Will the Argentine peso be great again?

What to look out for today

Companies reporting on Monday, 27th October: Cadence Design Systems, F5, Keurig Dr Pepper, Nucor, Revvity, Welltower, NXP Semiconductors, Waste Management

Key data to move markets today

EU: German IFO Current Assessment, Expectations and Business Climate Index and a speech by ECB Executive Board member Frank Elderson

USA: Durable Goods Orders, Nondefence Capital Goods Orders excluding Aircraft, and Dallas Fed Manufacturing Business Index

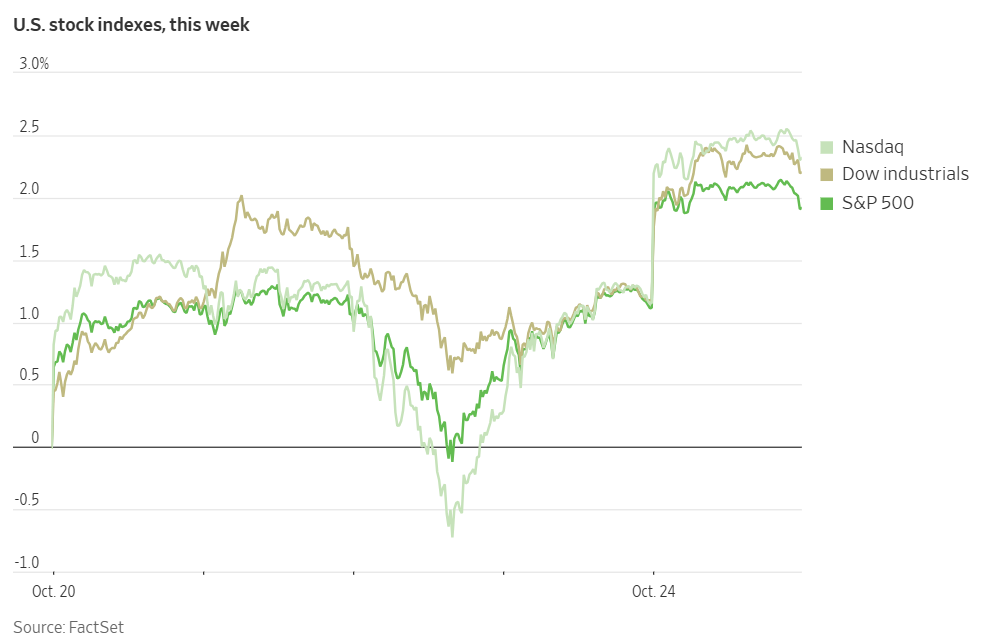

US Stock Indices

Dow Jones Industrial Average +1.01%

Nasdaq 100 +1.04%

S&P 500 +0.79%, with 6 of the 11 sectors of the S&P 500 up

US equities ended the week stronger as robust corporate earnings and positive inflation data propelled all three major US stock indexes to record highs, erasing the declines seen earlier in October. Investor confidence broadened beyond the AI sector leading to advances in companies such as Ford Motor Company, Albemarle, and General Dynamics.

On Friday, the Dow Jones Industrial Average surpassed the 47,000 mark for the first time, closing the week up +2.18%. The Nasdaq Composite and the S&P 500 were +2.31% and +1.92%, respectively. Each posted their second consecutive week of advances.

According to LSEG I/B/E/S data, y/o/y earnings growth for the S&P 500 in Q3 is projected to be +10.4%. This number jumps to 11.2% when excluding the Energy sector. Of the 143 companies in the S&P 500 that have reported earnings to date for Q3 2025, 87.4% have reported earnings above analyst estimates, with 81.9% of companies reporting revenues exceeding analyst expectations. The y/o/y revenue growth is projected to be 6.7% in Q2, increasing to 7.3% when excluding the Energy sector.

The Real Estate sector, at 100.0%, is the sector with most companies reporting above estimates. Materials with a surprise factor of 19.0%, is the sector that’s beaten earnings expectations by the highest surprise factor. Within Communication Services, 25.0% of companies have reported below estimates and it is the sector with the lowest surprise factor at -3.5%. The S&P 500 surprise factor is 8.2%. The forward four-quarter price-to-earnings ratio (P/E) for the S&P 500 sits at 22.9x.

In corporate news, Ford Motor Company signalled a strong recovery trajectory for the coming year following a significant disruption caused by a supplier fire affecting its flagship F-150 pickup line. This announcement drove Ford shares to their largest increase in more than five years.

General Motors announced several hundred job cuts shortly after raising its annual profit outlook, a move that resulted in a sharp rise in its share price.

As part of its plan to streamline operations and restore competitiveness, Target revealed plans to eliminate approximately 8% of its corporate workforce in its first major restructuring in years, according to a memo obtained by Bloomberg news.

According to Bloomberg news, Newmont is exploring an acquisition to secure control over Barrick Mining’s Nevada gold assets.

Eli Lilly & Co. agreed to acquire Adverum Biotechnologies, a firm specialising in treatments for blindness, in a transaction valued at up to $261.7 million, furthering Lilly’s expansion into gene therapy.

JPMorgan Chase announced that it will enable institutional clients to use their Bitcoin and Ether holdings as collateral for loans by year’s end.

Bayer received approval from US regulators for its menopause drug, which is expected to launch in November under the name Lynkuet.

S&P 500 Best performing sector

Information Technology +1.58%, with IBM +7.88%, Advanced Micro Devices +7.63%, and Micron Technology +5.96%

S&P 500 Worst performing sector

Energy -1.01%, with Baker Hughes -3.25%, APA -3.21%, and Halliburton -2.46%

Mega Caps

Alphabet +2.67%, Amazon +1.41%, Apple +1.25%, Meta Platforms +0.59%, Microsoft +0.59%, Nvidia +2.25%, and Tesla -3.40%

Information Technology

Best performer: IBM +7.88%

Worst performer: Microchip Technology -2.95%

Materials and Mining

Best performer: Albemarle +8.50%

Worst performer: Newmont -6.23%

European Stock Indices

CAC 40 -0.00%

DAX +0.13%

FTSE 100 +0.70%

Corporate Earnings Reports

Posted on Friday, 24th October

Baker Hughes quarterly revenue +1.5% to $7.010 bn vs. $6.829 bn estimate.

EPS at $0.68 vs. $0.62 estimate.

Lorenzo Simonelli, Chairman and CEO, said, “Our strong third quarter performance represents clear evidence of the consistent execution and operational discipline embedded across the organization. This performance reflects continued momentum from our Business System deployment, positive trends in Gas Technology, and strong outperformance in U.S. land, where our leverage to production-related activity gives us a clear advantage. While OFSE margins softened, reflecting the broader macro backdrop, IET delivered another quarter of strong performance, driving consolidated Adjusted EBITDA margins higher year-over-year. This positive margin progression highlights the resilience of our portfolio and the foundation we've built through disciplined execution.” — see report.

General Dynamics quarterly revenue +10.6% to $12.907 bn vs. $12.495 bn estimate.

EPS at $3.88 vs. $3.70 estimate.

Phebe Novakovic, Chairman and CEO, said, “Each of our four segments grew earnings and backlog in the quarter, reflecting solid execution coupled with growing demand. The Aerospace segment in particular performed impressively, growing revenue 30.3% and expanding margins by 100 basis points from the same period a year ago, with order activity for business jets remaining very strong.” — see report.

Sanofi quarterly revenue +2.3% to $14.883 bn vs. $14.805 bn estimate.

EPS at $3.38 vs. $3.13 estimate.

Paul Hudson, CEO and President, said, “We continued executing on our strategy and the growth momentum continued in Q3 with sales up by 7.0% over a high base of comparison last year. Newly launched medicines and vaccines grew by 40.8%. Dupixent grew by 26.2% and exceeded for the first time both four billion euros in quarterly global sales and three billion euros in the US, despite an unfavorable currency impact. As expected, our flu vaccines business declined because of increased price competition and lower vaccination rate. Business EPS increased by 13.2%, supported by disciplined spending, R&D prioritization, and operational efficiency. After three quarters of profitable growth, we reiterate our 2025 guidance.” — see report.

Commodities

Gold spot -0.31% to $4,111.52 an ounce

Silver spot -0.67% to $48.59 an ounce

West Texas Intermediate -0.34% to $61.44 a barrel

Brent crude -0.09% to $65.85 a barrel

Gold prices trimmed earlier losses on Friday after the release of slightly softer-than-anticipated US inflation data, which bolstered expectations that the Fed will lower interest rates this week. Spot gold settled -0.31% lower at $4,111.52 per ounce. Last week gold was -3.23%, its first weekly decline in ten weeks.

Last Monday, spot gold reached an all-time high of $4,381.21 per ounce. It has since retreated -6.16% due to profit taking amid signs of easing trade tensions between the US and China. Nevertheless, gold ended Friday +56.70% year-to-date, driven by ongoing geopolitical and trade uncertainties, strong central bank purchases, and expectations of lower US interest rates, among other factors.

Oil prices experienced a modest decline on Friday. Brent crude futures were down 6 cents or -0.09% to settle at $65.85 per barrel. US WTI crude futures settled at $61.44 per barrel, down 21 cents, or -0.34%.

Earlier in the session, both benchmarks extended gains of over five percent from Thursday, following the announcement of sanctions, but subsequently retreated during the final two hours of trading. For the week, WTI was +6.59% and Brent crude +7.30%, marking their strongest weekly performance since mid-June.

Earlier last week, President Donald Trump imposed sanctions on Rosneft and Lukoil to pressure Russian President Vladimir Putin to end the war in Ukraine. Collectively, these two companies are responsible for more than 5% of global oil production, with Russia ranking as the world’s second-largest crude oil producer in 2024, trailing only the US.

Major Chinese state oil companies temporarily halted Russian oil purchases as a result of these sanctions, while Indian refiners — the largest importers of seaborne Russian crude — were expected to sharply reduce imports from Russia, according to industry sources cited by Reuters.

Kuwait’s oil minister stated that OPEC stands ready to increase output to compensate for any market shortages.

President Putin dismissed the sanctions as an unfriendly gesture, asserting that they would not have a significant impact on Russia’s economy and emphasising Russia’s vital role in the global oil market.

Additionally, the UK imposed sanctions on Rosneft and Lukoil last week, and the EU approved its 19th package of sanctions against Russia, which includes a ban on Russian liquefied natural gas imports. The EU also added two Chinese refiners — with a combined capacity of 600,000 barrels per day — and Chinaoil Hong Kong, the trading arm of PetroChina, to its Russian sanctions list, as detailed in the official journal released on Thursday.

Note: As of 5 pm EDT 24 October 2025

Currencies

EUR +0.09% to $1.1625

GBP -0.10% to $1.3309

Bitcoin +1.39% to $111,102.37

Ethereum +3.01% to $3,944.19

The US dollar remained largely unchanged on Friday. It briefly declined after September CPI data came in slightly weaker than expected, boosting expectations of a Fed cut this week. The US dollar index ended the day -0.02% at 98.94. It still posted a +0.40% gain for the week.

The euro advanced +0.09% to $1.1625 on Friday following the release of survey data showing that business activity in the eurozone expanded at a stronger pace than anticipated in October. This rise was driven primarily by the services sector. However, the euro was -0.22% over the last week.

The Japanese yen depreciated by -0.20% on Friday, reaching a two-week low of ¥152.85 per US dollar. This contributed to a -1.48% decline for the week. Earlier in the day, official data revealed that Japan’s core consumer prices remained above the central bank’s 2% target, sustaining expectations for a possible near-term rate increase. Prime Minister Sanae Takaichi is reportedly preparing an economic stimulus package expected to exceed last year’s $92 billion, according to government sources cited by Reuters. Over the past week, the US dollar was +1.48% against the yen.

The British pound edged down -0.10% to $1.3309. Official figures indicated that British retail sales unexpectedly increased in September, supported by robust technology sales and heightened demand for gold from online jewelers. Furthermore, British consumer sentiment improved in October, reaching its joint-highest level since August 2024. Despite these positive indicators, sterling declined -0.86% over the week, as softer inflation data led investors to increase their expectations for a BoE rate cut within the year. Against the euro, the pound was relatively stable at 87.17 pence. It had its weekly loss against the euro in four weeks.

Futures markets now reflect approximately a 65% probability of a quarter-point rate reduction by the BoE before year-end, slightly lower than the 75% likelihood observed prior to Friday’s data.

Fixed Income

US 10-year Treasury +1.8 basis points to 4.023%

German 10-year bund +4.0 basis points to 2.628%

UK 10-year gilt +0.0 basis points to 4.435%

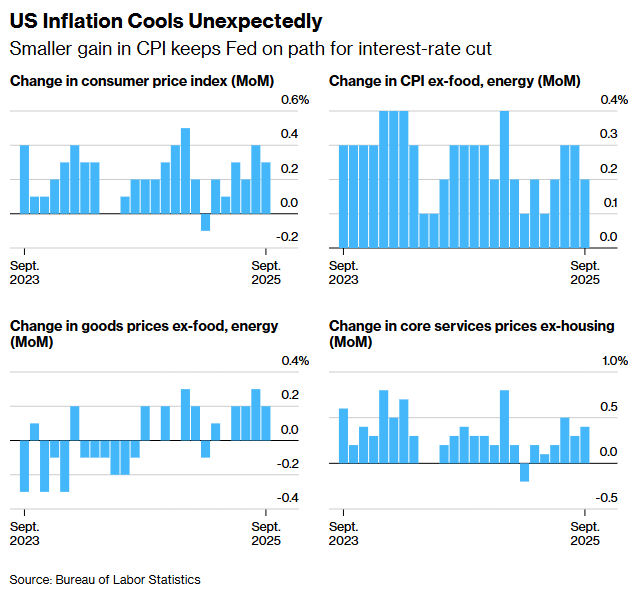

Treasury yields remained relatively stable on Friday. Investor attention centred on US CPI, which increased 0.3% last month following a 0.4% rise in August. Year-over-year, CPI advanced 3.0%, up from 2.9% in August. The core CPI, which excludes volatile food and energy prices, rose 0.2% after a 0.3% increase in August and was up 3.0% annually, compared to 3.1% the previous month.

The yield on the 10-year Treasury note closed the day +1.8 bps higher at 4.023%. For the week, the 10-year yield rose +0.9 bps, marking its first weekly gain after three consecutive weekly declines. The yield on the 30-year Treasury was +2.9 bps to 4.604%, although it finished the week -1.1 bps lower. The two-year yield, which is closely tied to interest rate expectations, was unchanged at 3.501%.

The yield curve steepened in response to the CPI data, with the spread between the two-year and 10-year Treasury yields widening to 52.2 bps from 50.4 bps late Thursday.

The Treasury will be auctioning two and five year notes today.

According to CME Group's FedWatch Tool, Fed funds futures traders are pricing in a 96.7% probability of a 25 bps rate cut at October’s FOMC meeting, lower than last week’s 98.4%. Traders are currently expecting 48.9 bps of cuts by year-end, lower than the 51.7 bps anticipated the prior week.

Eurozone government bond yields advanced on Friday as traders responded to unexpectedly robust eurozone PMI figures, with French political developments remaining a focal point. Yields rose following data indicating that eurozone business activity accelerated at a faster rate in October. This led investors to marginally reduce expectations for an ECB rate cut next year. French business activity contracted more sharply than anticipated in October, whereas Germany’s private sector experienced its strongest expansion in nearly two and a half years.

Germany’s 10-year Bund yields climbed +4.0 bps to 2.628%, its most significant daily increase in six weeks. The two-year Bund yield, which is particularly sensitive to ECB rate policy speculation, increased +2.9 bps to 1.967%. At the longer end, the 30-year yield rose +3.9 bps. Last week the 10-year yield was up +0.4 bps, the two-year yield gained +5.4 bps, and the 30-year yield increased +3.0 bps.

Money markets reflected a 50% probability of a 25-basis-point ECB rate reduction by July, down from 60% before the release of the latest data. Projections place the key rate at approximately 1.85% in December 2026, compared to the current 2.0%.

The yield spread between safe-haven German Bunds and 10-year French government bonds widened to 81.0 bps as analysts awaited Moody’s credit rating review for France. French 10-year yields were +7.6 for the week.

On Friday, France’s Socialist party threatened to bring down the government by Monday if their budgetary demands were not fulfilled. That evening, Moody’s affirmed France’s AA3 rating—the fourth-highest tier—while placing the outlook on negative.

Italy’s 10-year yield rose +4.8 bps on Friday to 3.391%, contributing to a weekly increase of +3.3 bps. This left the spread between Italy’s 10-year BTPs and 10-year Bunds at 76.3 bps, a contraction of 1.1 bps from 77.4 bps the previous week.

Note: As of 5 pm EDT 24 October 2025

Global Macro Updates

September CPI eases, PMI shows growth and UoM consumer sentiment stable. September’s core Consumer Price Index (CPI), released with a delay, rose by 0.2% m/o/m, undershooting both consensus expectations of a 0.3% increase and August’s 0.3% gain. Headline CPI advanced 0.3% m/o/m, also coming in below consensus of 0.4% and August’s 0.4% rise. On an annualised basis, both core and headline CPI were 3.0%, slightly cooler than the consensus forecast of 3.1%. The gasoline index surged 4.1% in September, serving as the primary contributor to the overall CPI increase.

Both core goods and core services posted a 0.2% monthly increase, marking a slowdown from August’s 0.3% pace. Areas of further deceleration included shelter (down from +0.4% to +0.2%), food at home (down from +0.6% to +0.3%), used vehicles (from +1.0% to -0.4%), airline fares (from +5.9% to +2.7%), and car insurance (from 0.0% to -0.4%). Conversely, acceleration was observed in apparel (up from +0.5% to +0.7%), household furnishings (from +0.1% to +0.2%), and medical care services (from -0.1% to +0.3%). There was a marked moderation in rent and Owners’ Equivalent Rent (OER).

The preliminary October S&P PMI composite reading reached 54.8, up from September’s 53.9. PMI Manufacturing registered at 52.2, closely aligning with consensus estimates of 52.3 and slightly above September’s 52.0. PMI Services came in at 55.2, surpassing both consensus and September’s figure of 54.2. Overall employment growth remains subdued, while business confidence deteriorated further amid ongoing tariff concerns. Prices charged increased at the slowest rate since April.

The UoM’s final October consumer sentiment was largely unchanged, posting a reading of 53.6 versus consensus expectations of 55.0 and September’s final 55.1. Month-over-month inflation expectations remained stable, with October’s one-year expectation finalised at 4.6% (matching the preliminary reading and slightly below September’s 4.7%). Five-year inflation expectations for October were finalised at 3.9%, compared to the preliminary 3.7% and September’s 3.7%. The report notes that consumers continue to express concern about inflation, although only 2% spontaneously referenced the government shutdown as a source of worry during interviews.

Milei wins big, accelerates reform drive in Argentina. Argentine President Javier Milei’s libertarian party has secured a significant victory in the national midterm legislative election. This win provides renewed momentum for his free-market reform agenda following recent financial market turbulence.

With 98% of votes tallied from provisional electoral commission figures, Milei’s La Libertad Avanza (LLA) party captured 40.7% of the vote, outpacing the Peronist opposition alliance’s 31.7%. Voter turnout stood at 68%, a slight decrease from the 71.8% recorded in the previous midterm election in 2021.

This outcome strengthens President Milei’s standing in congress and supports his efforts to advance an ambitious restructuring of Argentina’s historically troubled economy. Concerns among investors about diminishing support for Milei’s reforms led to a run on the peso in September.

US Treasury Secretary Scott Bessent has pledged up to $40 billion in support for Argentina and, according to economists’ estimates, has already allocated approximately $2 billion to stabilise the peso. The US regards Milei as an essential ally in Latin America.

Approximately half of the 257 seats in Argentina’s lower legislative chamber were contested in Sunday’s election. Official results indicate that LLA secured 64 of the 127 available seats, achieving notable success nationwide.

Projections based on these results suggest that Milei and his coalition will hold more than 100 seats in the upcoming lower house, though collaboration with smaller centrist parties will be necessary to reach the 129-seat threshold required for passing legislation. The scenario in the senate remains largely similar, with one-third of seats renewed.

While every effort has been made to verify the accuracy of this information, EXT Ltd. (hereafter known as “EXANTE”) cannot accept any responsibility or liability for reliance by any person on this publication or any of the information, opinions, or conclusions contained in this publication. The findings and views expressed in this publication do not necessarily reflect the views of EXANTE. Any action taken upon the information contained in this publication is strictly at your own risk. EXANTE will not be liable for any loss or damage in connection with this publication.

本文提供給您僅供資訊參考之用,不應被視為認購或銷售此處提及任何投資或相關服務的優惠招攬或遊說。金融商品交易涉及重大損失風險,可能不適合所有投資者。過往績效不代表未來表現。