The beat goes on

What to look out for today

Companies reporting on Tuesday, 4th November: Advanced Micro Devices, American International Group, Amgen, Apollo Global, Arista Networks, Corteva, Eaton, Live Nation Entertainment, MARA Holdings, Marathon Petroleum, Marriott International, Martin Marietta Materials, Match Group, Molson Coors Beverage, Pinterest, Spotify, Super Micro Computer, Mosaic, Rivian Automotive, Uber Technologies, Yum! Brands

Key data to move markets today

EU: Speeches by ECB President Christine Lagarde, Bundesbank President Joachim Nagel, and Bank of Spain President José Luis Escrivá

UK: A speech by BoE Deputy Governor for Financial Stability Sarah Breeden

USA: A speech by Michelle Bowman, Vice Chair for Supervision on the Board of Governors of the Federal Reserve, Goods and Trade Balance, Factory Orders, and JOLTs Job Openings

JAPAN: BoJ Monetary Policy Meeting Minutes

CHINA: RatingDog Services PMI

US Stock Indices

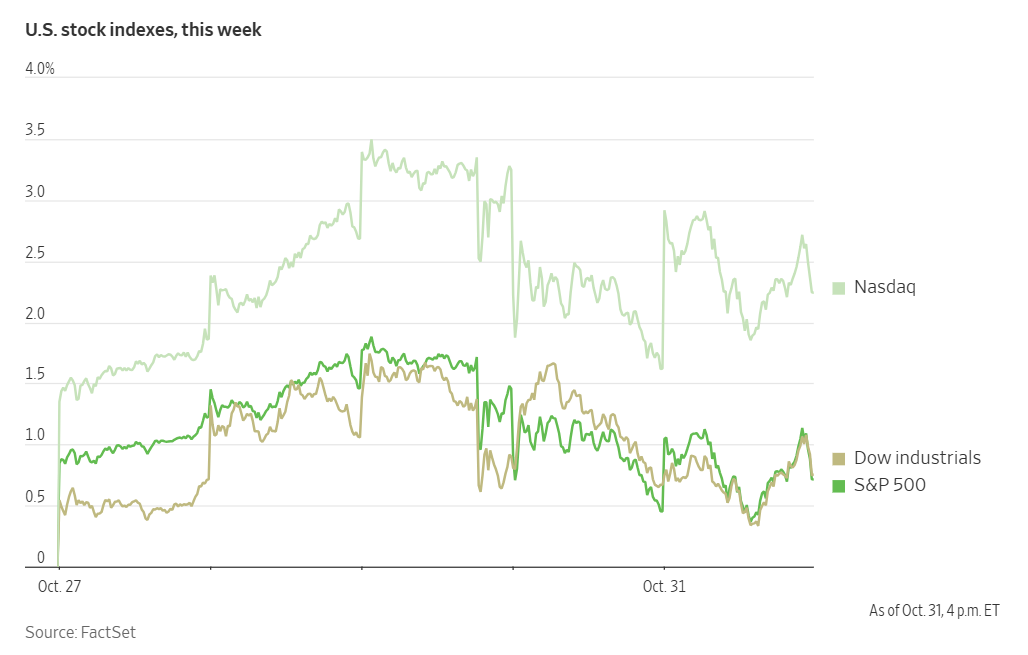

Dow Jones Industrial Average -0.48%

Nasdaq 100 +0.44%

S&P 500 +0.17%, with 4 of the 11 sectors of the S&P 500 up

Stocks closed with mixed results in a relatively subdued start to November. The Dow Jones Industrial Average declined -0.48%, while the Nasdaq Composite rose +0.46% and the S&P 500 gained +0.17%. Despite ongoing enthusiasm surrounding AI, over 300 companies within the S&P 500 experienced declines.

A range of industries are expected to report corporate earnings this week. Monday’s session was comparatively quiet, with earnings from AI analytics firm Palantir standing out after the close. Ahead of its report, Palantir shares climbed +3.35%, reaching a new record high.

In corporate news, Starbucks announced that private-equity firm Boyu Capital will acquire up to a 60% stake in Starbucks’s retail operations in China. Starbucks will retain a 40% interest and continue to own and license its brand and intellectual property. The joint venture is expected to be finalised next year. As of 28th September, Starbucks operated 8,011 stores in China, with its business valued at over $13 billion.

Kimberly-Clark reached an agreement to acquire Kenvue, forming a health and wellness company with approximately $32 billion in annual revenue. Under the cash-and-stock transaction, Kimberly-Clark will pay $21.01 per share, above Kenvue’s closing price of $14.37 on Friday. The total deal value, including debt, is $48.7 billion, with completion anticipated in H2 2026. The combined organisation will be led by Kimberly-Clark CEO Mike Hsu and headquartered in Irving, Texas. Upon closing, Kenvue shareholders will receive $3.50 per share in cash and 0.14625 Kimberly-Clark shares for each Kenvue share held, resulting in Kimberly-Clark shareholders owning ~54% of the merged company and Kenvue shareholders ~46%. This acquisition follows Kenvue’s 2023 spin-off from Johnson & Johnson and comes amid pressure from activist investors such as Toms Capital Investment Management, Third Point, and D.E. Shaw.

Microsoft has entered into an agreement valued at approximately $9.7 billion to purchase AI computing capacity from IREN, making Microsoft the Australian company’s largest client. Additionally, Microsoft plans to invest over $7.9 billion in data centres, cloud infrastructure, and personnel in the United Arab Emirates over the next four years, leveraging US government approval to export AI chips to the region.

Alphabet is issuing $17.5 billion in US bonds after previously launching €6.5 billion in notes in Europe. This reflects a broader trend of technology companies raising capital to fund significant investments in AI.

Eaton agreed to acquire liquid cooling specialist Boyd Thermal for $9.5 billion, targeting rising demand from AI data centres.

SM Energy’s will acquire Civitas Resources in the largest US shale deal of the year, indicating ongoing consolidation in the Permian Basin.

Coeur Mining will proceed with an all-stock purchase of New Gold for roughly $7 billion, consolidating two leading North American gold producers amid renewed investor interest driven by higher bullion prices.

BBVA raised Additional Tier 1 capital for the first time since shareholders rejected its proposed acquisition of Banco Sabadell last month.

BP announced an agreement to divest stakes in US shale assets to Sixth Street for $1.5 billion, as it aims to strengthen its balance sheet and restore investor confidence.

S&P 500 Best performing sector

Information Technology +0.39%, with Western Digital +5.20%, Micron Technology +4.88%, and Seagate Technology Holdings +3.78%

S&P 500 Worst performing sector

Materials -0.56%, with FMC -6.46%, International Paper Company -4.43%, and Celanese -3.59%

Mega Caps

Alphabet +0.82%, Amazon +4.00%, Apple -0.49%, Meta Platforms -1.64%, Microsoft -0.15%, Nvidia +2.17%, and Tesla +2.59%

OpenAI partners with Amazon for next-gen AI model training. OpenAI has entered into a multiyear agreement with Amazon, committing to pay $38 billion for computing power in what represents the first partnership between the two companies.

Announced on Monday, the deal is designed to meet OpenAI’s rapidly expanding computational requirements. Amazon anticipates that the entire computing capacity outlined in the agreement will be available to OpenAI by the end of next year, enabling the ChatGPT developer to promptly access advanced Nvidia chips within Amazon’s data centres.

Under the terms of the seven-year agreement, OpenAI will have the capability to train new artificial intelligence models using Amazon’s infrastructure and utilise these resources to process ChatGPT queries. Furthermore, OpenAI may leverage Amazon’s central processing units (CPUs) to support agentic AI, a technology that enables autonomous task completion.

Information Technology

Best performer: Western Digital +5.20%

Worst performer: Motorola Solutions -3.74%

Materials and Mining

Best performer: DuPont de Nemours +1.58%

Worst performer: FMC -6.46%

European Stock Indices

CAC 40 -0.14%

DAX +0.73%

FTSE 100 -0.16%

Corporate Earnings Reports

Posted on Monday, 3rd November

Coterra Energy quarterly revenue +33.7% to $1.817 bn vs $1.817 bn estimate.

EPS at $0.41 vs $0.42 estimate.

Tom Jorden, Chairman, CEO and President, said, “We are pleased with our strong operational execution during the quarter and are on track to meet or exceed our annual targets. Our nine rig and three completion crew program in the Permian program continues to be highly capital efficient, cost effective, and is generating strong returns at today’s prevailing prices. We are also pleased with the competitive returns currently being generated in both the Marcellus and Anadarko Basin. The durability of our high-quality asset portfolio shines throughout various price cycles. The stellar returns across our diversified asset base are driven by the quality of the rock, our competitive drilling and completion costs, low cost structure and high margins. We remain focused on delivering a highly capital efficient program and maintaining a conservative reinvestment rate. Our balance sheet strength and limited long-term contracts provide maximum flexibility through commodity cycles.” — see report.

Palantir Technologies quarterly revenue +62.8% to $1.181 bn vs $1.181 bn estimate.

EPS at $0.21 vs $0.21 estimate.

Alex C. Karp, Co-Founder and CEO, said, “114% - our Rule of 40 score! These results make undeniable the transformational impact of using AIP to compound AI leverage. Year-over-year growth in our U.S. business surged to 77%, and year-over-year growth in U.S. commercial climbed to 121%. We are yet again announcing the highest sequential quarterly revenue growth guide in our company’s history, representing 61% year-over-year growth.” — see report.

Vertex Pharmaceuticals quarterly revenue +11.0% to $3.076 bn vs $3.076 bn estimate.

EPS at $4.80 vs $4.78 estimate.

Reshma Kewalramani, CEO and President, said, “Vertex delivered strong results across the board in the third quarter, extending our leadership in CF, continuing to build global momentum for CASGEVY, and advancing the launch of JOURNAVX in acute pain. We also delivered strong progress across the R&D pipeline, with completion of enrollment in the Phase 3 study of povetacicept in IgAN, initiation of the Phase 2/3 study of povetacicept in primary membranous nephropathy, as well as advancement of several programs in research and earlier-stage clinical development. For the remainder of 2025, we are focused on executing the ongoing launches, initiating the povetacicept BLA submission in IgAN for potential U.S. accelerated approval, advancing the pipeline, and preparing for new launches in additional disease areas.” — see report.

Commodities

Gold spot -0.02% to $4,001.15 an ounce

Silver spot -1.17% to $48.08 an ounce

West Texas Intermediate +0.23% to $61.02 a barrel

Brent crude -0.32% to $64.86 a barrel

Gold prices remained stable on Monday. Spot gold posted a marginal change, closing at $4,001.15 an ounce. Despite the metal's impressive +52.49% gain year-to-date, it has declined -8.67% since reaching a record high on 20th October.

In a significant policy shift, China ended a longstanding tax exemption for certain gold retailers on Saturday. This may curb the recent surge in gold purchases within the world's largest consumer market. Effective 1st November, the Ministry of Finance announced that the full exemption from the 13% value-added tax for gold acquired from the Shanghai Gold Exchange or the Shanghai Futures Exchange will be reduced to 6%. This revised exemption is scheduled to remain in effect until 31st December, 2027. VAT exemptions on standard gold trading through these exchanges will continue under the new regulations.

Oil prices remained stable on Monday as the market weighed the OPEC+ supply increase against the group’s intention to halt further output hikes in the first quarter of 2026. These developments, combined with concerns over a potential supply surplus and weak manufacturing data in Asia, contributed to a cautious market sentiment.

Brent crude futures closed down 21 cents, or -0.32%, to $64.86 per barrel, while US WTI crude rose by 14 cents, or +0.23%, to $61.02 per barrel.

On Sunday, OPEC+ reached an agreement to raise production by a modest 137,000 barrels per day in December, while also committing to suspend additional increases during the first quarter of next year. The International Energy Agency has forecast a global oil surplus of up to 4 million barrels per day for the coming year, whereas OPEC anticipates a more balanced supply and demand outlook.

At the ADIPEC energy conference in Abu Dhabi, European oil executives urged caution against overly pessimistic views regarding future oil supply, according to Reuters. Claudio Descalzi, CEO of Eni, stated, “I do not believe we will face excess supply in 2026,” emphasising that investment in production has been insufficient over the past 12 years to meet rising demand. He further noted that demand continues to grow, but supply and investment have not kept pace.

Patrick Pouyanne, CEO of TotalEnergies, highlighted steady annual oil demand growth of approximately 1%. While China’s growth rate has slowed significantly compared to five years ago, India is emerging as a key driver of demand. Pouyanne remarked, “OPEC is unwinding part of its capacity, which could result in lower prices, reduced investment, less spare capacity, and eventually a rebound in prices.”

BP CEO Murray Auchincloss observed that oil supply growth outside OPEC+ could begin to taper off by April. He suggested that price movements — which have seen a decline of roughly 13% this year — will be influenced by OPEC+ production decisions, Chinese stockpiling, and trade sanctions. Auchincloss added, “There has been a supply increase outside of OPEC+, but we expect that trend to conclude between February and April, followed by stable or declining production levels.” He also emphasised the necessity for industry expansion in regions such as Abu Dhabi, Iraq, and Libya to accommodate ongoing demand growth.

Note: As of 5 pm EDT 3 November 2025

Currencies

EUR -0.09% to $1.1519

GBP -0.08% to $1.3140

Bitcoin -2.42% to $106,865.88

Ethereum -6.73% to $3,600.68

The US dollar advanced to a three-month high against the euro on Monday, building on last week’s momentum amid uncertainty surrounding the likelihood of another Fed rate cut this year. Divergent perspectives among Fed officials continued to shape market sentiment, with debate expected to intensify as the next FOMC policy meeting approaches.

Appearing on Bloomberg Surveillance, Fed Governor Stephen Miran reiterated his support for substantial interest rate reductions, a stance he has consistently advocated since joining the Board of Governors in September. Conversely, Chicago Fed President Austan Goolsbee expressed caution in an interview with Yahoo Finance. He seemed reluctant to implement further rate cuts while inflation remains notably above the Fed’s 2% target and is projected to accelerate through the remainder of 2025.

The euro declined to $1.1505 against the dollar—its weakest level since August 1—before trimming losses to end the day -0.09% lower at $1.1519. This followed data revealing that US manufacturing contracted for the eighth consecutive month in October, as subdued new orders and extended supplier delivery times persisted amid ongoing tariffs on imported goods.

Sterling weakened as expectations for another BoE rate cut increased following last month’s softer-than-anticipated inflation data. On Monday, the pound traded -0.08% lower at $1.3140. The BoE is meeting on Thursday, and while some analysts foresee a potential 25 bps rate cut, current market pricing reflects only a one-in-three probability of such action.

The dollar rose +0.14% to ¥154.21, hovering near an eight-and-a-half-month low for the yen, pressured by pronounced interest rate differentials. Despite BoJ Governor Kazuo Ueda signalling last week the possibility of a rate hike as early as December, markets have remained cautious toward the central bank’s measured approach, particularly in light of the Fed’s more assertive policy stance.

This dynamic has further weighed on the yen, prompting verbal interventions from Japanese authorities to curb the currency’s depreciation. The yen is nearing levels at which official intervention occurred in 2022 and 2024 to bolster the currency.

Fixed Income

US 10-year Treasury +3.4 basis points to 4.113%

German 10-year bund +3.5 basis points to 2.669%

UK 10-year gilt +3.4 basis point to 4.442%

US Treasury yields advanced on Monday, driven by substantial corporate debt issuance and a continuation of last week’s bearish sentiment following Fed Chair Jerome Powell tempered expectations for further monetary easing this year.

The US government shutdown, which began on 1st October, could potentially set a new record for duration this week. This disruption threatens the release of important economic data at a time when policymakers and investors are seeking clarity on inflation trends and the weakening labour market.

In its quarterly borrowing estimates, the US Treasury Department indicated an expectation to borrow $569 billion in Q4, marking a $21 billion reduction from its July projection. Details on quarterly refunding will be announced on Wednesday and may provide some insight on the government’s broader deficit financing strategies.

Supply dynamics have not been limited to government issuance, as technology firms have been actively issuing large volumes of corporate bonds. These may compete with government securities for investor capital. Last week, Meta Platforms entered the market with its largest bond offering to date at $30 billion, while Alphabet launched a multi-tranche of senior unsecured notes in US and European markets expected to total approximately $25 billion, according to IFR News.

Robust corporate bond issuance can exert pressure on Treasury markets, either by attracting investor demand away from government bonds or by prompting companies to hedge their borrowing costs through Treasury short positions prior to finalising their deals.

On Monday, the yield on the US 10-year Treasury rose +3.4 bps to 4.113%, while the two-year yield increased +3.5 bps to 3.617%. Further along the curve, the 30-year yield climbed +4.0 bps to 4.695%. The spread between two-year and 10-year Treasury yields stood at 49.6 bps.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 67.3% probability of a 25 bps rate cut at December FOMC meeting, lower than last week’s 94.4%. Traders are currently expecting 16.8 bps of cuts by year-end, lower than the 23.6 bps anticipated last week.

Eurozone government bond yields experienced modest increases on Monday. Germany’s benchmark 10-year yield rose +3.5 bps, reaching 2.669% — its highest level since 10th October. The two-year yield climbed +3.0 bps to 2.002%. At the longer end, the 30-year German yield advanced +4.1 bps to settle at 3.253%.

In the money markets, the probability of a 25 bps rate cut by the ECB by September of next year was priced at approximately 50%, a decrease from more than 80% in mid-October.

Fiscal policy developments in France once again drew attention following a critical parliamentary vote on Friday. Amidst tense deliberations over the austerity-oriented budget proposed by Prime Minister Sebastien Lecornu’s government, lawmakers voted to reject amendments put forward by a coalition of left-wing opposition parties. This decision places even greater pressure on the government's strategy of relying primarily on deep spending cuts to stabilise the nation's public finances.

The yield spread between10-year German Bunds and 10-year French government bonds narrowed by 0.9 bps on Friday, standing at 77.9 bps. This compares to an early October peak of 87.96 bps—the widest margin since January — primarily driven by investor unease over France’s fiscal path.

In Italy, the 10-year government bond yield increased +1.7 bps to 3.380%, leaving the spread between Italian 10-year BTPs and 10-year Bunds at 71.1 bps.

Note: As of 5 pm EDT 3 November 2025

Global Macro Updates

US manufacturing faces eighth straight month of decline. October’s ISM Manufacturing Index registered a reading of 48.7, falling short of both the consensus estimate of 49.6 and September’s figure of 49.1. This marks the eighth consecutive month of contraction for the index. The New Orders Index increased slightly to 49.4 from 48.9; however, it remained in contraction territory for the second straight month. Similarly, the Employment Index rose to 46.0 from 45.3, though it, too, continued to contract.

The Prices Index declined to 58.0 from 61.9, and the Production Index decreased to 48.2 from 51.0. The Backlog of Orders Index showed improvement, rising to 47.9 from 46.2. Participants’ commentary reflected ongoing caution, citing persistent challenges related to trade tensions, fluctuating tariffs, and a general climate of uncertainty.

Early analyst responses to the report highlighted the sequential improvements in new orders and employment, yet underscored the difficult macroeconomic environment facing the broader manufacturing sector outside of data centres. In a related development, the final October PMI Manufacturing Index reached 52.5, up from 52.0 in September. Employment growth remained modest, with hiring activity tempered by uncertainty. Tariffs continued to be a significant driver of higher input costs.

Greece and Spain outperform in mixed eurozone manufacturing. Eurozone manufacturing activity remained stagnant in October, as the final HCOB Manufacturing PMI registered precisely 50.0, matching the flash estimate and representing a slight increase from September’s 49.8. Although production expanded for the eighth consecutive month, the rate of growth was subdued. New orders showed no improvement after experiencing nearly three and a half years of continuous decline. Export orders fell for the fourth consecutive month, further weighing on overall demand. The pace of employment reductions accelerated, extending the period of manufacturing job losses to almost two and a half years, with HCOB indicating that job cuts persisted and even intensified due to weak demand. Performance across the eurozone varied significantly, with Greece (53.5) and Spain (52.1) posting the most notable improvements, while Germany (49.6) and France (48.8) continued to contract. Input costs remained stable, whereas output prices edged higher for the first time since April. Business confidence declined for the second consecutive month, falling below long-term averages amid ongoing economic uncertainty.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。