta Platforms -1.38%, Tesla -4.44%, and Nvidia -6.05%.

Energy stocks had a mostly negative performance this week, with the Energy sector itself -0.87%. WTI and Brent prices are +1.40% and -0.59%, respectively, this week. Over this past week, Marathon Petroleum +0.62%, Baker Hughes +0.49%, and APA +0.40%, while BP -0.40%, Chevron -0.74%, Shell -0.79%, Occidental Petroleum -1.22%, ExxonMobil -1.27%, Phillips 66 -1.73%, Energy Fuels -2.17%, Halliburton -3.18%, and ConocoPhillips -3.32%.

Materials and Mining stocks had a mostly negative performance this week, with the Materials sector -1.10%. Over the past seven days, Sibanye Stillwater +11.85%, Freeport-McMoRan +5.33%, and Newmont Corporation +4.19%, while CF Industries -1.83%, Mosaic -2.39%, Yara International -2.39%, Nucor -3.41%, Celanese Corporation -5.34%, and Albemarle -8.63%.

European Stock Indices Price Performance

Stoxx 600 -0.61% MTD and +7.71% YTD

DAX -1.29% MTD and +18.51% YTD

CAC 40 +0.21% MTD and +4.59% YTD

IBEX 35 -0.98% MTD and +27.55% YTD

FTSE MIB -0.98% MTD and +22.23% YTD

FTSE 100 -0.10% MTD and +12.30% YTD

This week, the pan-European Stoxx Europe 600 index is -1.44%. It was +0.66% on Wednesday, closing at 546.78.

So far this month in the STOXX Europe 600, Health Care is the leading sector, +1.44% MTD and -2.56% YTD, while Insurance is the weakest at -2.50% MTD and +16.08% YTD.

This week, Health Care outperformed within the STOXX Europe 600, at +0.36%, followed by Basic Resources and Personal & Household Goods at -0.01% and -0.10%, respectively. Conversely, Technology underperformed at -3.74%, followed by Utilities and Retail at -3.55% and -3.52%, respectively.

Germany's DAX index was +0.46% on Wednesday, closing at 23,594.80. It was -1.88% over the past seven days. France's CAC 40 index was +0.86% on Wednesday, closing at 7,719.71. It was -0.31% over the past week.

The UK's FTSE 100 index was -0.84% last week to 9,177.99. It was +0.67% on Wednesday.

In Wednesday's trading session, Basic Resources was the market's outperformer, boosted by new data showing an acceleration in China's services activity, which was aided by a stronger rise in new business and exports. The Industrial Goods & Services sector was also a strong advancer, led by Airbus, which rose on news of aircraft delivery constraints, and BAE Systems, which gained amid talks of a UK frigate deal. Additionally, Schneider Electric and ABB shares climbed following rating upgrades from brokers.

The Technology sector also traded higher, with attention on a major US legal development where a federal judge ruled that Alphabet is not required to sell its Chrome browser but must share search data with competitors. In the Health Care sector, Valneva jumped on positive Phase 2 data for its Lyme disease vaccine. Luxury goods were firmer as well, with Watches of Switzerland Group outperforming on the back of strong US trading and the success of its Rolex boutiques.

Insurance was the day's underperformer. Swiss Life Holding declined due to higher tax expenses and Helvetia Holding was softer despite reporting a profit that exceeded expectations. The Food & Beverages sector also fell sharply, with attention on Hilton Food Group, which declined despite reporting in-line H1 EPS, as it warned of future margin pressure. Bakkavor Group also declined after releasing its results. Other defensive sectors, such as Telecom and Utilities, were also among the biggest underperformers.

Other Global Stock Indices Price Performance

MSCI World Index -0.45% MTD and +12.16% YTD

Hang Seng +1.06% MTD and +26.34% YTD

The MSCI World Index is -0.44% over the past 7 days, while the Hang Seng Index is -0.71% over the past 7 days.

Currencies

EUR -0.21% MTD and +12.63% YTD to $1.1660.

GBP -0.46% MTD and +7.40% YTD to $1.3441.

Over the last seven days the US dollar index is -0.04%. It is +0.30% MTD, and -9.54% year-to-date.

The US dollar weakened against the yen and Swiss franc on Wednesday after economic data indicated a softening in the labour market. This reinforced investor expectations that the Fed would ease monetary policy.

The US Labor Department reported that job openings, a key indicator of labour demand, dropped to 7.181 million in July, a larger decline than the 7.378 million forecast by economists. This data prompted the dollar index to fall -0.28% to 98.14. The dollar reverses its earlier gains against both the Japanese yen and the Swiss franc. The dollar declined by -0.20% to ¥148.05 and fell -0.06% against the Swiss franc, reaching 0.8042.

The euro extended its gains against the dollar, rising +0.16% to $1.1660. The British pound also strengthened against the dollar, gaining +0.36% to $1.3441, following a sell-off in UK government bonds. Meanwhile, the euro declined -0.15% against the pound to 0.8675.

Fedspeak on Wednesday offered little new information, though remarks from Federal Reserve officials placed a greater focus on potential softness in the labour market. In a speech, St Louis Fed President Alberto Musalem, a FOMC voting member, said the current modestly restrictive policy rate aligns with the economic outlook. However, he noted that recent data have heightened his view that risks to the labour market are tilted to the downside. Musalem also believes there is a reasonable possibility that above-target inflation could be more persistent.

In a quarterly message, Atlanta Fed President Raphael Bostic, a non-voting member, said the labour market is slowing sufficiently that a 25 bps rate cut may be appropriate this year. He warned this could change depending on the future path of inflation and the evolution of the labour market. Bostic added that it is not yet ‘unambiguously clear’ that the labour market is materially weakening.

In a Q&A session, Minneapolis Fed President Neel Kashkari, also a non-voting member, cautioned that inflation remains too high. While he acknowledged that the labour market shows signs of cooling, he believes there is room for interest rates to come down gradually without causing a recession.

Over the last seven days, the euro is +0.21% against the US dollar, and sterling -0.40%. This week, the US dollar traded +0.45% against the Japanese currency. Its performance is -5.63% year-to-date.

Note: As of 5:00 pm EDT 3 September 2025

Cryptocurrencies

Bitcoin +3.31% MTD and +19.42% YTD to $112,059.13.

Ethereum +2.26% MTD and +33.49% YTD to $4,464.58.

Bitcoin is +0.47% and Ethereum -1.31% over the past 7 days. On Wednesday, Bitcoin was +0.79% to $112,059.13 and Ethereum was +3.04% to $4,464.58.

This week saw Bitcoin benefit from increasing Spot Bitcoin ETF flows after experiencing outflows in 3 of the past 4 weeks. Ethereum has continued to rise this month due to stronger ETF flows from institutional investors and from those investors building on the Ethereum chain itself due to the Pectra upgrade back on 7 May that improves staking efficiency. There has also been growing demand from digital asset treasuries for Ethereum. According to data from CoinShares, Spot Ethereum ETFs attracted $1.4 billion in inflows last week, nearly double the $748 million that flowed into Bitcoin funds during the same period. The total cryptocurrency ETP market attracted $2.48 billion in inflows last week, effectively offsetting the previous week’s $1.4 billion in outflows. However, the total assets under management (AUM) for crypto funds decreased by approximately 7%, falling from $234.7 billion to $219 billion. Nevertheless, looking to the wider macro environment, a weakening US dollar, rising governance risks due to President Trump’s pressure on the Fed, yield curve steepening due to concerns around Fed independence and rising inflation, and inflows into more liquid assets such as gold as investors seek out hedges, may be creating a more bullish narrative for Bitcoin and other cryptocurrencies.

Note: As of 5:00 pm EDT 3 September 2025

Fixed Income

US 10-year yield -1.2 bps MTD and -35.5 bps YTD to 4.221%.

German 10-year yield +1.6 bps MTD and +37.4 bps YTD to 2.743%.

UK 10-year yield +2.5 bps MTD and +18.1 bps YTD to 4.749%.

Following the release of the July JOLTS data on Wednesday, which showed a decline in job openings, US Treasuries rallied on expectations that the Fed would cut interest rates later this month. The Treasury yield curve flattened as the spread between the two-year and 10-year yields narrowed to 59.6 bps, compared to 61.8 bps at the close of trading on Tuesday. Earlier Wednesday, the spread had reached 63.8 bps, its widest since April as investors are demanding higher returns to lend money for longer periods.

By afternoon trading, the yield on two-year US Treasuries was -2.0 bps to 3.625%. The 10-year yield also fell, dropping -4.2 bps to 4.221%.

Yields on 30-year US bonds declined -4.7 bps to 4.895%, after having reached 5% earlier in the session, their highest point in approximately 1 1/2 months as investors worry about rising debt levels and fiscal imbalances at a time when the Fed’s independence is also being questioned.

Over the past seven days, the yield on the 10-year Treasury note was -1.8 bps. The yield on the 30-year Treasury bond was +0.4 bps. On the shorter end, the two-year Treasury yield was -2.8 bps.

Fed funds futures traders are now pricing in a 97.6% probability of a September cut, according to CME Group's FedWatch Tool. Traders are currently pricing in 58.4 bps of cuts by year-end, higher than last week’s 56.3 bps.

Across the Atlantic, in the UK, on Wednesday the 10-year gilt was -6.0 bps to 4.749%. The UK 10-year yield was +1.0 bps over the past seven days. The 30-year gilt ended the day -9.2 bps to 5.606% on Wednesday after reaching 5.747% on Wednesday, above the high of 5.723% hit on Tuesday. This was the highest level since 1998. Investors have been reacting to higher debt levels and growing fiscal concerns.

Germany's 30-year bond yield, after reaching a 14-year high of 3.4340%, reversed its course and closed -4.7 bps lower at 3.355%. Similarly, other long-dated regional bond yields in France and Italy mirrored their German counterpart, reaching multi-year highs before falling to 4.453% and 4.609%, respectively, down -4.7 bps and -5.7 bps.

Yields on Germany's 10-year and 2-year bonds also decreased, with the 10-year yield falling -4.8 bps to 2.743% and the 2-year yield declining -2.6 bps to 1.962%. These declines followed a period of sharp increases in bond yields over recent days, particularly for long-dated bonds.

Despite this stabilisation, bond markets are not yet fully recovered. Concerns persist regarding high debt levels in numerous countries, political instability, and reduced demand for long-dated debt from investors such as pension funds. Investors are also preparing for an increase in bond supply from Germany, Japan, and the US in September and October, while also facing political uncertainties in France and Japan.

In France, Finance Minister Eric Lombard stated that the minority government would have to compromise on its plans to reduce the budget deficit if Prime Minister François Bayrou is unseated in a confidence vote on 8th September.

In Japan, the 30-year government bond yield hit a record high Wednesday at 3.286%, following the jump in UK, US and eurozone bond yields and the announcement from Hiroshi Moriyama, the Secretary-General of Japan's ruling party and a close aide to Prime Minister Shigeru Ishiba, that he intends to resign. The yield on Japan’s 20-year government bonds rose to levels last seen in 1999. This further pressured the yen.

Over the past seven days, the German 10-year yield was +4.1 bps. Germany's two-year bond yield was +4.6 bps, and on the longer end of the curve, Germany's 30-year yield was +4.6 bps.

The spread between US 10-year Treasuries and German Bunds is now 147.8 bps, 5.9 bps lower than last week’s 153.7 bps.

The spread between Italian BTP 10-year yields and German Bund 10-year yields stood at 87.1 bps, a 0.5 bps contraction from 87.6 bps last week. The Italian 10-year yield is +3.6 bps over last week.

Commodities

Gold spot +3.25% MTD and +35.01% YTD to $3,558.72 per ounce.

Silver spot +3.73% MTD and +41.96% YTD to $41.15 per ounce.

West Texas Intermediate crude -0.53% MTD and -11.34% YTD to $63.67 a barrel.

Brent crude -1.07% MTD and -9.91% YTD to $67.39 a barrel.

Gold prices are +4.87% over the past seven days and +35.01% YTD.

Gold's record-breaking rally continued on Wednesday, supported by softer US jobs data that bolstered expectations for a Fed interest rate cut later this month. The ongoing global uncertainties also sustained a strong demand for the precious metal as a safe-haven asset.

Spot gold reached a new record high, rising +0.69% on the day to $3,558.72 per ounce. This increase followed a US government report showing that job openings declined more than anticipated in July and that hiring was moderate, indicating a cooling of labour market conditions.

With this data released, investor attention is now turning to upcoming US employment reports, including jobless claims and ADP employment data today, and the key monthly NFP report due tomorrow.

Oil prices declined by over two percent on Wednesday in anticipation of a weekend meeting of OPEC+ producers, who are expected to consider another increase in production targets for October.

Brent crude fell by $1.71, or -2.47%, to settle at $67.39 a barrel, while WTI crude fell $1.95, or -2.97%, to $63.67 a barrel.

This week, WTI and Brent are +1.40% and -0.59%, respectively.

At the OPEC+ meeting on 7 September, eight members will discuss a potential increase in oil production as the group works to regain market share. This would mark the beginning of the unwinding of a second layer of output cuts, totaling approximately 1.65 million barrels per day (bpd), or 1.60% of global demand—more than a year ahead of schedule. The group had previously committed to raising output targets by about 2.2 million bpd from April to September, in addition to a 300,000 bpd quota increase for the United Arab Emirates.

However, the group's actual production increases have been below their stated commitments. This is primarily because some members are making up for past over-production, while others face capacity constraints that hinder their ability to boost output.

Note: As of 5:00 pm EDT 3 September 2025

Key data to move markets

EUROPE

Thursday: Eurozone Retail Sales and a speech by ECB Executive Board member Piero Cipollone.

Friday: German Factory Orders, Eurozone Employment Change, and Eurozone GDP.

Monday: German Industrial Production and Eurozone Sentix Investor Confidence.

UK

Friday: Retail Sales.

Monday: BRC Like-for-Like Retail Sales.

Tuesday: A speech by BoE’s Deputy Governor for Financial Stability Sarah Breeden.

USA

Thursday: Initial and Continuing Jobless Claims, Challenger Job Cuts, ADP Employment Change, Nonfarm Productivity, Unit Labour Costs, S&P Global Composite and Services PMIs, ISM Services New Orders Index, ISM Services Employment Index, ISM Services PMI, ISM Services Prices Paid, and speeches by New York Fed President John Williams and Chicago Fed President Austan Goolsbee.

Friday: Nonfarm Payrolls, Unemployment Rate, Labour Force Participation Rate, Average Weekly Hours, Average Hourly Earnings, and U6 Unemployment Rate.

Wednesday: PPI.

CHINA

Wednesday: CPI and PPI.

JAPAN

Thursday: Labour Cash Earnings.

Sunday: GDP and GDP Deflator.

Global Macro Updates

Bond markets gone wild. This week saw an initial sell-off in global bond markets as yields steepened with Japan’s 30-year yield hitting a record high and the UK’s 30-year gilt yield reaching a fresh post-1998 high at 5.75%. Markets were only slightly calmed following the release of Wednesday’s JOLT report which indicated a continued slowdown in hiring, raising expectations that the Fed would cut interest rates at their September meeting and at least one other time this year.

UK 30-year yields are up 0.51 percentage points since the start of the year, but in the US, Germany and Japan they are up by a respective 0.19, 0.77 and 1.01 percentage points. In short, the yield difference between short and long-term debt everywhere has steepened and by very similar amounts.

In the UK concerns over budget ‘blackholes’ are causing investors to sell UK long-term bonds, driving up yields to the highest in a generation, leading to more money being spent on interest payments on sovereign debt. With debt levels rapidly approaching 100% of GDP, poor productivity, concerns around growth, and an expected increase in social spending as the population ages may also be contributing to investor caution. In addition, there has been a drop in demand for long term issuance due to pension funds managing defined benefit schemes reducing their direct gilt holdings. Bond vigilantes have been focussing more on the UK than the US or Germany ever since Liz Truss’s “mini” Budget in September 2022. The UK’s fiscal credibility has also not been helped by the looser stance taken since last year’s budget and by the policy U-turns on welfare spending. With the autumn budget now not expected until 26 November, market participants are increasingly worried about the impact the range of expected tax rises will have on the UK economy.

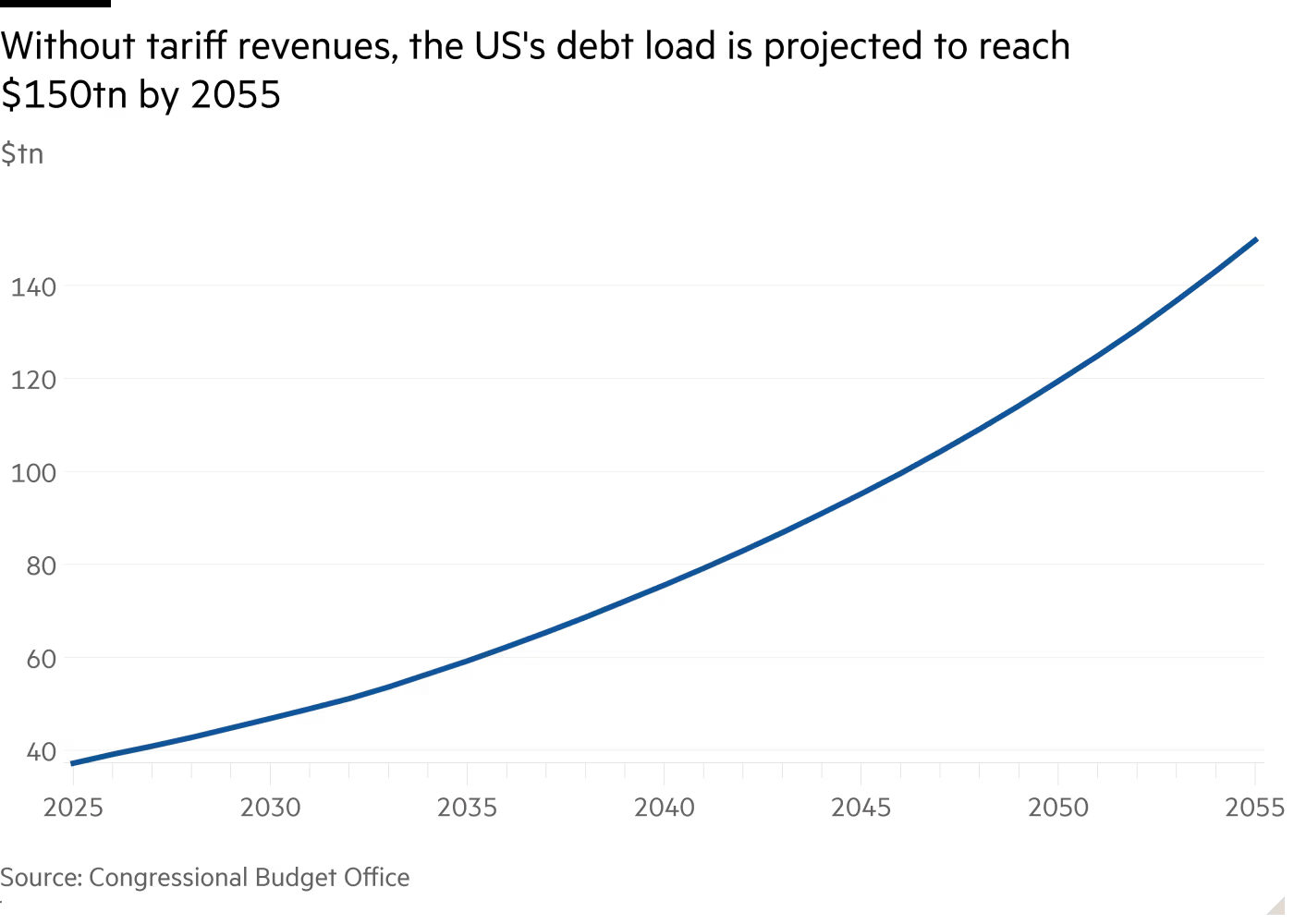

In the US, benchmark 10-year treasuries have reached nearly 5%, reflecting investor concerns about the expanding US deficit and fiscal looseness under the Trump administration. Although tariff revenues have increased dramatically from last year’s levels, they have, so far, not been enough to start rebalancing the books. However, as noted by the Financial Times, the non-partisan Congressional Budget Office (CBO) last month forecast President Trump’s tariffs would boost US government revenues by $4 tn over the coming decade. That would help pay for tax cuts in Trump’s One Big Beautiful Bill Act, which is projected to increase borrowing by $4.1 tn over the same period. But, if last week’s ruling on the illegality of the tariffs is upheld, then reduced tariff revenues may lead to a glut of Treasury issuance.

In France bond yields have risen as investors prepare for another collapse of the French government during the 8 September confidence vote called for by PM Bayrou over the contentious 2026 budget. This budget includes €44 bn in cuts aimed at reducing France's 5.8% deficit. If he fails the confidence vote, it will make him the fifth prime minister ousted in under two years.

The growing strains across sovereign bond markets can be attributed to record levels of borrowing by developed markets amid falling demand for longer dated debt from traditional buyers such as pension funds and insurers. Add in sticky inflation, still a problem in the US and even more so in the UK, which is bad for longer term bond returns and the political difficulties over budgets and debt sustainability, and the outlook for bonds looks increasingly volatile.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

Tento článek je poskytován pouze pro informační účely a neměl by být považován za nabídku nebo výzvu k nákupu nebo prodeji jakýchkoli investic nebo souvisejících služeb, jejichž odkazy se v něm můžou vyskytovat. Obchodování s finančními nástroji je spojeno se značným rizikem ztráty a nemusí být vhodné pro všechny investory. Dřívější produktivita není spolehlivým ukazatelem budoucí produktivity.