How long will the trade truce last?

Markets in October

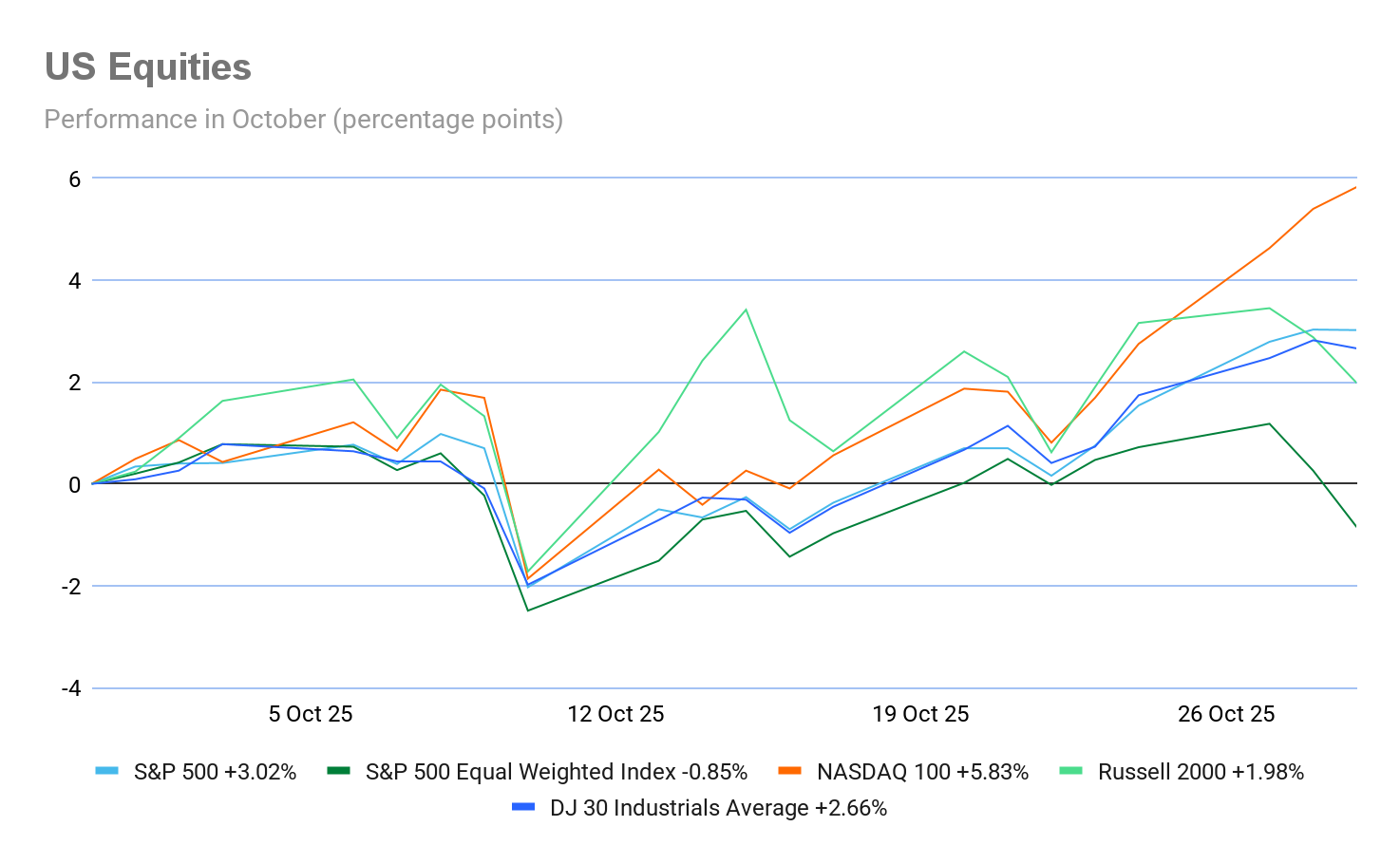

Major US indices have shown positive month-to-date (MTD) performance: S&P 500 +3.02%, Nasdaq 100 +5.38%, Dow Jones +2.66%, and Russell 2000 +1.98%.

Beyond the basic names: broad-based positive AI sentiment in earnings. The positive momentum surrounding generative AI (GenAI) was evident across a range of Q3 earnings. SK Hynix reported record operating earnings, attributing this performance to soaring AI memory demand and noting that it has secured orders across all NAND and DRAM products through 2026. Teradyne indicated that Q3 growth was primarily driven by system-on-chip (SOC) solutions for AI applications and robust memory segment results, with continued strong AI-related test demand expected into Q4. TE Connectivity reported AI-related sales exceeding $900 million in 2025 — a 3x increase from 2024 — and highlighted strong momentum extending into 2026, including 80% y/o/y growth in its AI data centre business. Bloom Energy referenced rising electricity demand spurred by AI infrastructure expansion. Caterpillar underscored robust demand for its power generation equipment, driven by data centre growth linked to cloud computing and GenAI adoption.

Need a boost? Announce a deal with OpenAI. OpenAI deal announcements continued to be a tailwind in October. On Tuesday, PayPal announced it will become the first payments wallet integrated into ChatGPT. Earlier in the month, Walmart shares rose following news of a partnership with OpenAI, enabling customers to make purchases directly through ChatGPT’s ‘Instant Checkout’ feature. Thermo Fisher Scientific outperformed the broader market by approximately 230 bps on 16th October after revealing a collaboration with OpenAI aimed at accelerating and improving drug development. SK Hynix and Samsung experienced early-month rallies after joining OpenAI’s Stargate initiative; AMD shares are +63.4% MTD, propelled by a 6-gigawatt agreement to support OpenAI’s next-generation AI infrastructure using multiple generations of AMD Instinct GPUs.

Merger Monday is back. The recent uptick in M&A activity has become an essential element of the bullish narrative for equities. On Tuesday, Skyworks announced a major transaction — an approximately $9.8 billion cash and stock agreement to acquire Qorvo. This consolidation of two prominent Apple suppliers comes on the heels of over $80 billion in deals announced just the day before. ‘Merger Monday’ was highlighted by a move by American Water Works Company and Essential Utilities’ to form a utilities entity with an enterprise value of $63 billion. Additionally, the regional banking sector consolidated further as Huntington Bancshares agreed to acquire Cadence Bank in an all-stock deal valued at $7.4 billion. In the biopharmaceutical space, Novartis is acquiring Avidity Bioscience in a transaction with an enterprise value of $11 billion.

According to the Financial Times, M&A activity surpassed $1 trillion in Q3. More than fifty transactions exceeding $10 billion have been announced this year, setting 2025 on course to be a record year for megadeals. This surge in deal-making is largely attributed to a more accommodating regulatory environment, renewed Fed easing, and reduced uncertainty regarding trade policy.

US - China trade relations: from escalation to détente. Trade policy emerged as a significant source of market volatility in October. Early in the month, President Trump threatened to impose additional massive tariffs on Chinese goods effective 1st November in response to China's proposed restrictions on rare earth mineral exports.

This escalation sent markets tumbling on 10th October, with the S&P 500 plunging -2.71% in its worst day since April. However, sentiment shifted dramatically by late October as US and Chinese negotiators met in Malaysia to establish a framework for a trade agreement. Treasury Secretary Scott Bessent expressed optimism following weekend talks, stating he expected China to delay rare earth export restrictions for a year and resume purchases of US soybeans. Despite the positive tone, analysts cautioned that the agreement represented more of a ‘tactical pause than a strategic breakthrough,’ with longer-term economic tensions between the geopolitical rivals likely to persist. On 30th October the US and China announced that they have agreed to postpone export controls on rare earths and chips as part of a broader one-year trade deal. The US will cut fentanyl-related tariffs on Chinese goods to 10% from 20%, while China resumes purchases of soybeans, sorghum and other farm products. Talks are expected to continue in April when the US president said he would visit China and that Xi would make a reciprocal visit to the US.

AI hyperscalers’ CapEx update. AI hyperscalers posted strong Q3 earnings, with most beating analyst estimates due to booming demand for AI and cloud services. However, the good news came with a shared warning: all three are planning for massive increases in CapEx to fund the relentless AI arms race.

Microsoft posted impressive revenue of $77.67 billion, driven by a 40% surge in its Intelligent Cloud division. Alphabet also surpassed expectations, with revenue climbing to $102.3 billion, supported by strong ad sales and a 34% expansion in its cloud business. Both firms highlighted traction in AI, with Microsoft noting Copilot's revenue potential and Alphabet's Gemini app reaching 650 million users.

Meta Platforms also exceeded revenue forecasts, reporting $51.2 billion, a 26% y/o/y increase. Its net income, however, missed estimates, primarily due to a significant $15.9 billion one-time tax charge. Meta’s report signalled a clear strategy of increased spending to remain competitive in AI, a move that made some investors nervous.

Looking ahead, all three companies are gearing up for major investment cycles. Alphabet, Microsoft, and Meta all indicated that 2026 CapEx will rise substantially relative to 2025 to build out AI infrastructure. This aggressive spending highlights key operational risks, as Microsoft faces significant Azure capacity constraints through at least fiscal year 2026, and Meta continues to navigate regulatory uncertainty.

The economic picture

USA. US economic data was limited in October following the government’s shutdown on 1 October. The FOMC’s October meeting resulted in a widely anticipated 25 bps rate cut with the suggestion that QT will end on 1 December.

On the consumer side, confidence weakened. The Consumer Confidence Index dropped by 1.0 point in October to 94.6 from an upwardly revised 95.6 in September. The Present Situation Index—based on consumers’ assessment of current business and labour market conditions—gained 1.8 points to 129.3. The Expectations Index—based on consumers’ short-term outlook for income, business, and labour market conditions—declined by 2.9 points to 71.5. The UoM’s final October consumer sentiment was largely unchanged, posting a reading of 53.6 versus consensus expectations of 55.0 and September’s final 55.1. Month-over-month inflation expectations remained stable, with October’s one-year expectation finalised at 4.6% (matching the preliminary reading and slightly below September’s 4.7%). Five-year inflation expectations for October were finalised at 3.9%, compared to the preliminary 3.7% and September’s 3.7%. The report notes that consumers continue to express concern about inflation, although only 2% spontaneously referenced the government shutdown as a source of concern during interviews.

Business activity was up in October. The October Flash S&P PMI composite reading reached 54.8, up from September’s 53.9. The Flash PMI Manufacturing came in at 52.2, closely aligning with consensus estimates of 52.3 and slightly above September’s 52.0. The Flash PMI Services came in at 55.2, surpassing both consensus and September’s figure of 54.2. Overall employment growth remains subdued, while business confidence deteriorated further amid ongoing tariff concerns. Prices charged increased at the slowest rate since April.

Consumer prices increased slightly less than expected in September. The core Consumer Price Index (CPI), released with a delay, rose by 0.2% m/o/m, undershooting both consensus expectations of a 0.3% increase and August’s 0.3% gain. Headline CPI advanced 0.3% m/o/m, also coming in below consensus of 0.4% and August’s 0.4% rise. On an annualised basis, both core and headline CPI were 3.0%, slightly cooler than the consensus forecast of 3.1%. The gasoline index surged 4.1% in September, serving as the primary contributor to the overall CPI increase. Both core goods and core services posted a 0.2% monthly increase, marking a slowdown from August’s 0.3% pace.

The federal government shutdown since 1 October could cost the US economy between $7 billion and $14 billion, according to a new report from the nonpartisan Congressional Budget Office (CBO). In the CBO's assessment, ‘the shutdown will delay federal spending and have a negative effect on the economy that will mostly, but not entirely, reverse once the shutdown ends’. It estimates that real GDP, which has been adjusted to remove the effects of inflation, will be lower in Q4 than it would have been without the shutdown. Depending on its length, the government shutdown will reduce annualised real GDP growth in Q4 by 1.0 to 2.0 percentage points. The agency expects that after the shutdown, real GDP will be temporarily higher and that most of the decline in real GDP will be eventually recovered. However, the CBO estimates that between $7 billion and $14 billion (in 2025 dollars) will not be.

EU. The ECB, as widely expected, kept rates on hold today at 2%. As noted by Bloomberg news, this rate is expected to remain at that level through 2027 unless December’s updated outlook reveals a significant undershoot in inflation.

Eurozone headline inflation in September rose above the ECB’s 2.0% target for the first time since April, registering 2.2% y/o/y, consistent with consensus and up from August’s 2.0%. Core inflation surprised slightly on the upside at 2.4%, above both consensus and the previous reading of 2.3%. Services prices also increased, reaching 3.2%. These figures reinforce the ECB’s decision to hold rates steady at the next policy meeting on 30th October.

The European Commission's consumer confidence index increased for the second month in a row, by 0.7 percentage points (pps) in the euro area. Consumer confidence moved closer to its long term average, coming in at -14.2 points.

Eurozone business activity growth accelerated in October, suggesting improved economic growth momentum at the start of the fourth quarter. The HCOB Flash Composite PMI rose to a 17-month high in October, signalling sustained growth in the eurozone at 52.2, up from September’s 51.2. The HCOB Flash Services PMI was 52.6, up from September's 51.3 and a 14-month high. The HCOB Flash Manufacturing PMI edged up to 50 from September’s 49.8, a 2-month high.

However, there are still signs of overall weakness in the euro area despite the German government raising its 2025 GDP forecast to 0.2% and its 2026 forecast to 1.3%. According to the German Federal Statistics Office, Germany’s GDP was unchanged in the 3rd quarter of 2025 compared with the 2nd quarter of 2025. This was despite signs that Germany’s business sentiment may be improving. The German Ifo Business Climate Survey for October rose to 88.4, up from September’s 87.7. This improvement was primarily driven by a significantly better Expectations Index, which rose to 91.6 and outperformed the 89.1 consensus. However, the Current Conditions Index remained soft, declining slightly to 85.3 from the previous 85.7 and falling just short of the 85.5 forecast. The Ifo Institute noted that companies remain hopeful about an economic upturn next year. The Manufacturing index rose as the decline in new orders stopped. The Services sector posted a significant increase. Trade sentiment also improved marginally, while the Construction sector recorded a slight decline.

France grew by 0.5% — the fastest pace since 2023 thanks to trade and domestic demand. However, Prime Minister Sebastien Lecornu is struggling with the budget and may yet be ousted by a split parliament. Bank of France Governor François Villeroy de Galhau has warned of a “gradual suffocation” from the country’s incapacity to deal with rising debt.

UK. The UK’s economy continued its trend of relatively slow growth in October 2025, with the Office for National Statistics figures suggesting that GDP grew by 0.3% in June to August 2025 compared with the previous three months. However, there was some positive business momentum in October. The S&P Flash UK PMI Composite Output Index rose to 51.1 in October from September’s 50.1, a 2-month high. The Flash Services PMI also rose to 51.1 from September’s 50.8. The Flash UK Manufacturing PMI, although still in contractionary territory, did rise from September’s 46.2 to 49.6, a 12-month high. As noted by Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, “October’s flash UK PMI survey brings hope that September was a low point for the economy from which business conditions are starting to improve.” However, he also stated that the overall pace of growth signalled by the PMI remains consistent with only sluggish GDP growth of around 0.1%. He stressed that job cuts are continuing, business confidence remains subdued, and Goods exports also continue to fall at a worryingly steep rate, in part due to the global trade disruptions caused by US tariff policy. Companies remained worried in the run up to the 26 November budget.

Government borrowing was £7.2 billion more than forecast in the first six months of the fiscal year, with the budget deficit climbing to £99.8 billion. The budget deficit climbed to £99.8 billion, overshooting the £92.6 billion forecast by the Office for Budget Responsibility in March. As noted by Bloomberg news, the government has paid £59.5 billion servicing the debt this year so far, an increase of £14.4 billion on the same period in 2024. According to Bloomberg Economics, higher borrowing costs, U-turns over welfare cuts and a predicted productivity downgrade by the Office for Budget Responsibility (OBR) means that the Chancellor of the Exchequer, Rachel Reeves, will need to find as much as £35 billion just to restore the £9.9 billion buffer she left against her binding fiscal rule when she reveals the budget on 26 November.

Retail sales in the UK improved in September, growing for a fourth straight month, with the volume of goods sold online and in stores climbing 0.5% month-on-month, slightly above consensus expectations. The ONS said volumes hit their highest level since July 2022 with non-food sales climbing 0.9%. The GfK consumer confidence index rose two points to -17 in October. Four measures were up and one was down from last month’s announcement. Buying sentiment was up, with a four-point rise in the Major Purchase Index. The Personal Financial Situation increased two points to -5 from -7. In addition, the measure for the general economic situation of the country during the last 12 months was up three points to -42; the same level as in October 2024. Expectations for the general economic situation over the next 12 months increased two points to -30.

Inflation in the UK remains well above BoE target, coming in at 3.8% y/o/y, unchanged from August. However, it was below the 4% economists and the BoE were expecting. Core inflation came in at 3.9% in the 12 months to September 2025, down from 4.0% in the 12 months to August. Services inflation, watched closely by the BoE as a sign of domestic price pressures, was unchanged at 4.7%.

Global market indices

USA:

S&P 500 +3.02% MTD and +17.15% YTD

Nasdaq 100 +5.83% MTD and +24.31% YTD

Dow Jones Industrial Average +2.66% MTD and +11.96% YTD

NYSE Composite -0.18% MTD and +12.72% YTD

Source: FactSet

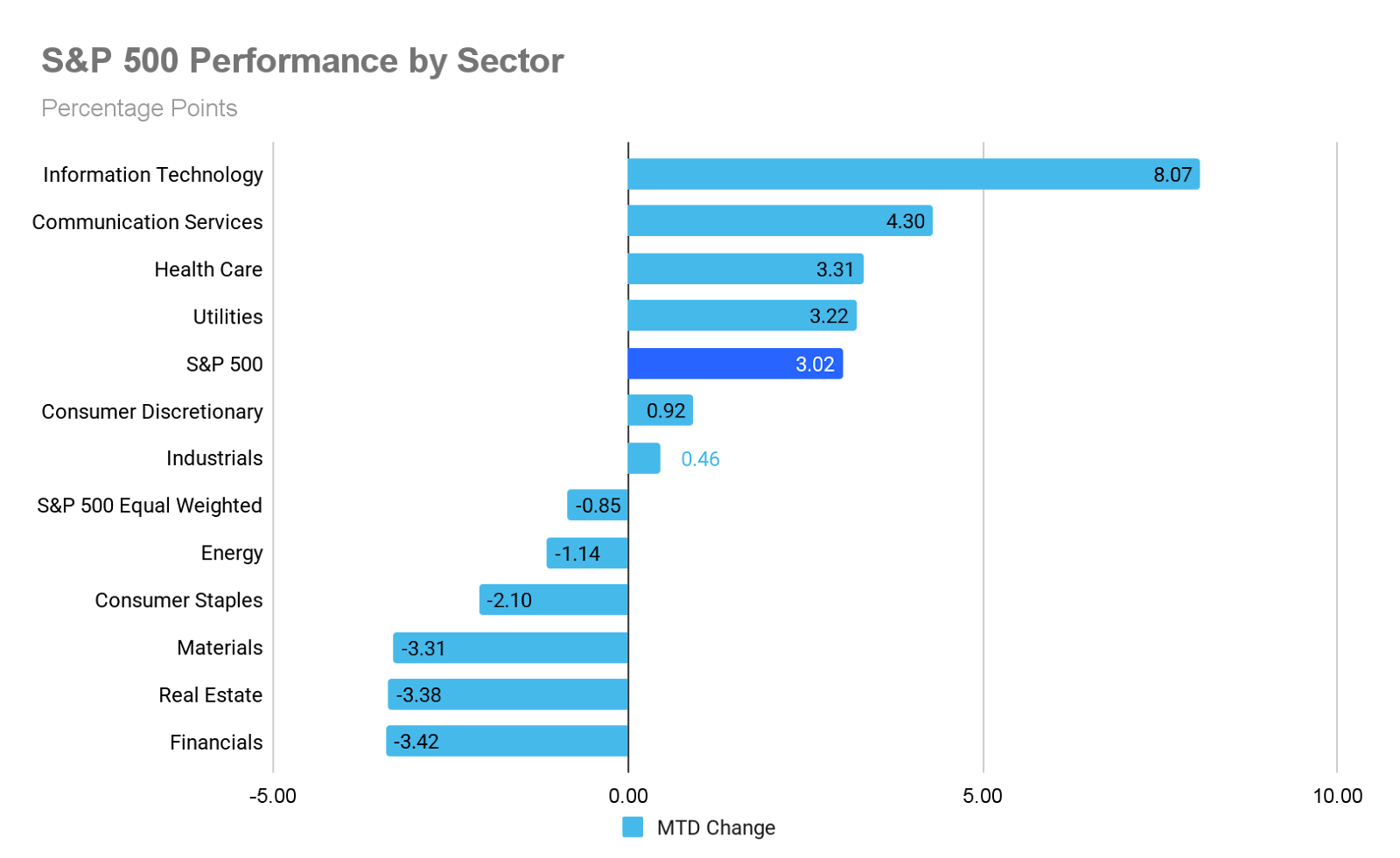

The Equally Weighted version of the S&P 500 is -0.85% MTD for October, 3.87 percentage points lower than the benchmark.

The S&P 500 Information Technology sector is the top performer in October at +8.07% MTD, while Financials underperformed at -3.42% MTD.

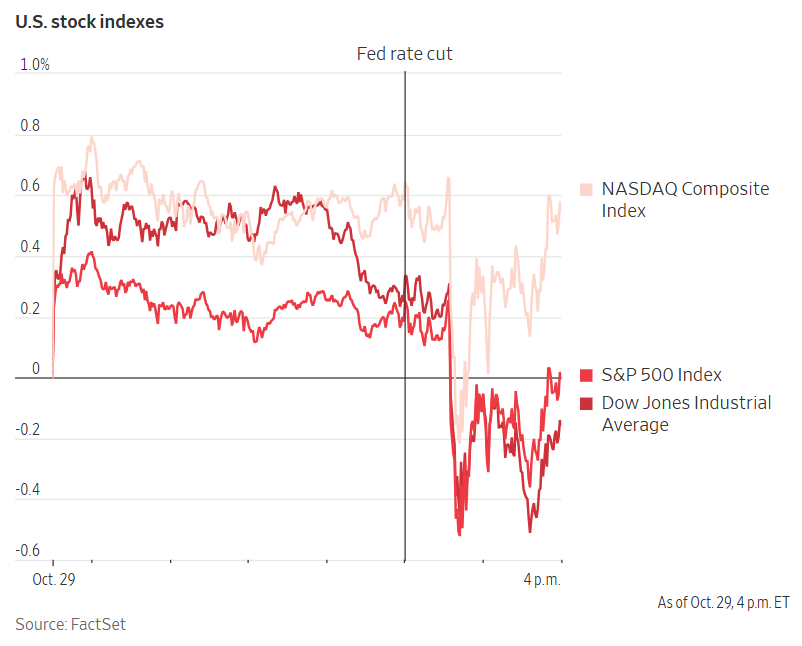

On Wednesday, all three major US stock market indices were positioned to achieve new record highs following the FOMC anticipated quarter-point interest rate cut. Then, Fed Chair Jerome Powell took the mic. He stated that “A further reduction in the policy rate at the December meeting is not a foregone conclusion—far from it. Policy is not on a preset course.”

Stocks subsequently declined, though they later recouped some losses and ended the trading session with mixed results. The Dow Jones Industrial Average decreased by -0.16%, or 74.37 points, while the S&P 500 closed unchanged. The Nasdaq Composite, buoyed by prominent technology companies benefiting from the AI boom, advanced +0.55%.

In corporate news, Paramount Skydance initiated a scheduled round of workforce reductions, impacting 1,000 employees as part of efforts to reduce costs by $2 billion following its August merger with Skydance Media. Additional layoffs are expected.

Uber Technologies announced plans to introduce driverless rides next year in the San Francisco Bay Area utilising vehicles developed by Lucid Group and Nuro, thereby entering direct competition with Waymo’s robotaxi service.

Thermo Fisher Scientific reached an agreement to acquire Clario Holdings—a privately held provider of drug trial software—for approximately $8.9 billion in cash.

Etsy appointed Chief Growth Officer Kruti Patel Goyal as CEO, tasking her with guiding the company through the artificial intelligence era and steering the marketplace beyond its post-pandemic slowdown.

Caterpillar reported Q3 earnings and revenue that surpassed expectations, driven by robust demand for its power-generation equipment from AI data centres.

Southern California Edison on Wednesday launched a voluntary wildfire compensation programme for residents and businesses affected by the devastating Eaton fire in January. The initiative offers compensation ranging from hundreds of thousands to millions of dollars, contingent upon participants waiving their right to pursue legal action, according to the company.

Europe:

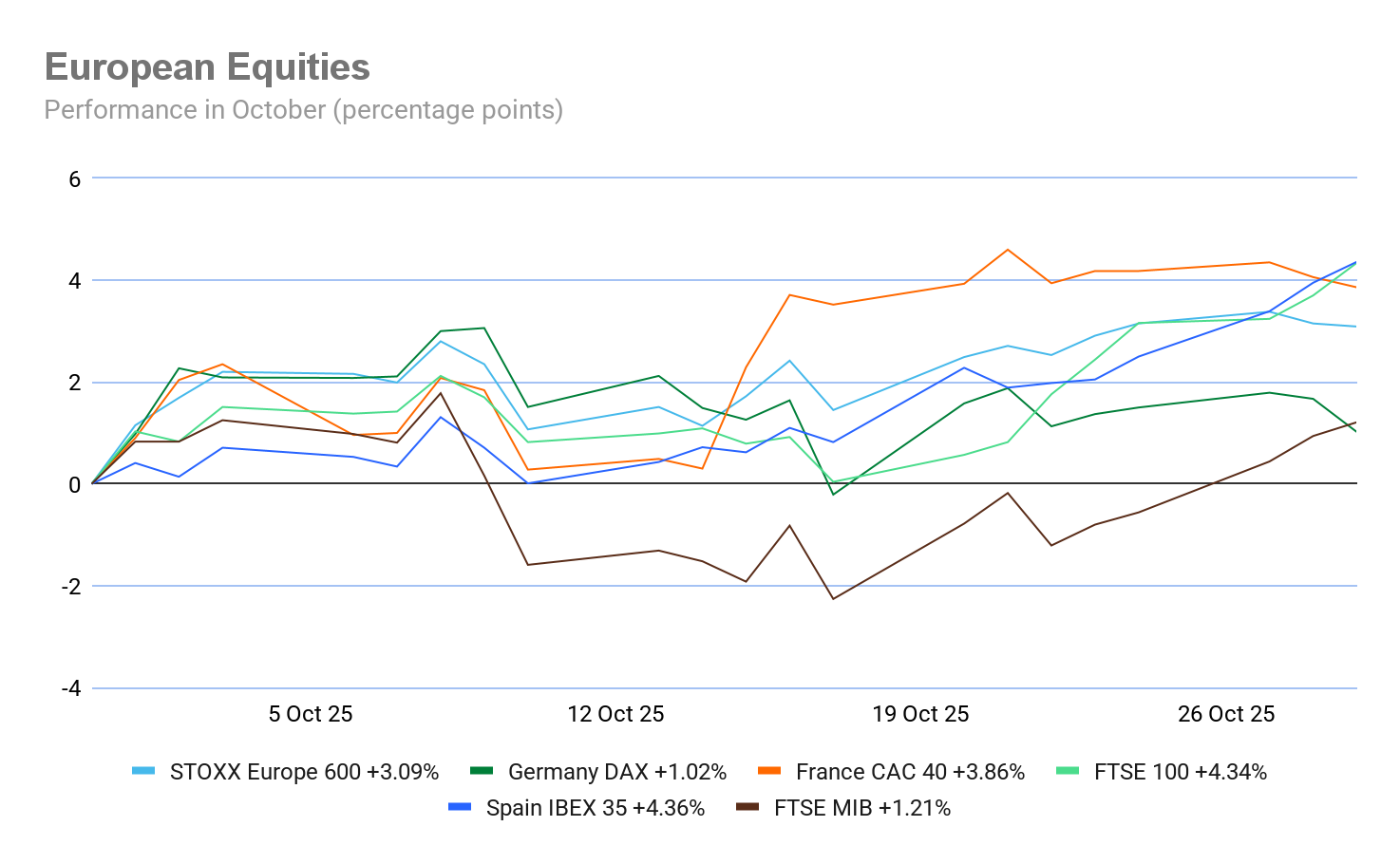

Stoxx 600 +3.09% MTD and +13.35% YTD

DAX +1.02% MTD and +21.17% YTD

CAC 40 +3.86% MTD and +11.11% YTD

FTSE 100 +4.34% MTD and +19.37% YTD

IBEX 35 +4.36% MTD and +39.29% YTD

FTSE MIB +1.21% MTD and +26.49% YTD

Source: FactSet

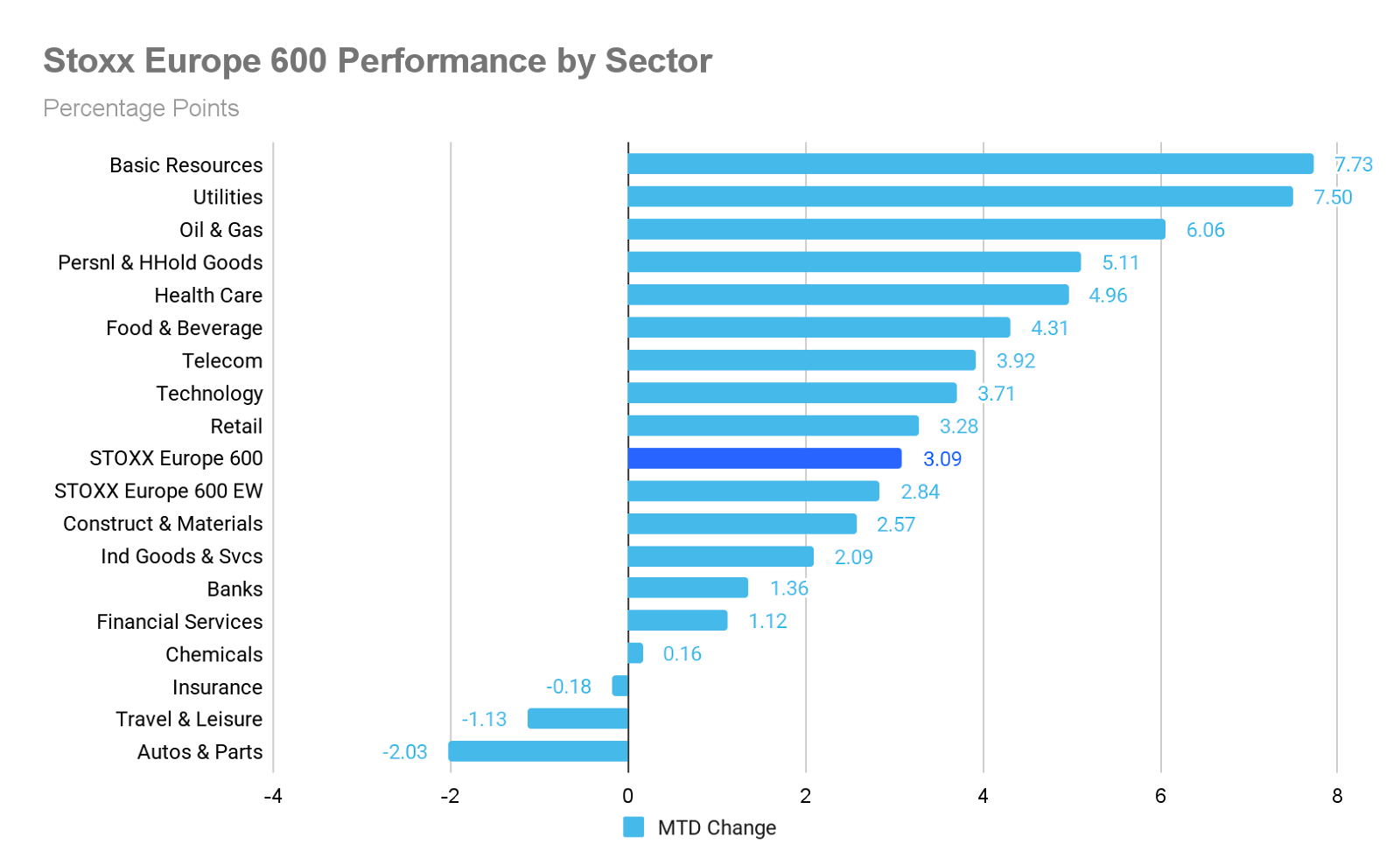

In Europe, the Equally Weighted version of the Stoxx 600 is +2.84% MTD, 0.29 percentage points lower than the benchmark.

The Stoxx 600 Basic Resources is the leading sector, +7.73% MTD, while Autos & Parts exhibited the weakest performance at -2.03% MTD.

On Wednesday, within the STOXX Europe 600 sectors, the Autos & Parts sector led gains among European industries, primarily driven by Mercedes-Benz Group following its Q3 earnings per share of €1.22, which exceeded the consensus estimate of €1.20. The company also reported robust margins and announced a €2 billion share buyback. In contrast, Aston Martin Lagonda Global underperformed due to broader-than-expected losses, though it reaffirmed its full-year guidance. Stellantis advanced after announcing a new collaboration in the robotaxi space.

Basic Resources outperformed as base metal prices rallied, with copper reaching a record high amid supply concerns. Glencore shares rose on the back of a 36% q/o/q increase in Q3 copper output, higher coal production guidance, and marketing EBIT projected in a range of $2.3 - $3.5 billion. The Oil & Gas sector also traded higher, led by OMV, which reported Q3 clean CCS net income of €594 million versus a consensus of €471 million, supported by strong operational performance and a positive outlook for hydrocarbons.

Banks advanced as Banco Santander, UBS Group, and Deutsche Bank all surpassed expectations on the back of higher revenues. Retail advanced too, with Next rising after Q3 sales increased by 10.5% y/o/y and the company raising its full-year profit forecast; however, Adidas traded lower due to weak performance in North America.

Conversely, Telecommunications declined amid defensive outflows and disappointing results from Telenor, which missed Q3 income projections and reduced its fiscal year 2025 growth target. Travel & Leisure underperformed as Ferrovial’s Q3 EBITDA came in ~3% below consensus, with analysts expecting ongoing margin volatility. Food, Beverage & Tobacco, and Personal & Household Goods, also declined amid a general shift toward risk-on sentiment.

Global:

MSCI World Index +2.74% MTD and +19.34% YTD

Hang Seng -1.90% MTD and +31.34% YTD

Mega cap stocks had a positive performance in October. Alphabet +12.95%, Nvidia +10.97%, Apple +5.92%, Amazon +4.89%, Microsoft +4.56%, Tesla +3.78%, and Meta Platforms +2.35%.

Alphabet Q3 earnings. Alphabet, Google’s parent company, reported a 16% y/o/y increase in Q3 revenue, driven by notable growth in its digital advertising and cloud computing segments. This expansion has enabled substantial investment in AI initiatives. The company’s sales reached a record $102.3 billion, exceeding analyst expectations, while net income rose to $35 billion—a 33% increase compared to the same period last year.

Within Google Services, revenue totaled $87.05 billion, surpassing the FactSet consensus of $84.81 billion. This included Google Search and Other revenues of $56.57 billion, outperforming estimates of $55.10 billion, and YouTube advertising revenue of $10.26 billion, ahead of the $10.01 billion forecast. Alphabet also revised its CapEx projections for the year, now expecting between $91 and $93 billion, a significant increase from the $52.5 billion expended in 2024.

Google’s cloud division continued its rapid expansion amid heightened competition in AI development, generating $15.2 billion in Q3—a 34% increase over the prior year and above the consensus estimate of $14.7 billion. The company also highlighted the success of its Gemini application, which now boasts over 650 million monthly users, with query volume tripling since Q2.

The operating margin, excluding a €2.95 billion European Commission fine charge, stood at 33.9%, surpassing the FactSet estimate of 32.2%. FCF reached $24.5 billion, well above the expected $17.5 billion.

Looking ahead to 2026, Alphabet indicated capital expenditures will rise substantially, with more details forthcoming in its Q4 2025 earnings report.

The Q&A session emphasised YouTube’s dual monetisation strategy—combining advertising and subscriptions—which continues to deliver strong growth, with premium subscribers providing higher gross profit margins than ad-supported users. The company’s investment in custom silicon (TPUs/GPUs) is fueling robust demand for its AI infrastructure, and its comprehensive AI approach is helping to differentiate its cloud offerings and expand profit margins.

Alphabet acknowledged that sustaining infrastructure investments presents a key risk, particularly in managing pressures from rising capital expenditures, increased depreciation, and the tight supply-demand balance for AI hardware capacity.

Meta Platforms Q3 earnings. Meta Platforms announced its intention to significantly increase spending to remain a leader in the competitive AI landscape, a strategy that has investors sweating. The company reported revenue of $51.2 billion for Q3, representing a 26% y/o/y increase. However, net income fell short of analyst expectations, totaling $2.7 billion. This shortfall was primarily attributed to an accounting adjustment related to anticipated future tax liabilities arising from the One Big Beautiful Bill Act, reflected in a one-time, non-cash tax charge of $15.9 billion, which substantially impacted net income.

Revenue generated from Meta’s Family of Apps reached $50.77 billion, surpassing FactSet’s estimate of $49.12 billion. The company’s operating margin (GAAP) was 40.1%, exceeding the consensus of 39.4%. Meta also reported Q3 EPS of $7.25 excluding certain items, ahead of the forecast of $6.72.

During its earnings call, Meta provided near-term guidance, projecting total revenue of $56 billion to $59 billion for Q4 2025 and CapEx of $70 billion to $72 billion for FY 2025.

Looking forward to 2026, the company indicated that CapEx will grow substantially compared to 2025, with total expenses expected to increase at a significantly faster rate. The primary drivers of this expense growth are infrastructure investments and costs associated with AI talent, as Meta plans to invest heavily in both its internal infrastructure and third-party cloud services throughout 2026.

In the Q&A, Meta gave no margin guidance for upcoming AI products. Furthermore, the company sees considerable potential for expanded adoption of its Advantage+ automated advertising solutions, which have already demonstrated lower costs per lead. Additionally, Meta’s wearables business, including Ray-Ban Meta and Oakley products, shows promise; however, long-term profitability is contingent on successfully scaling hardware and integrating services and AI on a global level.

CEO Mark Zuckerberg stressed the need for proactive infrastructure investment, pushing for an upfront commitment of CapEx on computing and data centres. This strategy is intended to ensure the company is ready for the anticipated acceleration in AI development.

Meta also acknowledged regulatory uncertainty as a significant risk. The company faces substantial legal challenges in both the US and EU, which could have implications for future revenue and operational stability.

Microsoft Q3 earnings. Microsoft continues to experience exceptionally strong demand for its cloud computing and artificial intelligence services, a trend that is significantly driving the company's income growth.

For Q3, Microsoft reported revenue of $77.67 billion, exceeding FactSet’s consensus estimate of $75.38 billion. The Intelligent Cloud segment generated $30.90 billion in revenue, surpassing the forecast of $30.25 billion and representing a 40% y/o/y increase (39% in constant currency).

The company achieved an operating margin of 48.9%, ahead of the FactSet consensus of 46.5%. Net income reached $27.7 billion, with Q3 EPS of $4.13 compared to the estimate of $3.67.

Microsoft recorded a $3.1 billion charge associated with its investment in OpenAI. Some investors have expressed concerns about the company's reliance on cloud contracts with OpenAI, reflecting broader industry apprehension regarding concentration risk.

During its earnings call, Microsoft provided guidance for Q4, projecting total revenue between $79.5 and $80.6 billion. The Intelligent Cloud segment is expected to deliver revenue between $32.25 and $32.55 billion in Q4. Notably, Azure will remain capacity-constrained through at least the end of fiscal year 2026.

Looking ahead to 2026, Microsoft anticipates a higher rate of CapEx growth compared to 2025, primarily driven by increased demand for GPU and CPU resources. The company reiterated its intention to double its total data centre footprint over the next two years and to expand its AI capacity by more than 80% in FY 2026. Longer-term, Microsoft maintains exclusive intellectual property rights and API exclusivity for Azure with OpenAI until the advent of artificial general intelligence or through 2030.

In the Q&A session, Microsoft emphasised that its remaining performance obligations (RPO) are diversified across products and customers, with most contracts consumed within two years. Additionally, Copilot’s average revenue per user (ARPU) is viewed as expansive compared to legacy Microsoft 365 metrics.

The most significant risk identified in the earnings call pertains to ongoing capacity constraints; Azure continues to face supply limitations, raising concerns about the potential for unmet demand or the migration of workloads to competitors.

The pervasive adoption of AI is expected to create broad new revenue streams, as Copilot is integrated across various domains, extending beyond traditional software business models.

Energy stocks experienced a mixed performance so far in October, with the Energy sector -1.14% MTD. Energy Fuels +32.94%, Halliburton +11.71%, Shell +8.65%, ExxonMobil +3.28%, Marathon Petroleum +1.56%, and Phillips 66 +1.46%, while Chevron -0.12%, Baker Hughes Company -0.82%, ConocoPhillips -6.88%, Apa Corp -7.17%, and Occidental Petroleum -14.12%.

Phillips 66 Q3 earnings. Phillips 66 reported a decline in Q3 net profit, primarily due to the impact of one-off costs. On Wednesday, the downstream energy provider announced net income of $133 million, or EPS $0.32, compared to $346 million, or EPS $0.82, in the same period last year.

The Q3 results included pretax special item adjustments totaling $948 million within the refining segment and $226 million in the marketing and specialties segment, which weighed on overall earnings for the period.

Adjusted EBITDA stood at $2.59 billion, exceeding FactSet’s consensus estimate of $2.26 billion. Adjusted earnings—which exclude exceptional items and one-time costs such as the aforementioned special item adjustments—were EPS $2.52, surpassing analysts’ expectations of EPS $2.14.

Management highlighted that both the Refining and Midstream businesses achieved record year-to-date clean product yields and fractionation volumes, respectively. The recent acquisition of the remaining 50% interest in WRB Refining was described as a strategic move to simplify the company’s portfolio and enhance opportunities for margin capture, further reinforcing Phillips 66’s leading position in the Central Corridor.

For Q4, the company issued guidance indicating that Global Olefins & Polyolefins utilisation is expected to be in the mid-90% range, while Refining crude utilisation should fall within the low to mid-90% range. Wind-down costs at the Los Angeles refinery are anticipated to continue affecting results through Q4 2025. Jet fuel prices are projected to remain above diesel, and octane spreads are expected to be stronger in Q4 2025, serving as a potential tailwind. Additionally, a working capital benefit of approximately $1.5 billion in Q4 is expected to support debt reduction efforts.

During the Q&A session, management emphasised that full ownership of WRB enables integration with the Ponca City and Borger facilities, unlocking organic growth potential and operational flexibility. The Western Gateway Pipeline project, designed to serve underserved West Coast markets, is being developed as a 50/50 joint venture with Kinder Morgan.

The principal risk identified by the company relates to regulatory uncertainty, as Phillips 66 continues to navigate evolving federal and state policies affecting renewables, permitting for new pipelines, and increasing environmental compliance costs.

Materials and Mining stocks had a mostly negative performance in October. The Materials sector is -3.31% MTD. Albemarle +20.62%, Nucor Corporation +14.03%, Freeport-McMoRan +7.57%, and Yara International +1.59%, while Sibanye Stillwater -3.81%, Celanese Corporation -4.66%, Newmont Mining -5.50%, and Mosaic -17.39%.

Commodities

Gold prices moderated their earlier advances on Wednesday as investors processed remarks from Fed Chair Jerome Powell concerning the future direction of monetary policy, following the FOMC anticipated quarter-point interest rate reduction.

Spot gold declined -0.56% to $3,929.37 per ounce, retreating after an earlier increase of up to 2.0% during the session. Concurrently, the dollar index extended gains, rendering greenback-denominated gold less affordable for international purchasers.

Year-to-date, gold has appreciated by +49.76%, reaching an all-time high of $4,381.21 on 20th October. However, the metal has registered a -4.43% decline so far this week. Gold prices are +1.79% MTD.

Oil prices advanced on Wednesday, supported by data indicating that US crude and refined product inventories declined more than anticipated in the previous week. Brent crude futures increased by 34 cents, or +0.53%, settling at $64.80 per barrel, while US WTI crude futures rose by 34 cents, or +0.30%, closing at $60.36 per barrel.

Both Brent and WTI crude benchmarks recorded their largest weekly gains since June, following the imposition of Ukraine-related sanctions on Russia by President Trump in his second term, which targeted major oil companies including Lukoil and Rosneft.

Nonetheless, concerns remain regarding the effectiveness of these sanctions in counteracting oversupply, combined with speculation about a potential increase in production by OPEC+. These factors exerted downward pressure on prices, with both benchmarks declining by more than 1.9 percent in the prior session.

OPEC+ is reportedly considering a moderate output increase in December, estimated at approximately 137,000 barrels per day (bpd).

US WTI is -3.39% MTD and is -15.84% YTD. Brent crude is -3.37% MTD and -13.05% YTD.

EIA report. According to the latest EIA weekly report, US oil inventories decreased last week as crude imports reached their lowest levels since February 2021. Crude stocks declined by 6.86 million barrels, totaling 416 million barrels for the week ending 24th October. Imports of crude oil, excluding those to the Strategic Petroleum Reserve, fell by 867,000 bpd to 5.05 million bpd.

Crude imports to the US Gulf Coast—where approximately half of the nation's refining capacity is located—dropped to a record low, decreasing by 477,000 bpd to 597,000 bpd. Crude inventories at the Cushing, Oklahoma delivery hub increased by 1.33 million barrels.

Refinery crude throughput declined by 511,000 bpd, and utilisation rates decreased by two percentage points to 86.6%. Gasoline stocks fell by 5.94 million barrels, amounting to 210.7 million barrels for the week.

Distillate inventories, which encompass diesel and heating oil, were reduced by 3.36 million barrels to 112.2 million barrels. The EIA also reported that total product supplied—a measure indicative of demand—rose to 21.28 million bpd from 20.01 million bpd the previous week, with gasoline demand increasing to 8.92 million barrels bpd from 8.46 million bpd.

Currencies

The US dollar index is +1.37% so far in October and is -8.63% YTD. The GBP is -1.89% against the dollar in October and is +5.45% YTD. The EUR is -1.12% MTD against the USD and +12.06% YTD.

The US dollar strengthened Wednesday after the Fed’s rate cut, which was met with dissent from two policymakers. Fed Governor Stephen Miran reiterated his call for a more substantial reduction in borrowing costs, while Kansas City Fed President Jeffrey Schmid advocated against any reduction.

During the subsequent FOMC press conference, Fed Chair Jerome Powell remarked that Fed officials remain divided over the future direction of monetary policy. He cautioned financial markets not to assume that another rate cut will take place by year-end.

Market participants are also closely watching ongoing trade negotiations between the US and China, as President Donald Trump is scheduled to meet with Chinese President Xi Jinping today.

The dollar index rose +0.40% to 99.13, while the euro declined -0.41% to $1.1604. The British pound was among the day’s largest decliners, as traders priced in an increased likelihood that the BoE will lower rates in the coming week. Recent data showed British inflation remained unchanged in September. Earlier reports indicated that wage growth slowed to its weakest rate since 2022, with the unemployment rate edging higher.

Sterling fell -0.63% against the dollar to $1.3189, touching $1.3137—its lowest level since 12th May.

The Japanese yen depreciated -0.41% against the dollar, settling at ¥152.70. The yen had briefly strengthened after US Treasury Secretary Scott Bessent pressed the Japanese government to allow the BoJ greater flexibility to raise interest rates, intensifying warnings against keeping the yen artificially weak through prolonged low borrowing costs. Secretary

Bessent, visiting Japan with President Trump for discussions with Prime Minister Sanae Takaichi’s new administration, has repeatedly criticised the BoJ for its measured pace in tightening monetary policy.

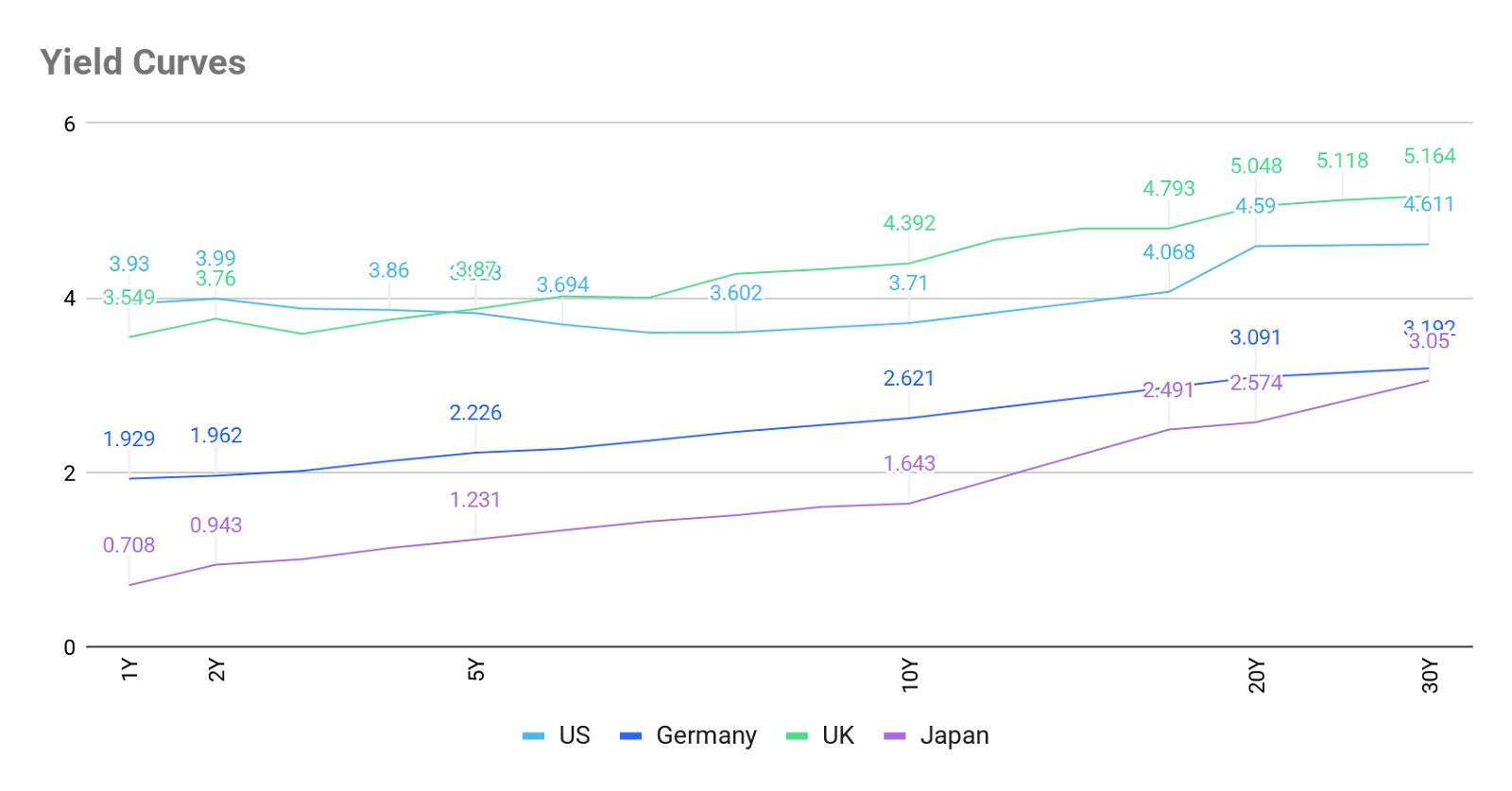

Fixed Income

US 10-year yield -7.6 bps MTD and -50.0 bps YTD to 4.076%

German 10-year yield -9.1 bps MTD and +25.6 bps YTD to 2.625%

UK 10-year yield -30.6 bps MTD and -17.4 bps YTD to 4.394%

US Treasury yields rose on Wednesday after Fed Chair Jerome Powell moderated expectations for a rate cut in December, stressing that monetary easing is not guaranteed given policymakers' divergent perspectives on the economic outlook and policy direction. Powell's comments followed his earlier characterisation of September’s rate cut as a ‘risk management cut,’ reflecting a consistent approach.

In response to Powell’s remarks, the yield on the 10-year Treasury note rose to its highest level since 10th October and closed the session up +9.6 bps at 4.076%. The two-year yield, particularly sensitive to changes in interest rate expectations, advanced to a one-month high, gaining +10.6 bps to reach 3.604%. The 10-year note experienced its largest single-day increase since 6th June, while the two-year yield registered its most significant gain since early June. On the long end of the curve, yields on 30-year US bonds increased by +7.8 bps to 4.625%.

The Fed also announced plans to resume limited purchases of Treasury securities due to emerging liquidity constraints in money markets, thereby bringing its extended balance sheet reduction programme—referred to as quantitative tightening (QT)—to a close. The Fed confirmed it would maintain its policy of allowing up to $35 billion in mortgage-backed securities (MBS) to mature each month, a threshold it has not met in more than three years of reductions. However, starting 1st December, all proceeds from maturing MBS will be reinvested in Treasury bills.

The end of QT is expected to support the Treasury market by reducing the supply of securities that private investors need to absorb, pushing prices higher and yields lower. Additionally, halting QT implies the Treasury’s borrowing needs will diminish, as there is no longer a requirement to cover the Fed’s redemptions.

During the session, the yield spread between two-year and 10-year Treasury notes narrowed to an intraday low of 46.1 bps—the tightest since 11th September —and ended the day at 47.2 bps, contracting 6.3 bps from 53.5 bps at the end of September.

The yield on the US 10-year Treasury note is -7.6 bps MTD for October. The US 30-year yield is -10.5 bps. At the short end, the two-year Treasury yield is -1.3 bps MTD.

Following today’s FOMC meeting, current sentiment in the Fed funds futures market, according to CME's FedWatch Tool, suggests a 67.8% probability of an additional reduction to the Fed funds rate at the December FOMC meeting. Markets are pricing in an implied target rate 17.0 bps lower by year-end, compared to 49.0 bps the week prior, and 41.1 bps a month ago.

In the euro area, eurozone government bond yields traded lower on Wednesday as investors awaited the outcome of the FOMC meeting and subsequent press conference.

The ECB and the BoJ are expected to hold rates steady today.

The German 10-year bond yield was little changed late on Wednesday, -0.2 bps lower at 2.625%, having traded around this level for most of the day. The two-year Schatz, which is closely linked to ECB monetary policy expectations, finished the session -0.6 bps at 1.975%. On the longer end of the maturity spectrum, the 30-year Bund yield advanced slightly, +0.1 bps to 3.194%.

The yield spread between German Bunds and 10-year French OATs stood at 78.6 bps, near its highest level in seven months. The French 10-year yield traded lower on Wednesday, down -2.0 bps to 3.411%.

The German 10-year yield is -9.1 bps in October. The spread between US 10-year Treasuries and German Bunds stands at 145.1 bps, reflecting an expansion of 1.5 bps over the month so far, from 143.6 bps at the end of September.

The 2-year Schatz is -5.8 bps to 1.975% so far in October. On the long end of the curve, the German 30-year yield is -9.0 bps to 3.194%.

France’s 10-year OAT yield is -13.0 bps to 3.411% in October. The spread of French government bonds versus German Bunds has contracted by 3.9 bps over the month to 78.6 bps, from 82.5 bps at the end of September.

Italy's 10-year government bond yield -2.2 bps to 3.358%, leaving the spread over its German equivalent at 73.3 bps. During October, this spread has contracted by 9.6 bps, moving from 82.9 bps to 73.3 bps. The Italian 10-year BTP yield has declined by -18.7 bps in October to 3.358%.

In the UK, the 10 year gilt yield is -30.6 bps MTD and it was -1.1 bps Wednesday at 4.394%. The UK 30 year is -34.3 bps so far in October.

Note: As of 5:00 pm EDT 29 October 2025

What to think about in November 2025

October FOMC meeting: A hawkish cut. The Fed cut interest rates 25 bps to a target range of 3.75 - 4.00% at its October FOMC meeting on Wednesday, in line with broad market expectations. Notably, there were two dissents: Kansas City Fed Governor Schmid voted to maintain rates, while Fed Governor Miran advocated for a 50 bps cut for the second consecutive meeting. In addition, the Fed announced that quantitative tightening (QT) will conclude on 1st December. This decision was not completely unexpected given Chair Powell’s 14th October comment indicating that the central bank’s ‘ample’ reserves target could be reached ‘in the coming months.’

The language of the policy statement remained largely unchanged from previous communications. The Fed acknowledged that downside risks to employment have increased in recent months and that the economy continues to expand at a moderate pace. Markets had already priced in nearly a 100% probability of a 25 bps cut. However, Schmid’s dissent was regarded by some as unexpectedly hawkish. During the press conference, Fed Chair Powell’s remarks appeared slightly hawkish, stating that a rate cut in December is not a foregone conclusion, ‘far from it’, and noting that there are significant differing views within the FOMC regarding future policy actions. With the end of QT in sight, Fed policymakers will have to be careful not to let financial conditions ease too far given that inflation is still running above target at 3%.

Key events in November 2025

The potential policy and geopolitical risks for investors that could affect corporate earnings, stock market performance, currency valuations, sovereign and corporate bond markets include:

4 November Off-year elections, USA. The off-year election includes gubernatorial and state legislative elections in a few states, and numerous mayoral races and a variety of other local offices.

6 November Bank of England, Monetary Policy Summary and minutes of the Monetary Policy Committee meeting. With inflation still above target at 3.8% and uncertainty around potential economic growth impacts from the 26 November budget, the BoE is expected to keep rates at 4.00% during this meeting.

7 November G20 Joint Finance and Health Ministerial Meeting. The meeting will take place virtually. It will likely focus on mobilising financing mechanisms to combat global health challenges.

16 November Presidential and Parliamentary Election Elections. This election is for the presidency and all 155 seats of the Chamber of Deputies and 23 of the 50 seats in the Senate. According to the latest National Public Opinion (CEP) poll results, Jeanette Jara, the communist candidate for Chile's ruling leftist coalition, is ahead at 25% in the first round of the presidential election, but is closely trailed by hard-right candidate Jose Antonio Kast with 23% and Evelyn Matthei with 12%. As noted by Bloomberg news, over 100 politicians and economists signed a letter supporting centre-right contender Evelyn Matthei, saying she is the best option for Chile to recover confidence in itself, its democracy and its shared future.

22-23 November G20 Leaders Summit, South Africa. South African President Cyril Ramaphosa has put forth an agenda under the theme “Solidarity, Equality, and Sustainability” that builds on items addressed at recent G20 meetings in Brazil, India, and Indonesia. South Africa’s G20 agenda seeks to address issues that are especially important to emerging economies and will focus on climate change–related disaster resilience, debt relief for developing countries, and the mobilisation of finance for a just energy transition. There will also be task forces on inclusive economic growth, food security, and technology governance.

26 November 2025 EU-African Union (AU) Summit, Luanda Angola. EU-AU leaders will meet for the seventh EU-African Union summit. This multilateral summit will be co-chaired by the President of Angola, João Lourenço, and the President of the European Council, António Costa. Key themes expected to be touched on include: peace and security, economic integration, trade, multilateralism, green development, digitalisation, migration, mobility and human development.

While every effort has been made to verify the accuracy of this information, LHCM Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

This article is provided to you for informational purposes only and should not be regarded as an offer or solicitation of an offer to buy or sell any investments or related services that may be referenced here. Trading financial instruments involves significant risk of loss and may not be suitable for all investors. Past performance is not a reliable indicator of future performance.